Main Points

- Minimum Staking Requirement: No minimum required for most platforms.

- Lockup Periods: No lockup for Binance, Coinbase, and Kraken; Milkyway has a lockup period.

- Staking Options: Available through wallets, centralized exchanges, and DeFi platforms.

- Unstaking Period: Keplr and Milkyway requires 21day unbonding period.

- Rewards System: APYs range from 1% to 20%, depending on the platform.

- Recommended Platforms: Keplr Wallet, Binance, Milkyway

Quick Answer

- Choose a Staking Platform. Editors choice – Keplr Wallet

- Deposit TIA into your wallet

- Navigate to Keplr Dashboard

- Select network and validator

- Stake TIA tokens

- Approve transaction

What is TIA Staking?

Staking TIA involves participating in the Celestia network by locking up your TIA tokens to support the network’s operations. Celestia is a modular blockchain network designed to enhance scalability and flexibility in blockchain architecture.

By staking TIA, you help secure the network and validate transactions. In return for your participation, you earn rewards in the form of additional TIA tokens.

Staking TIA is similar to earning interest on a traditional savings account, but instead of depositing money into a bank, you’re holding and “staking” your TIA tokens within the Celestia network. This not only helps maintain the network’s security but also allows you to earn passive income.

Why Should I Stake TIA?

Staking TIA offers multiple advantages that make it a compelling option for beginners and experienced cryptocurrency enthusiasts. Here are three key reasons to consider staking TIA:

- Passive Income: By staking your TIA tokens, you can earn rewards in the form of additional TIA tokens. This allows you to grow your holdings over time without needing to actively manage your investment daily, similar to earning interest on a savings account.

- Governance Participation: Staking TIA gives you a voice in the governance of the Celestia network. As a staker, you can have voting rights on important decisions, such as protocol upgrades and reward structure changes, ensuring the network evolves according to the community’s interests and priorities.

- Network Security: Staking your TIA tokens helps secure the Celestia network and validate transactions. Your participation ensures the blockchain remains robust, stable, and resistant to attacks, contributing to the overall health of the ecosystem.

How Much Can I Earn Staking TIA?

Staking TIA can yield varying returns depending on the platform and the current market conditions. Generally, annual percentage yields (APYs) for TIA staking can range from 5% to 15%, providing a lucrative opportunity for passive income. Factors such as the staking duration, the amount staked, and network performance can influence the exact earnings.

Ways to Stake TIA?

Staking TIA can be accomplished through several methods, each offering unique benefits and varying levels of complexity. Here are some common ways to stake TIA:

1. Staking Wallets

Staking wallets like Keplr and Leap enable users to stake TIA tokens directly from their personal wallets, maintaining control over their private keys. This method offers enhanced security and typically lower fees, making it ideal for users who prioritize autonomy and are comfortable managing their own transactions.

2. Centralized Exchanges

Centralized exchanges such as Binance, Coinbase, and Kraken provide user-friendly staking services, allowing users to earn rewards by depositing TIA tokens into staking programs. This method is convenient and straightforward but comes with the security risks associated with keeping funds on a centralized platform.

3. DeFi Platforms

Decentralized Finance (DeFi) platforms like Milkyway offer staking opportunities in a decentralized manner, often yielding higher returns through participation in liquidity pools or lending protocols. This method requires more technical knowledge and involves higher risks, making it suitable for users comfortable with decentralized applications and seeking potentially greater rewards.

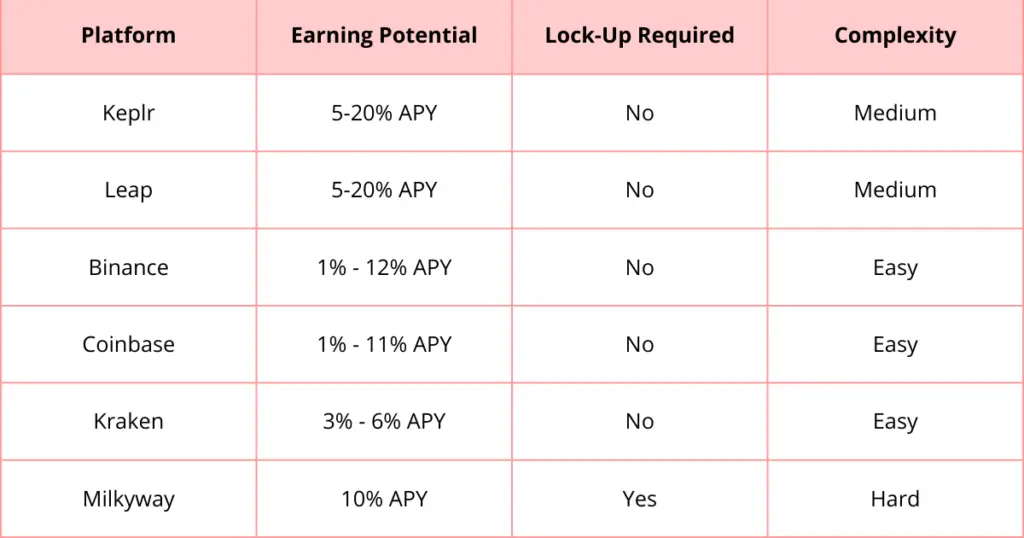

What are the Best Places for Staking TIA?

