Quick Answer

- Connect your wallet to Injective Hub

- Deposit INJ tokens to your wallet

- Go to the “Staking” section on Injective Hub

- Choose a validator and click “Delegate Now”

- Enter the amount of INJ to stake and confirm

- Check and claim rewards in the “Wallet” section

What is Injective staking?

Injective staking offers INJ token holders a way to earn rewards while contributing to the security of the Injective network. It’s similar to staking on other Proof-of-Stake blockchains, but with a key difference.

Injective utilizes a Proof-of-Stake mechanism, but instead of directly staking your INJ on the Injective chain, you lock up your tokens by delegating them to validators. These validators are responsible for verifying transactions and securing the network. By locking up your INJ, you essentially become a stakeholder in the network’s health and receive rewards for your contribution.

Why should I stake Injective INJ?

Staking Injective (INJ) offers a dual benefit of earning passive rewards and contributing to the network’s security. This process is essential for maintaining a decentralized and efficient ecosystem. Here are a few main reasons to stake Injective:

- Earn Passive Income: By staking your INJ tokens, you receive rewards in the form of additional INJ, providing a steady income stream.

- Support Network Security: Staking helps secure the Injective Protocol by validating transactions and preventing malicious activities, ensuring a safer environment for all users.

- Promote Decentralization: Your participation in staking enhances the decentralization of the network, which is crucial for its resilience and democratic operation.

How much can I earn staking INJ?

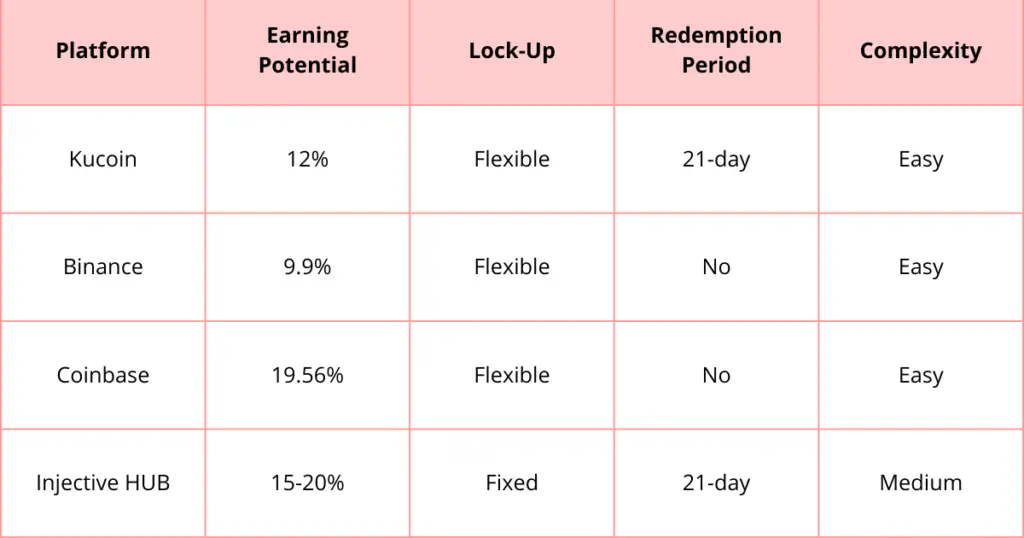

Earnings from staking Injective (INJ) typically range between 10% to 20% annually, depending on network conditions, the platform, and lock-up time. For example, staking on Binance can yield an APY of around 9.9%, while Injective Hub offers up to 15%. By consistently staking and reinvesting rewards, you can maximize your returns through the power of compound interest.

Ways to stake INJ?

Staking Injective (INJ) can be accomplished through several methods, each offering unique benefits and varying levels of complexity. Here are some common ways to stake INJ:

- Centralized Exchanges: Platforms like Binance and Coinbase allow users to stake INJ with ease, providing a user-friendly interface and additional security measures, albeit with slightly lower returns.

- DeFi Platforms: Decentralized finance platforms such as Injective Hub offer higher rewards and advanced staking options, making them ideal for users familiar with DeFi protocols.

What are the best platforms for staking INJ?

