Quick Answer

Earning rewards with VET is as simple as holding it in a compatible wallet, with the VeWorld Wallet being the top choice for most users.

- Download the VeWorld Wallet app from your device’s app store.

- Set up your wallet by creating a new one or importing an existing one, and securely store your seed phrase.

- Transfer your VET to the wallet from an exchange or another wallet.

Once your VET is in the VeWorld Wallet, you’ll automatically start earning VTHO, VeChain’s gas token, without any additional steps or lock-up periods.

What is VET Staking?

VET staking is like putting your money in a savings account, but for crypto. When you stake VET, you lock up your tokens to help keep the VeChain network safe and running smoothly. This is part of VeChain’s proof-of-stake system.

By staking, you get a chance to validate transactions on the network. The more VET you stake, the more likely you are to be picked as a validator. When you validate transactions, you earn VTHO as a reward, similar to earning interest in a savings account. This system uses less energy than proof-of-work and lets more people take part in running the network.

Why Should I Stake VET?

Staking VET offers several benefits that make it an attractive option for token holders:

- Earn passive income: Your VET grows while you sleep

- Support the network: Help VeChain run smoothly and securely

- Voting rights: Have a say in important network decisions

- No special equipment needed: Stake from your phone or computer

- Flexible options: Choose how much and how long to stake

- Learn about crypto: Gain hands-on experience with blockchain technology

How Much Can I Earn Staking VET?

The amount you can earn staking VET varies. It depends on a few key factors:

• How much VET you stake

• Where you stake it

• Current network rewards

On average, VET staking yields about 0.5% to 2% per year. For example, Binance offers 1.5% APY, while Atomic Wallet offers 1.63% APY. Remember, crypto prices change a lot. Your actual earnings in dollars might go up or down based on VET’s price. Some platforms offer higher rates, but be careful. If a deal seems too good to be true, it might be risky. Keep in mind: These numbers are just estimates. Always check the latest rates before you stake.

Ways to Stake VET

Software Wallets

Software wallets like the VeChainThor app let you stake VET directly from your phone or computer. They’re easy to use and give you full control over your tokens. You can start and stop staking whenever you want, and your VET stays in your own wallet. This option is great for people who like to manage their own crypto.

Crypto Exchanges

Exchanges offer a simple way to stake, especially for beginners. You can often start with small amounts of VET, and the process is usually just a few clicks. The downside is that you don’t truly own the keys to your crypto. Exchanges also might take a cut of your staking rewards. But for ease of use, they’re hard to beat.

Hardware Wallets

Hardware wallets provide top-notch security for staking. They keep your VET offline, safe from hackers. You can stake directly from some hardware wallets, like Ledger. While they cost money to buy, they’re a smart choice if you have a lot of VET. They’re best for serious investors who want peace of mind.

DeFi Platforms

DeFi platforms can offer higher rewards for staking VET, but they’re trickier to use. These platforms let you explore new ways to earn, like liquidity pools or yield farming. The catch is they carry more risk. Smart contracts can have bugs, and some platforms might not be trustworthy. Only use DeFi if you really know what you’re doing.

What are the Best Places for Staking VET?

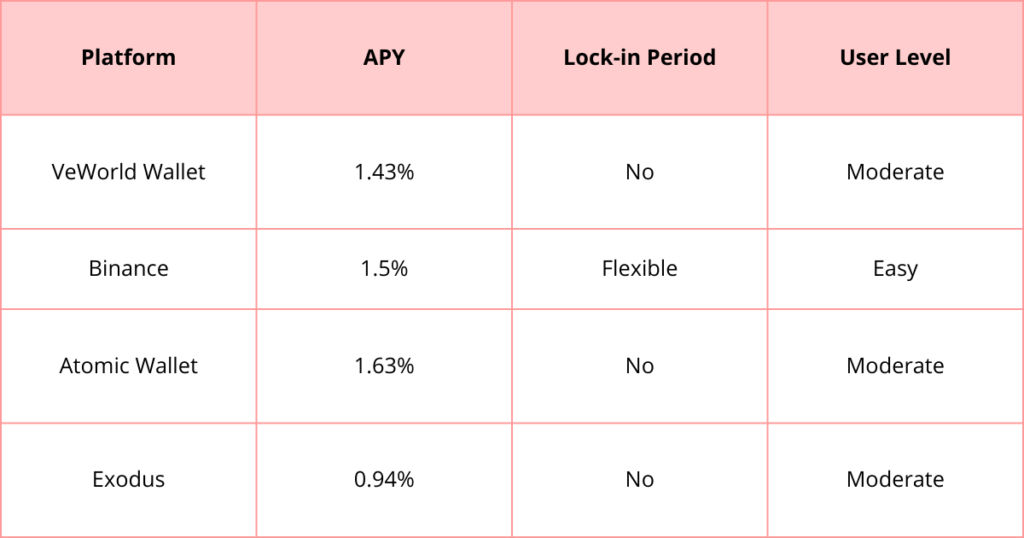

Here’s a quick comparison of some popular platforms for staking VET:

