Quick Answer

Staking GRT is a way to earn rewards while supporting The Graph network. Here’s a quick overview:

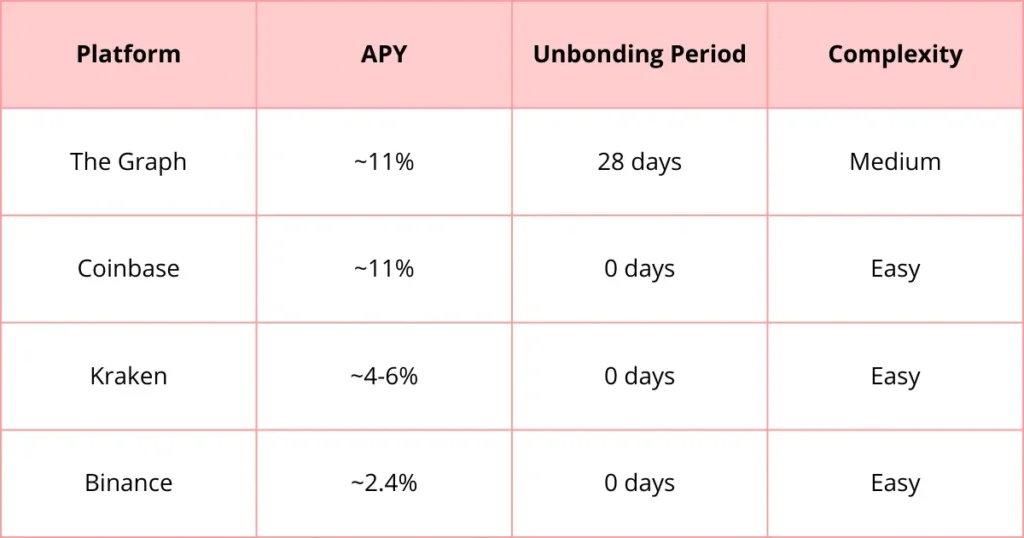

- Choose a staking platform: Options include The Graph’s native platform, Coinbase, Kraken, and Binance.

- Deposit GRT tokens into your chosen wallet.

- Select an Indexer and stake your tokens.

- Monitor your rewards and manage your stake.

With potential returns around 11% APY on The Graph’s native platform and options for different skill levels, staking GRT can be a rewarding strategy for growing your crypto holdings. However, always consider the risks and lock-up periods before getting started.

What is GRT Staking?

GRT staking is a way to support The Graph network and earn rewards. When you stake GRT tokens, you lock them up to help keep the network safe and running smoothly. In return, you get more GRT as a thank you.

Here’s the mechanism behind GRT staking: You allocate a portion of your GRT tokens to a designated pool. This pool contributes to the network’s operational infrastructure. While your GRT is committed to this pool, it becomes illiquid. However, this temporary sacrifice of liquidity is compensated by the accrual of additional GRT tokens over time.

Why Should I Stake GRT?

Staking GRT offers several compelling benefits for token holders.

1. Earn passive income

When you stake GRT, you’re rewarded with additional tokens over time. This passive income stream can help grow your investment without requiring active trading or management.

2. Support network security

By staking, you play a crucial role in maintaining the integrity and security of The Graph network. Your staked tokens contribute to the decentralized infrastructure that powers the protocol.

3. Participate in governance

Stakers often gain voting rights, allowing you to have a say in important decisions about the network’s future. This democratic approach ensures that those with a vested interest can influence the project’s direction.

It’s worth noting that staking also demonstrates confidence in the project’s long-term viability. As more tokens are staked, it can create a positive feedback loop, potentially increasing demand and stability for GRT. This alignment of interests between token holders and the network’s success is fundamental to many blockchain projects.

How Much Can I Earn Staking GRT?

The earnings from staking GRT can vary widely. Your potential rewards depend on:

- The staking method you choose

- How long do you keep your GRT staked

- The total amount of GRT you commit to staking

While exact figures fluctuate, some stakers report annual yields ranging from 5% to 15% or more. For example, native staking through The Graph’s protocol yields around 10-11% annually, while staking on centralized exchanges like Binance could offer lower rates, such as 2.4%.

Ways to Stake GRT

Native Staking

This is when you use The Graph’s own system. You’ll need to know a bit about how blockchains work. But you can earn more GRT this way. You connect your wallet to The Graph’s website and choose how much to stake. It’s like putting your money in a special piggy bank that grows over time. You can pick which Indexer to support, kind of like choosing a team to cheer for. The more you stake and the longer you keep it there, the more you can earn.

