Overview

Want to make your Pepe work for you? Staking is your golden ticket. Here’s the quick overview on how to get started:

- Choose a staking platform (Binance is our top pick)

- Set up an account and deposit your Pepe

- Select a staking option

- Confirm your stake and watch your Pepe multiply

It’s that simple. But don’t stop here – keep reading to unlock the full potential of your Pepe stash.

What is Pepe Staking?

Pepe staking is like putting your memes to work. Instead of letting your Pepe tokens sit idle in your wallet, you’re locking them up in a platform that uses them to validate transactions on the network. In return, you get rewarded with more Pepe. It’s passive income for the meme economy.

This isn’t just some get-rich-quick scheme. Staking plays a crucial role in keeping the Pepe ecosystem secure and efficient. You’re not just earning – you’re contributing to the network’s stability.

Think of it like this: by staking your Pepe, you’re essentially becoming a temporary landlord in the Pepe universe. Your tokens are like real estate, and the network is paying you rent for using them. The more Pepe you stake, the bigger your property, and the more rent you collect.

Why Should I Stake Pepe?

Why the hell not? Here’s why you’d be crazy not to stake your Pepe:

- Passive income: Earn more Pepe while you sleep

- Support the network: Be part of something bigger than your wallet

- Lower risk than trading: No need to time the market

- Potential for higher returns: Beat traditional savings rates

- Compound growth: Reinvest your staking rewards for exponential gains

- Flexibility: Many platforms offer options to unstake quickly if needed

Staking Pepe is a no-brainer for anyone serious about maximizing their crypto holdings. It’s not just about making gains – it’s about being smart with your assets.

Let’s break it down further. When you’re hodling Pepe in your wallet, it’s like keeping cash under your mattress. Sure, it’s safe, but it’s not doing anything for you. Staking puts that Pepe to work. It’s like moving from a savings account that pays 0.01% interest to one that’s offering 8% or more. You’d jump on that in the traditional finance world, so why not in the world of meme coins?

How Much Can I Earn Staking Pepe?

Your earnings depend on a few key factors:

- Amount of Pepe staked

- Current network rewards

- Duration of staking

- Platform-specific rates

- Network activity and transaction volume

- Total number of Pepe tokens staked network-wide

Don’t expect to become an overnight millionaire. But with current rates, you could be looking at some serious gains. For example, Binance is offering an 8% APY on Pepe staking. That means if you stake 100,000 Pepe tokens, you could earn 8,000 Pepe in a year. Not too shabby for letting your memes do the heavy lifting.

Let’s put this into perspective. Say you bought 100,000 Pepe at $0.01 each, investing $1,000. If the price stays stable and you stake for a year at 8% APY, you’d earn 8,000 Pepe, worth $80 at the current price. That’s an $80 return on a $1,000 investment, not counting any potential price appreciation of Pepe itself.

But here’s where it gets interesting. If you reinvest those staking rewards, you’re looking at compound growth. After five years of compounding at 8%, your initial 100,000 Pepe could grow to about 146,933 Pepe. That’s 46,933 free Pepe tokens just for staking.

Ways to Stake Pepe

Centralized Exchanges (CEX)

Staking on centralized exchanges like Binance or Bybit is the easiest way to get started. You deposit your Pepe, choose a staking option, and let the platform handle the rest. It’s perfect for beginners or those who want a hands-off approach.

CEX staking offers several advantages:

- User-friendly interfaces

- Lower technical barriers

- Often insured against hacks

- Customer support available

- Easier tax reporting in many cases

However, there are trade-offs:

- You don’t hold your private keys

- Potentially lower rewards compared to DeFi

- Less control over your staked assets

Decentralized Finance (DeFi) Platforms

For the more adventurous Pepe holders, DeFi platforms offer another avenue for staking. This method gives you more control and potentially higher rewards, but it comes with increased complexity and risk. You’ll need to be comfortable with smart contracts and have a solid understanding of the DeFi landscape.