Various platforms provide different levels of earning potential, lock-up requirements, and complexity. Whether you are looking for a user-friendly experience or higher yields with more complexity, there is a staking option that fits your needs. Below is a comparison table of some of the best platforms for staking TIA, outlining their earning potential, lock-up requirements, and complexity.

How to Stake TIA on Keplr ? Step-by-Step Guide

Step 1: Create a Keplr Wallet

- Visit the Keplr website and install the browser extension.

- Once installed, open the extension and click “Create new account.” Follow the prompts to set up your wallet and securely save your seed phrase.

Step 2: Deposit TIA into Your Wallet

- Open your Keplr wallet and select “Deposit” from the menu.

- Choose the “Celestia” network and copy your wallet address.

- Transfer TIA tokens from an exchange or another wallet to this address.

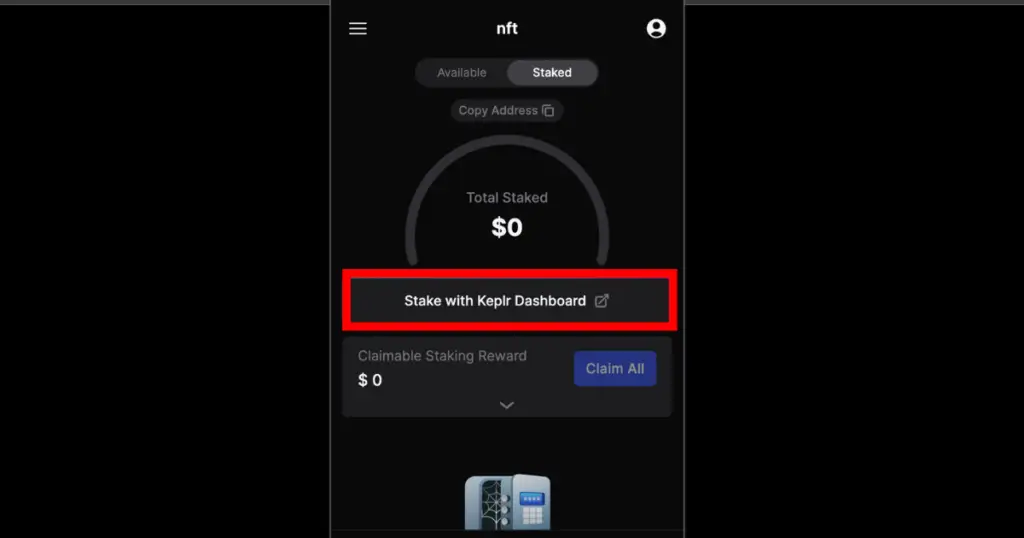

Step 3: Open Your Keplr Wallet

- Open the Keplr extension in your browser and unlock your wallet by entering your password.