VeWorld Wallet (Editor’s Choice)

The VeWorld Wallet is our top pick for staking VET. It offers a solid 1.43% APY with no lock-in period, giving you flexibility and decent returns. This official wallet for VeChain provides a user-friendly interface and direct connection to the VeChain network. It’s a great balance of security and ease of use, making it suitable for both newcomers and experienced users.

Binance

Binance, a leading cryptocurrency exchange, provides an easy staking option with a 1.5% APY. The flexible lock-in period means you can unstake your VET anytime. This platform is ideal for beginners due to its simple interface and low entry barrier. However, remember that keeping your crypto on an exchange means you don’t control your private keys.

Atomic Wallet

Atomic Wallet offers the highest APY on this list at 1.63% with no lock-in period. It’s a non-custodial wallet, meaning you have full control over your funds. The interface is fairly intuitive, but it might take some getting used to for complete beginners. It’s a solid choice for those who want higher returns and don’t mind a slightly steeper learning curve.

Exodus

While Exodus offers the lowest APY at 0.94%, it compensates with its extremely user-friendly design and no lock-in period. This wallet is known for its sleek interface and support for multiple cryptocurrencies. It’s a good option if you value ease of use and want to manage various crypto assets in one place, despite the lower VET staking returns.

How to Stake VET on VeWorld Wallet: Step-by-Step Guide

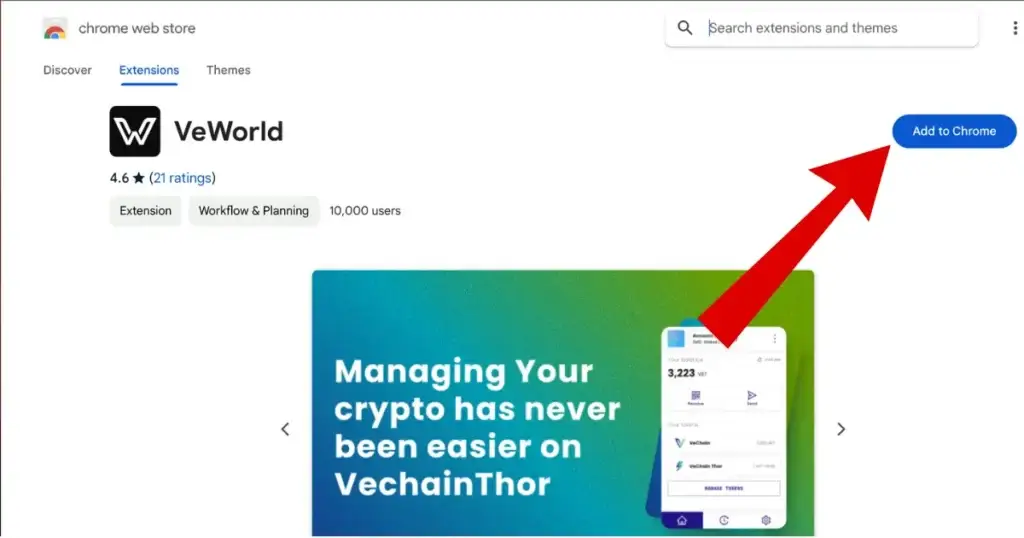

Step 1: Download VeWorld Wallet

- Get the app from your phone’s app store or the official VeChain website.