Exchange Staking

Big crypto websites like Binance let you stake GRT. It’s easy to do, but you might not earn as much. You also don’t have full control of your tokens. You just click a few buttons and the exchange does the rest. It’s like letting someone else hold your piggy bank. They give you some of the money it earns, but keep some for themselves. This is good if you don’t want to deal with complicated stuff.

DeFi Staking

Some apps let you stake GRT and use it in other ways too. This can be fun if you like trying new things with your crypto. But be careful – it can be risky. You might be able to lend your staked GRT or use it as collateral. It’s like using your piggy bank money to buy a lemonade stand. You could make more money, but you could also lose some if things go wrong.

Indexer Staking

If you’re really into The Graph, you can run a node and be an Indexer. This is hard work but can pay off big. You need lots of GRT and computer skills. It’s like building your own big piggy bank factory. You help keep The Graph running smoothly and earn rewards for your work. This takes a lot of time and effort, but you can earn more GRT than other ways of staking.

What are the Best Places for Staking GRT?

Here are some of the top places where you can stake your GRT tokens:

Editor’s Choice: The Graph Native Staking

The Graph’s native staking stands out as our top pick for good reasons. It offers a competitive 11% APY, matching the highest rate on our list. The 28-day unbonding period might seem long, but it plays a crucial role in network stability and security.

Coinbase provides an attractive alternative, especially for those new to staking. It matches The Graph’s APY without the unbonding period, offering more flexibility for your tokens.

Kraken and Binance cater to users seeking simplicity, though with lower returns. These platforms might appeal to those who prioritize ease of use and quick access to their funds over maximum yield.

Choosing where to stake depends on your goals. If you’re committed to The Graph’s ecosystem and can handle some complexity, native staking is ideal. For a balance of high returns and simplicity, Coinbase shines.