How to stake INJ on Injective HUB? Step-by Step

Staking INJ on the Injective Hub is a straightforward process that can be done in a few steps. Here’s how you can start earning rewards by staking your INJ tokens:

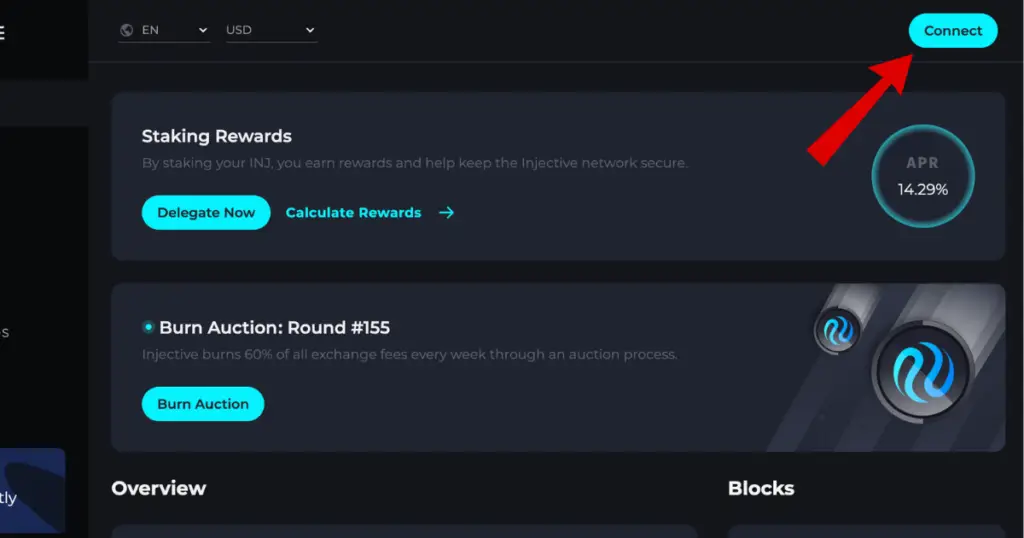

Step 1: Connect Your Wallet

1. Visit the Injective Hub

2. Click “Connect” on the top-right corner of the page.

3. Select your preferred wallet (e.g., MetaMask, Ledger, Keplr).

Step 2: Deposit INJ onto Injective

1. If you do not have INJ in your wallet, purchase it from major exchanges such as Binance or Coinbase.

2. Transfer from an exchange to your wallet

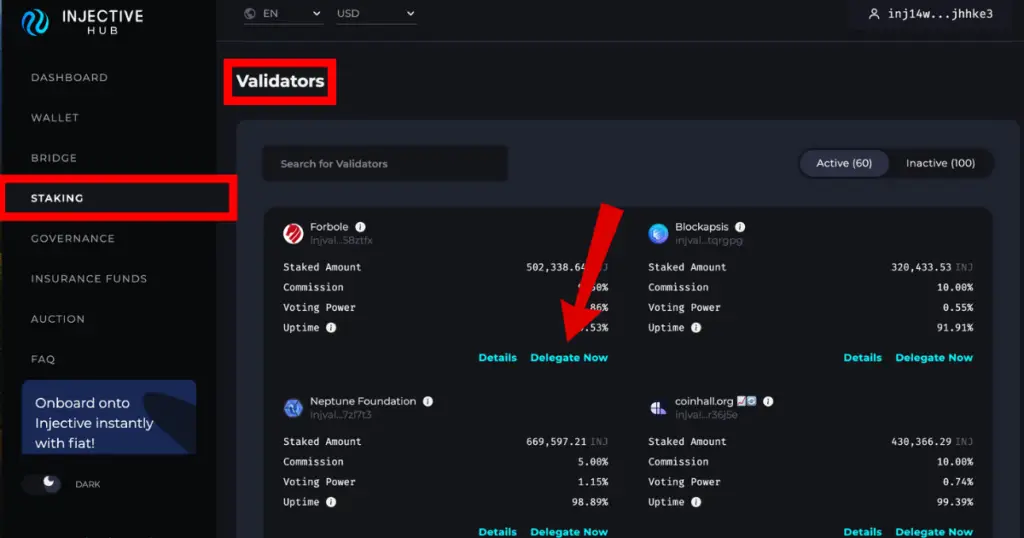

Step 3: Delegate to a Validator

1. Navigate to the “Staking” section on the left panel of the Injective Hub.

2. Review the list of validators, their staking APYs, and other details.

3. Choose a validator and click “Delegate Now”.

4. Specify the amount of INJ you wish to stake and confirm the delegation.

Step 4: Manage and View Rewards

1. Check your staking rewards by clicking “Wallet” on the left-hand side of the Injective Hub.

2. Rewards are distributed continuously on every block. Click “Claim” to collect your rewards.

3. Re-delegate your stake to a different validator, you won’t need to go through unbonding period, allowing continuous reward accrual.