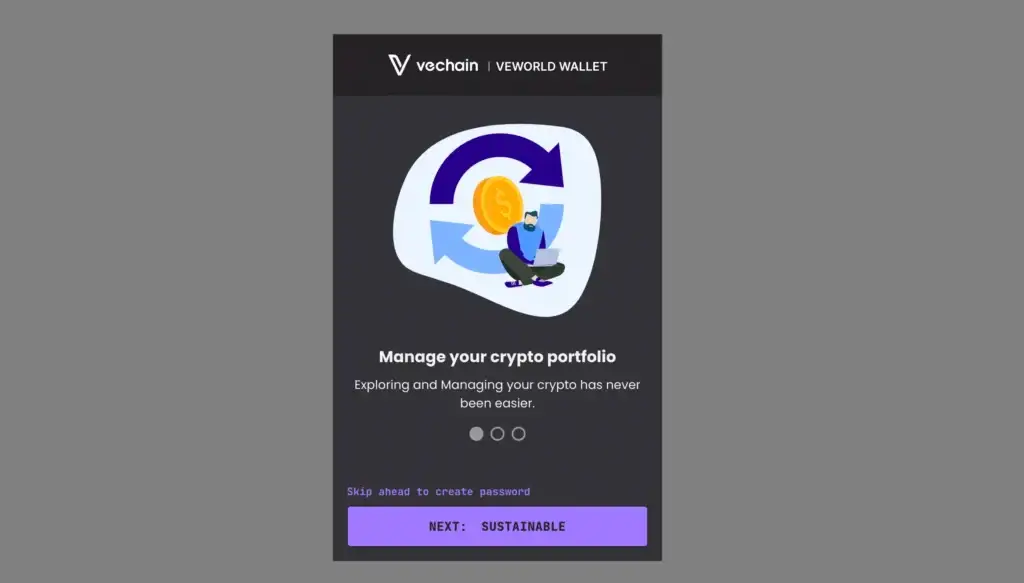

Step 2: Set Up Your Wallet

- Create a new wallet or import an existing one.

- Safely store your seed phrase.

Step 3: Add VET to Your Wallet

- Transfer VET from another wallet or buy it through supported methods.

Step 4: Hold VET in Your Wallet

- Simply holding VET generates VTHO automatically. There’s no separate “staking” process.

Remember, this process is often called “staking” in discussions, but it’s really just holding VET in your wallet. The VeWorld Wallet makes this process simple and automatic.