How to Stake GRT on The Graph: Step-by-Step Guide

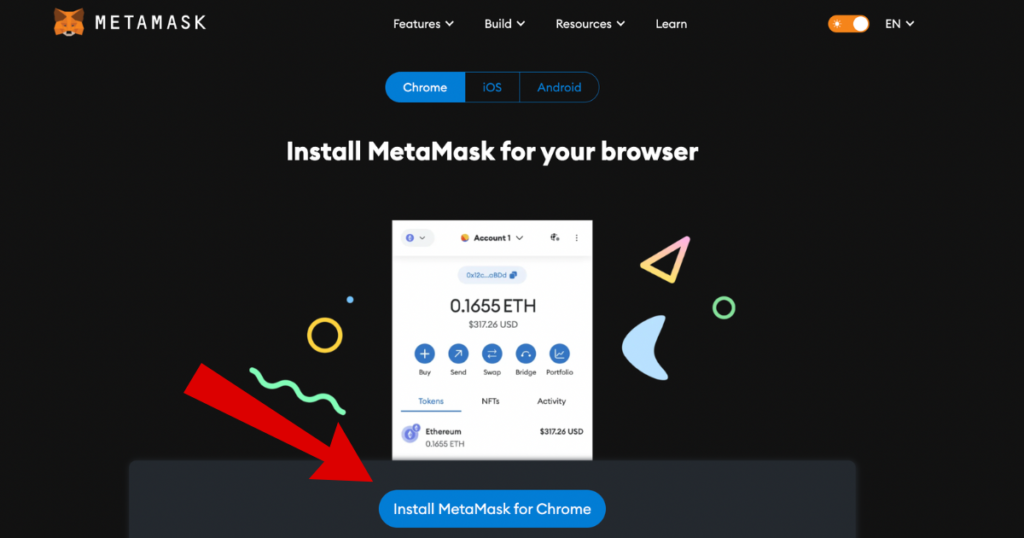

Step 1 – Set up MetaMask

– Visit metamask.io and download the extension for your browser

– Click “Create a wallet” and set a secure password

– Write down your secret recovery phrase and store it safely offline

– Never share your recovery phrase with anyone

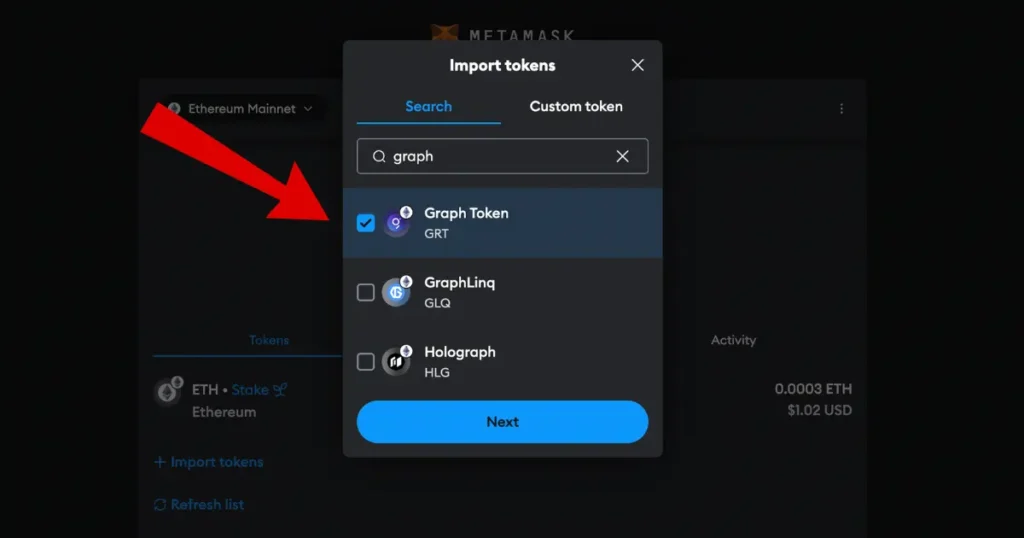

Step 2 – Import GRT token to MetaMask

– Open MetaMask and click on “Import tokens”

– Add the GRT token to your wallet

Step 3 – Fund your MetaMask wallet

– Send ETH and GRT to your MetaMask wallet address

– Ensure you have enough ETH for gas fees (check etherscan.io/gastracker)