How to stake INJ on Coinbase? Step-by Step

Staking INJ on Coinbase is a simple process that allows you to earn rewards while helping to secure the Injective network. Here’s how to do it:

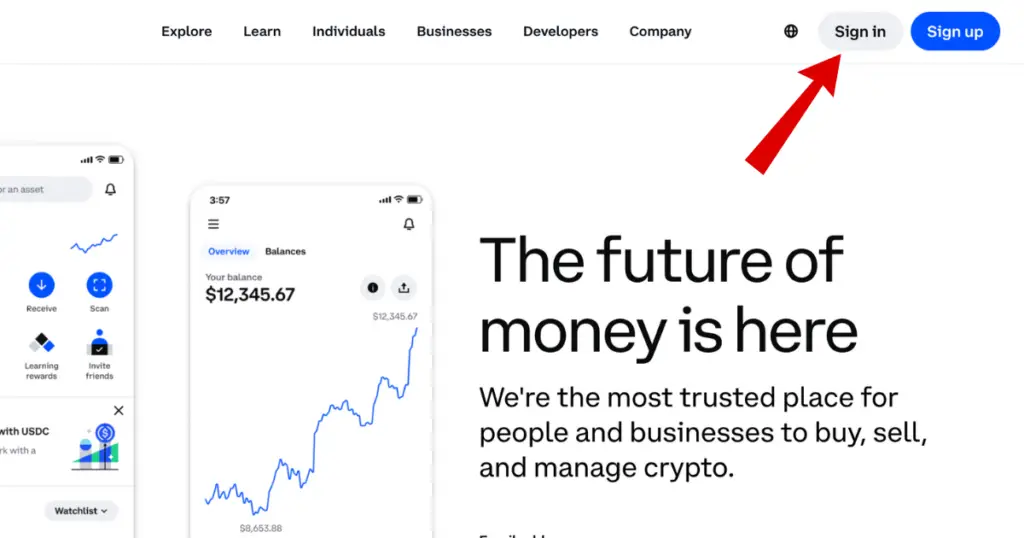

Step 1: Sign In to Coinbase

- Login to your Coinbase Account: Open your browser or the Coinbase mobile app and sign in to your Coinbase account.

Step 2: Select Injective (INJ)

- Navigate to My Assets: From your dashboard, go to the “My Assets” section.

- Select INJ: Find and select Injective (INJ) from your list of assets.

Step 3: Start Staking

- Click on Stake: Once you’ve selected INJ, click on the “Stake” button.

- Review Staking Information: You will be prompted to review the staking information. Click “Continue” to acknowledge that you have reviewed it.

Step 4: Enter Staking Amount

- Specify Amount: Enter the amount of INJ you want to stake. Ensure it meets any minimum balance requirements for staking.

- Preview Stake: Click “Preview Stake” to see the details of your staking transaction.

Step 5: Confirm Staking

- Stake Now: After reviewing the preview, click “Stake Now” to confirm your transaction. Your INJ will now be staked and earning rewards.

Step 6: Managing Your Staked INJ

- Monitor Rewards: You can view your staked balance and earned rewards in the “Earning” section of your INJ asset page.

- Unstake if Necessary: To unstake, go to your assets, select INJ, and choose “Unstake.” Follow the prompts to confirm the amount and finalize the unstaking process.

Risks of staking Injective

Staking Injective (INJ) offers rewards but comes with certain risks that investors should consider. One significant risk is slashing, where staked tokens can be partially or entirely lost if the chosen validator misbehaves or fails to operate correctly. Validators might be penalized for actions like double-signing or experiencing excessive downtime, which can directly impact your staked assets and reduce the overall rewards.

Another major risk is the unstaking period, which for Injective is typically around 21 days. During this time, your staked tokens are locked and cannot be transferred or sold. This exposes you to potential market volatility and opportunity costs if the value of INJ drops during the unstaking period.

Additionally, market volatility itself is a risk; the value of INJ tokens can fluctuate significantly, and a sharp decline in price can reduce the value of both your staked tokens and the rewards earned.

Conclusion

Staking Injective (INJ) offers a compelling opportunity to earn passive rewards while contributing to the network’s security and decentralization. If you are a new user, Coinbase provides a simple and user-friendly platform, while more experienced users can maximize their returns on Injective Hub.

FAQ

How much can I earn annually from staking Injective (INJ)?

You can earn between 10% to 20% annually from staking Injective (INJ), depending on the platform and network conditions.

Should I stake Injective?

Staking Injective is a good idea if you want to earn passive income and help secure the network. It’s beneficial for both you and the Injective ecosystem.

How to get INJ token?

You can get INJ tokens by purchasing them on major exchanges like Binance or Coinbase. Once bought, transfer them to your wallet for staking.

Can I unstake my INJ tokens at any time, and what is the unstaking period?

No, you cannot unstake immediately. The typical unstaking period for Injective is around 21 days, during which your tokens are locked and cannot be transferred or sold. But it also depends on the platform where you are staking.

How do I choose a reliable validator for staking my INJ tokens?

Choose a validator by reviewing their performance, fees, and community feedback. Reliable validators have a good track record, low downtime, and a fair fee structure.