DeFi staking pros:

- Higher potential rewards

- Full control over your assets

- Anonymity (in most cases)

- Contribution to decentralization

DeFi staking cons:

- Higher technical complexity

- Smart contract risks

- No customer support if things go wrong

- Potentially higher gas fees for transactions

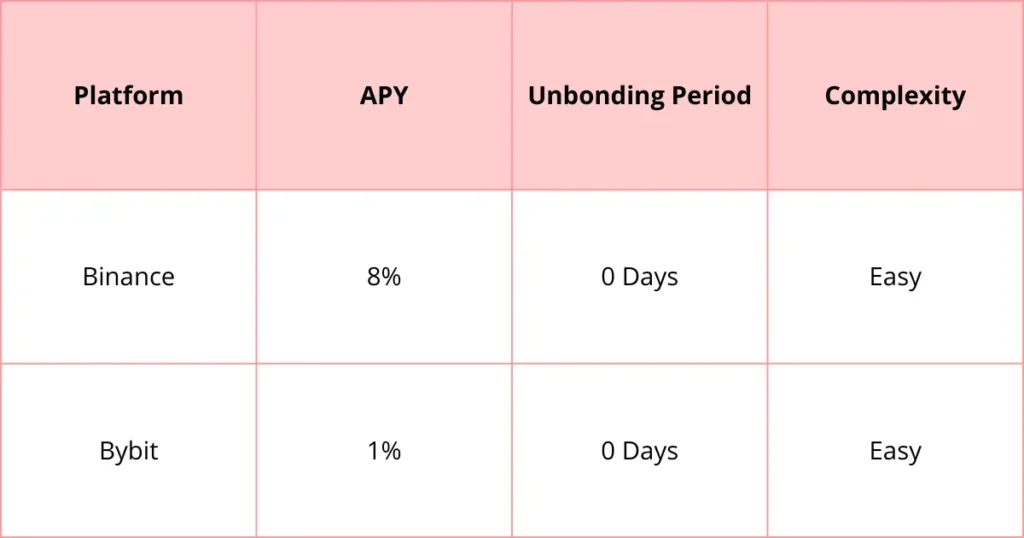

What are the Best Places for Staking Pepe?

Not all staking platforms are created equal. Here’s a quick comparison of top options:

Our pick? Binance, hands down. With the highest APY and zero unbonding period, it’s a no-brainer for most Pepe stakers.

But don’t just take our word for it. Do your own research. Check out user reviews, compare historical APY rates, and consider factors like platform security and ease of use. Remember, the best platform for you depends on your individual needs and risk tolerance.

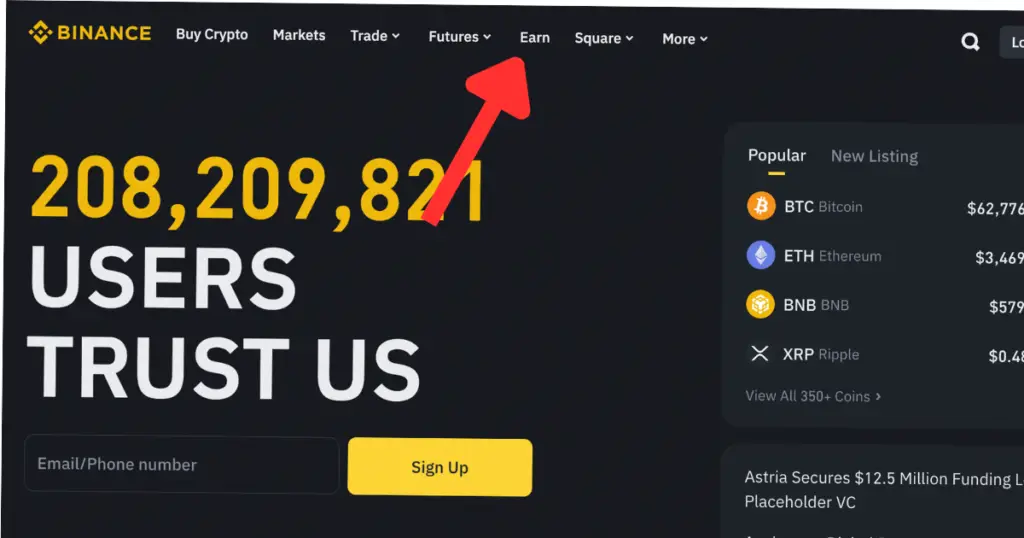

How to Stake Pepe on Binance: Step-by-Step Guide

Step 1: Navigate to Binance Staking

- Hit up the Binance homepage and hover over “Finance”

- Click on “Binance Earn”