– Remember to leave extra ETH for future transactions

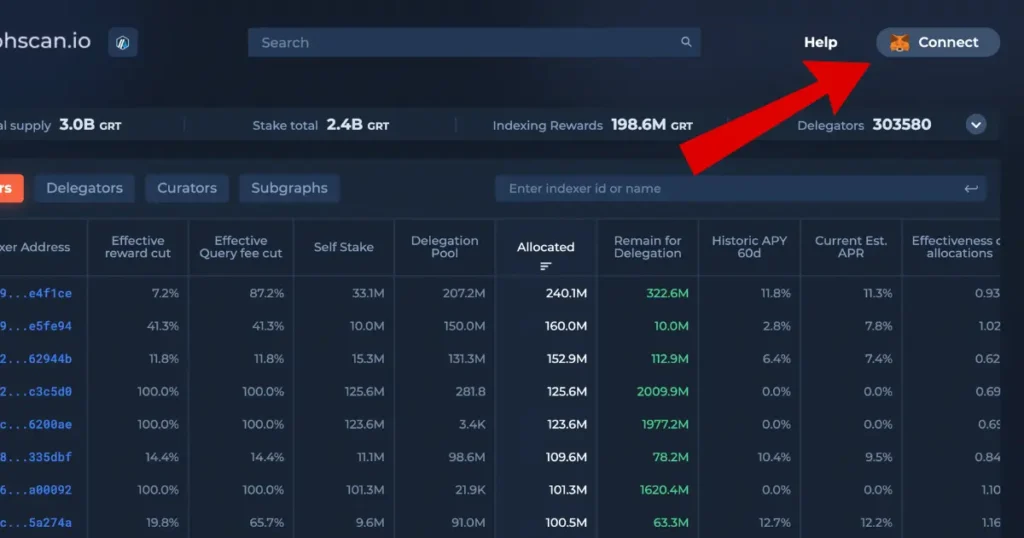

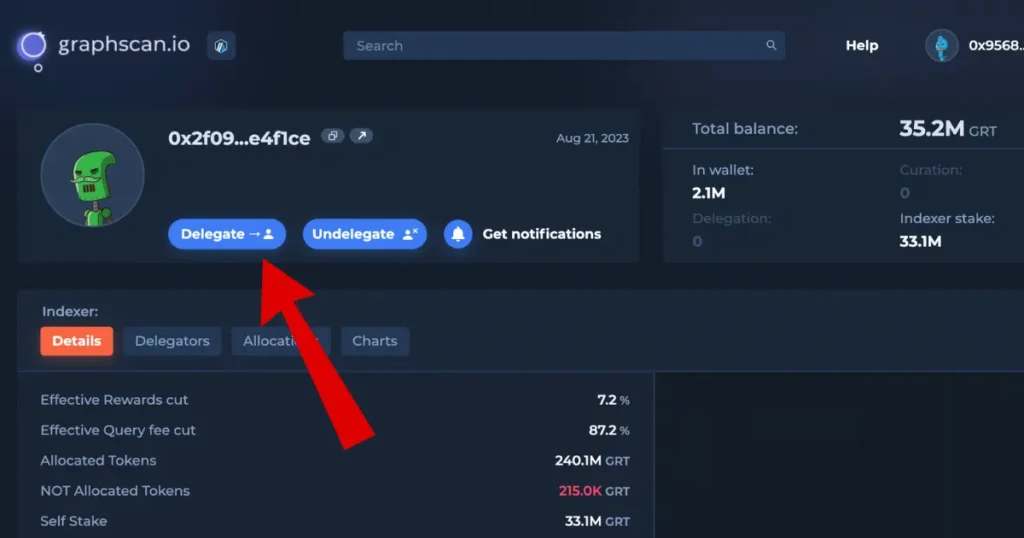

Step 4 – Choose an Indexer

– Go to graphscan.io/indexers

– Compare Indexers based on reward cuts, query fee cuts, and estimated APRs

Step 5 – Connect your wallet

– On the Graphscan platform, click “Connect wallet”

– Select your MetaMask account when prompted

Step 6 – Delegate your GRT

– Locate your chosen Indexer

– Click the “Delegate” button

– Enter the amount of GRT you want to stake

– Click “Submit transaction”

Step 7 – Confirm the transaction

– Review the transaction details in the MetaMask popup

– Check the associated gas fee

– If everything looks correct, confirm and sign the transaction

Step 8 – Verify your delegation

– Check your account details to confirm your delegated GRT amount

– You should see your current delegation and total delegated GRT

Remember:

- Rewards are accumulated daily but distributed based on when Indexers claim rewards

- There’s a 28-day unbonding period to unlock staked tokens

- A 0.5% token burn applies when delegating to a new Indexer

- Keep extra ETH in your wallet for future transactions

How to Stake GRT on Coinbase? Step-by-Step Guide

Staking GRT on Coinbase is a simple process that allows you to earn rewards while helping to secure the Injective network. Here’s how to do it:

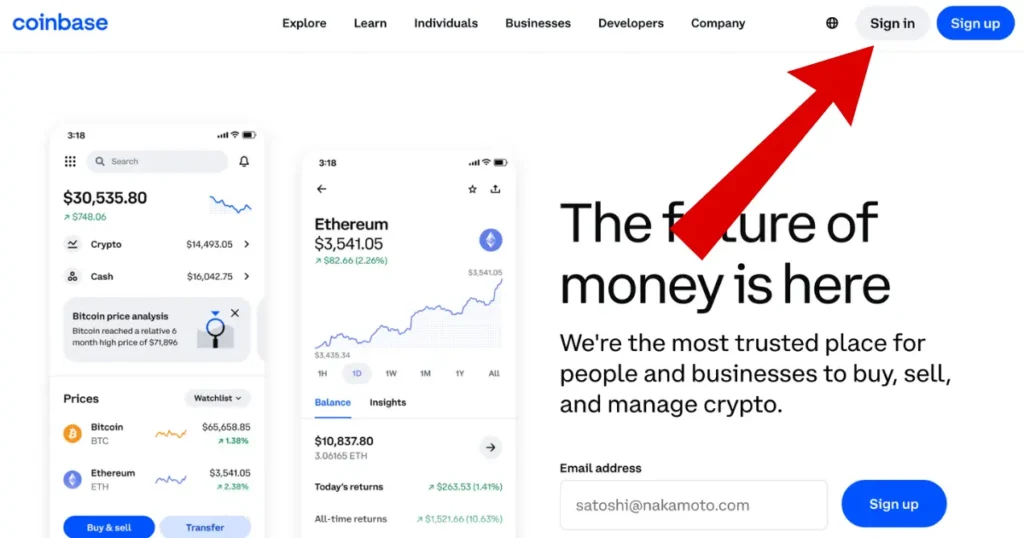

Step 1: Sign In to Coinbase

- Login to your Coinbase Account: Open your browser or the Coinbase mobile app and sign in to your Coinbase account.