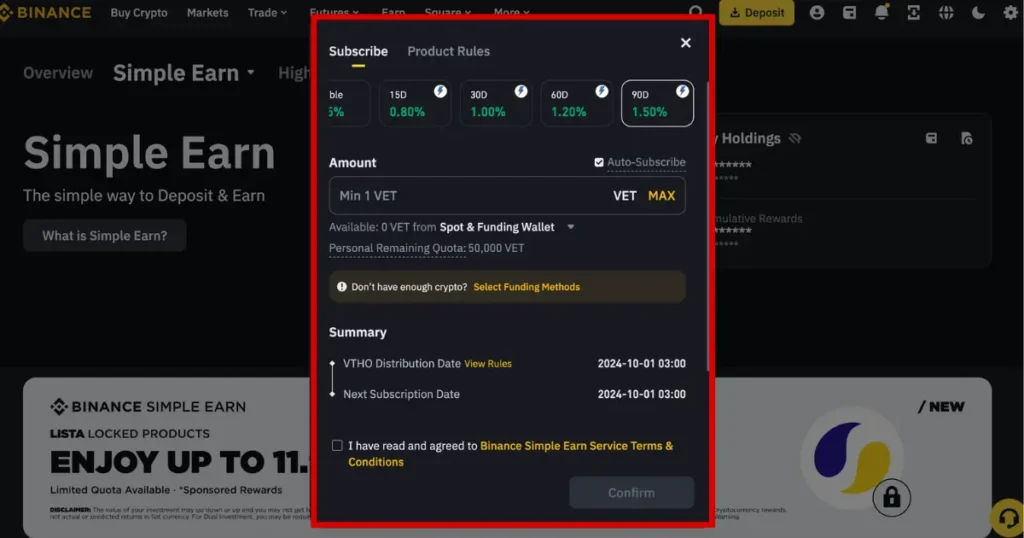

How to Stake VET on Binance? Step-by-Step Guide

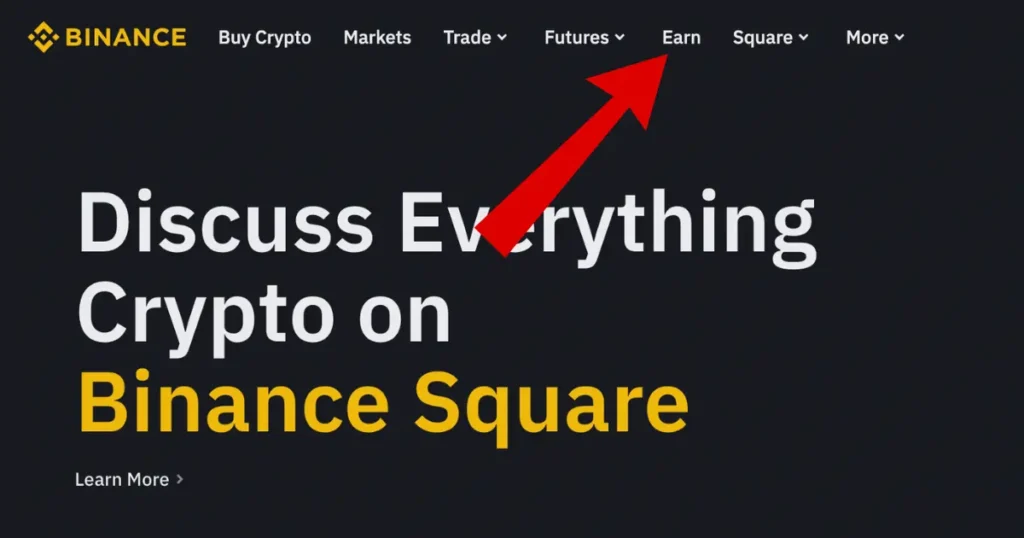

Step 1: Navigate to Binance Staking

- Hover over the “Finance” tab on the Binance homepage and click on “Binance Earn.”

- Click on the “Staking” tab within the Binance Earn section.

- Use the search bar to find VET staking options.

Step 2: Stake Your VET

- Choose the staking option that suits your preference (e.g., flexible or locked staking).

- Click on the “Stake Now” button next to the VET staking option.

- Enter the amount of VET you want to stake. Ensure it’s within the available balance in your wallet.

- Review the details such as staking duration, estimated APY (Annual Percentage Yield), and any other terms.

- Click on “Confirm” to finalize the staking process.

Step 3: Monitor Your Staking

- Monitor your staking status and rewards by going to the “Wallet” tab and selecting “Earn.”

- You will start receiving staking rewards based on the staking period you selected. These rewards can be viewed under the “Earn” section.

Step 4: Unstake VET (When Desired)

- Navigate to the “Earn” section under the “Wallet” tab.

- Find your staked VET and click on the “Redeem” button.

- Review the details and confirm the unstaking process. Note that some staking options may have a lock-up period, so ensure you check the terms before unstaking.

Risk of Staking VET

Staking VET isn’t risk-free, even though it’s safer than many crypto activities. Here are the main risks to keep in mind:

Market volatility is the biggest worry. VET’s price can swing wildly, so your staked value might drop. Even if you earn more VET, it could be worth less in dollars.

There’s also a small chance of smart contract bugs. While VeChain is well-tested, no code is perfect. A bug could lock up your funds or cause losses.

Some staking methods might have lockup periods. This means you can’t sell quickly if the market tanks. You could miss out on better investment chances too.

Lastly, don’t forget about taxes. In many places, staking rewards count as income. You might owe taxes even if VET’s price falls.

Always do your own research and only stake what you can afford to lose.

Conclusion

Staking VET offers a simple way to grow your crypto holdings. It’s like planting a money tree that bears fruit while you sleep. By holding VET in your VeWorld Wallet, you automatically earn VTHO. This process helps support the VeChain network and puts your tokens to work.

While it’s not risk-free, the potential rewards make it worth considering. Just remember to stay informed about market changes and keep an eye on your investment. Whether you’re a crypto newbie or a seasoned pro, VET staking can be a smart addition to your strategy.

As with any investment, only stake what you can afford to lose. But if you believe in VeChain’s future, staking VET is a great way to be part of it. So why not give your VET a job and watch it grow?

FAQ

What’s the minimum amount of VET I need to start?

There’s no minimum. Even small amounts of VET generate VTHO.

Can I stake my VeChain?

Technically, you don’t “stake” VET in the traditional sense. Instead, you generate VTHO by simply holding VET in a compatible wallet. This process is often referred to as staking, but it’s automatic and doesn’t require locking up your tokens.

Does VET generate VTHO?

Yes, VET automatically generates VTHO.

What is VTHO?

VTHO (VeThor Token) is the gas token of the VeChain network. It’s used to pay for transactions and smart contract operations on the VeChain blockchain. When you hold VET, you’re constantly generating VTHO at a set rate.

What is The Best Place to Stake VET?

The best place to “stake” (or hold) VET is typically the official VeWorld Wallet. It’s secure, user-friendly, and directly connected to the VeChain network. You’ll generate VTHO automatically just by keeping your VET in this wallet. Some exchanges also offer VET holding with VTHO generation, but using the official wallet gives you more control over your assets.