- Find the “Staking” tab

- Use the search bar to find PEPE staking options

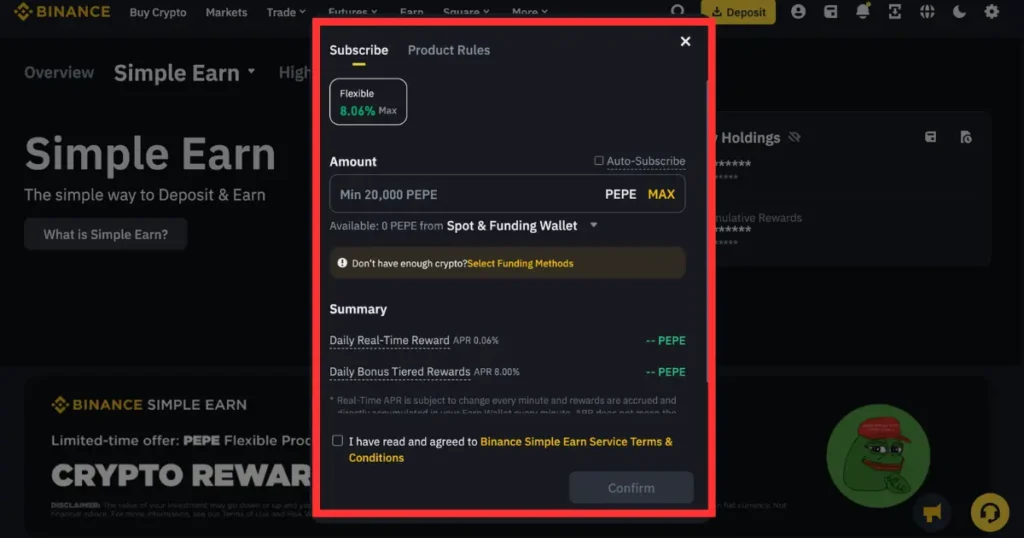

Step 2: Stake Your PEPE

- Choose your staking flavor (flexible or locked)

- Hit “Stake Now” next to your chosen option

- Enter how much PEPE you’re throwing in

- Double-check the details (duration, APY, terms)

- Click “Confirm” and you’re in business

Step 3: Monitor Your Staking

- Keep tabs on your staking game in the “Wallet” tab under “Earn”

- Watch those rewards roll in based on your chosen staking period

Step 4: Unstake PEPE (When Desired)

- Head back to “Earn” under the “Wallet” tab

- Find your staked PEPE and click “Redeem”

- Review and confirm – but watch out for any lock-up periods

Pro tip: Set calendar reminders for when your staking periods end. This way, you can quickly reinvest or change your strategy based on current market conditions.

Risk of Staking Pepe

Let’s get real for a second. Staking Pepe isn’t all rainbows and rocket ships. There are risks:

- Market volatility: Pepe’s value could tank while you’re staked

- Smart contract vulnerabilities: DeFi platforms can get hacked

- Regulatory uncertainty: The meme coin space is still the Wild West

- Liquidity risk: Some staking options might lock up your Pepe

- Opportunity cost: You might miss out on other investment opportunities

- Platform risk: The staking platform itself could face issues or shut down

Don’t stake more than you can afford to lose. Seriously.

To mitigate these risks, consider diversifying your staking across multiple platforms and coins. Keep a portion of your Pepe liquid for trading or emergencies. And always, always do your due diligence before committing to a staking platform.

Conclusion

Staking Pepe is a smart move for anyone looking to make their meme money work harder. It’s not without risks, but the potential rewards are too juicy to ignore. Whether you’re a Pepe veteran or a curious newcomer, platforms like Binance make it dead simple to get started.

Don’t let your Pepe collect dust in your wallet. Put that shit to work. The meme economy waits for no one.

Remember, staking is just one part of a well-rounded crypto strategy. Combine it with smart trading, dollar-cost averaging, and a dash of meme magic, and you’ll be well on your way to maximizing your Pepe potential.

FAQ

Is staking Pepe safe?

Nothing in crypto is 100% safe, but staking on reputable platforms minimizes risks.

Can I unstake my Pepe anytime?

Depends on the platform and staking option. Always check the terms before locking up your Pepe.

Do I need technical knowledge to stake Pepe?

Not if you use centralized exchanges like Binance. DeFi staking requires more crypto savvy.

What’s the minimum amount of Pepe I can stake?

Varies by platform. Some let you stake as little as 1 Pepe.

Are staking rewards taxable?

Probably. Check with a tax pro, because the last thing you want is the taxman coming for your memes.

Can I stake Pepe directly from my hardware wallet?

Not typically. You’ll usually need to transfer to a staking platform first.

What happens if Pepe’s price drops while I’m staking?

You’ll still earn staking rewards, but the overall value of your holdings may decrease.

Is staking Pepe better than trading it?

Depends on your goals and risk tolerance. Staking offers more stable returns, while trading can potentially yield higher profits (or losses).

Can I use staked Pepe for voting on network proposals?

Some platforms allow this, but it varies. Check the specific staking option for details.

How often are staking rewards distributed?

It varies by platform. Some distribute daily, others weekly or monthly. Always check the terms.