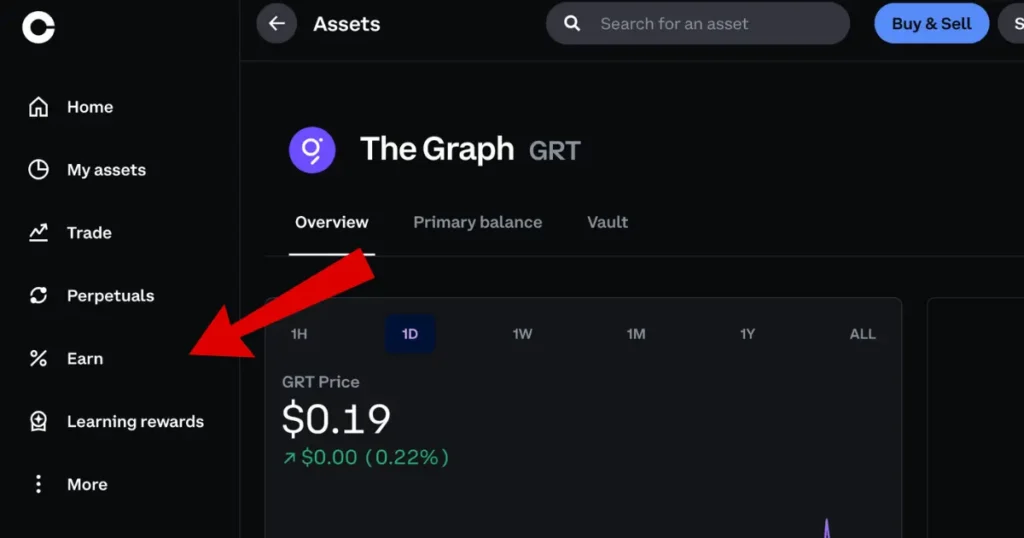

Step 2: Select The Graph (GRT)

- Navigate to My Assets: From your dashboard, go to the “My Assets” section.

- Select GRT: Find and select The Graph (GRT) from your list of assets.

Step 3: Start Staking

- Click on Stake: Once you’ve selected GRT, click on the “Stake” button.

- Review Staking Information: You will be prompted to review the staking information. Click “Continue” to acknowledge that you have reviewed it.

Step 4: Enter Staking Amount

- Specify Amount: Enter the amount of GRT you want to stake. Ensure it meets any minimum balance requirements for staking.

- Preview Stake: Click “Preview Stake” to see the details of your staking transaction.

Step 5: Confirm Staking

- Stake Now: After reviewing the preview, click “Stake Now” to confirm your transaction. Your GRT will now be staked and earning rewards.

Step 6: Managing Your Staked GRT

- Monitor Rewards: You can view your staked balance and earned rewards in the “Earning” section of your GRT asset page.

- Unstake if Necessary: To unstake, go to your assets, select GRT, and choose “Unstake.” Follow the prompts to confirm the amount and finalize the unstaking process.

Risk of Staking GRT

Staking GRT involves several risks to consider:

Market volatility can affect your staked GRT’s value. The 28-day unbonding period limits quick access to your tokens. A 0.5% delegation tax is applied when staking with a new Indexer, slightly reducing your initial stake.

Consider the opportunity cost of locking up your GRT. Network changes may affect staking mechanics, so stay informed about protocol updates.

Understanding these risks is crucial before staking. Only stake what you can afford to lock up, and always do your own research to make informed decisions.

Conclusion

Staking GRT on The Graph Network offers a valuable way to support decentralized indexing and potentially earn rewards. By following the steps in this guide, you can become a delegator and participate in network growth.

Remember, staking has both benefits and risks. You can earn passive income and enhance network security, but be mindful of market volatility, unbonding periods, and smart contract risks.

The Graph’s ecosystem is ever-changing. Stay updated, monitor your Indexer’s performance, and review your staking strategy regularly. Only stake what you can afford to lock up for a long period.

Whether you’re a crypto veteran or a newcomer, staking GRT can be a rewarding way to engage with Web3. Your participation as a delegator supports The Graph’s mission to organize and make blockchain data accessible.

FAQ

How do I stake my GRT?

To stake GRT, set up a compatible wallet like MetaMask, fund it with GRT and ETH, then connect to The Graph’s staking platform or an exchange and delegate your tokens to an Indexer.

Can you stake The Graph on Coinbase?

Yes, you can stake GRT on Coinbase by selecting GRT from your assets, clicking “Stake,” and confirming the transaction.

How to delegate GRT tokens?

Delegate GRT tokens by connecting your funded wallet to The Graph’s staking interface, choosing an Indexer, and specifying the amount to delegate.

Is GRT proof of stake?

Yes, GRT utilizes a proof-of-stake mechanism where token holders can stake their tokens to support network operations and earn rewards.

Where can I stake GRT?

You can stake GRT on The Graph’s native platform, Coinbase, Kraken, Binance, and various DeFi platforms.

What is the best platform for staking GRT?

The Graph’s native staking offers the highest returns (~11% APY), while Coinbase provides ease of use with the same APY. Kraken and Binance offer lower returns but are simpler to use.