- Navigate to Keplr Dashboard

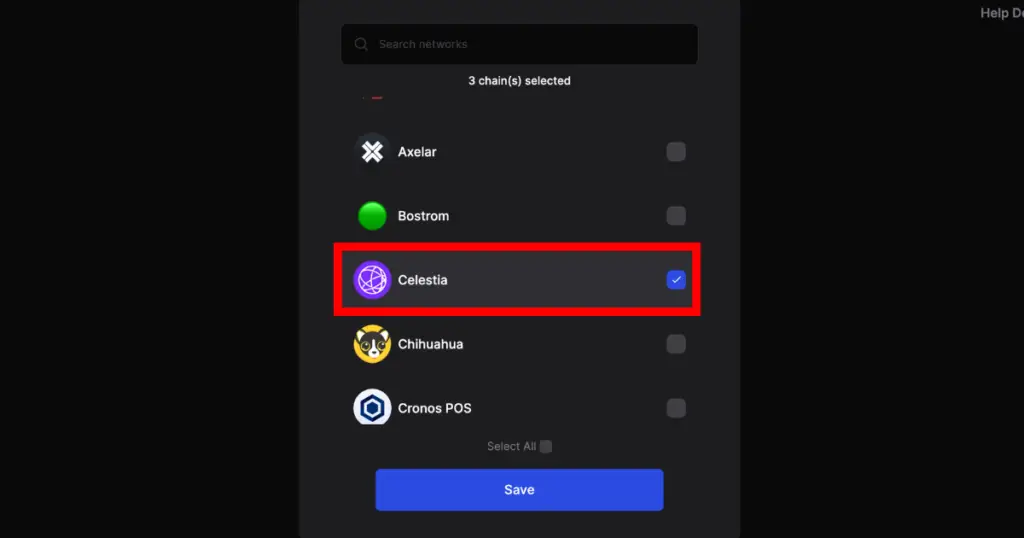

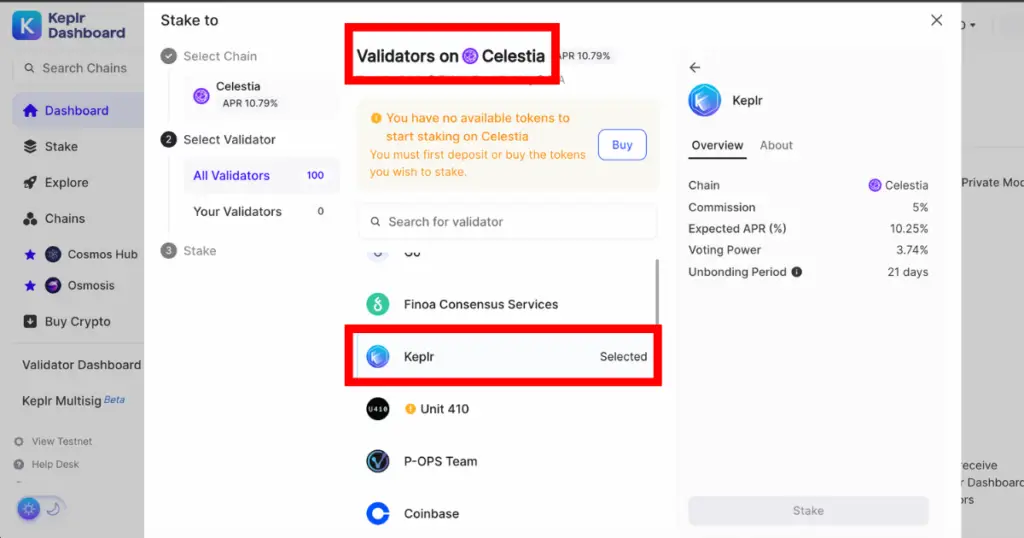

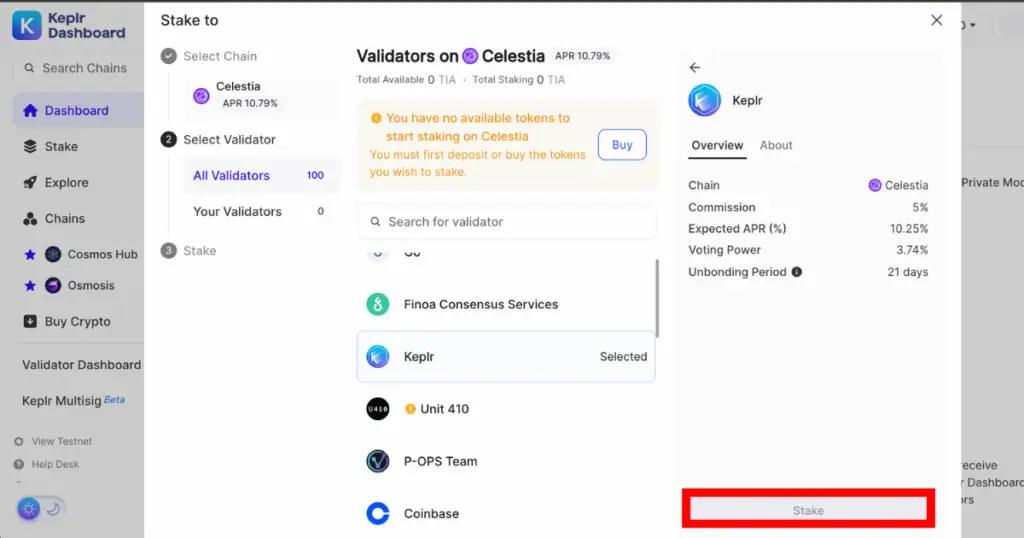

Step 4: Select Network and Validator

- In the left sidebar menu, click on “Stake.”

- Select the “Celestia” network and choose your validator.

Step 5: Stake TIA Tokens

- Click the “Stake” button next to your chosen validator

- Enter the amount of TIA you wish to delegate.

- Confirm by clicking “Stake” again.

Step 6: Confirm and Manage Your TIA Tokens

- Approve the staking transaction in your Keplr wallet.

- Use the Keplr dashboard to manage your staking activities: monitor your staked TIA, claim rewards, redelegate to different validators, or unstake your tokens as needed.

How to Stake TIA on Binance? Step-by-Step Guide

Step 1: Navigate to Binance Staking

- Hover over the “Finance” tab on the Binance homepage and click on “Binance Earn.”

- Click on the “Staking” tab within the Binance Earn section.

- Use the search bar to find TIA staking options.

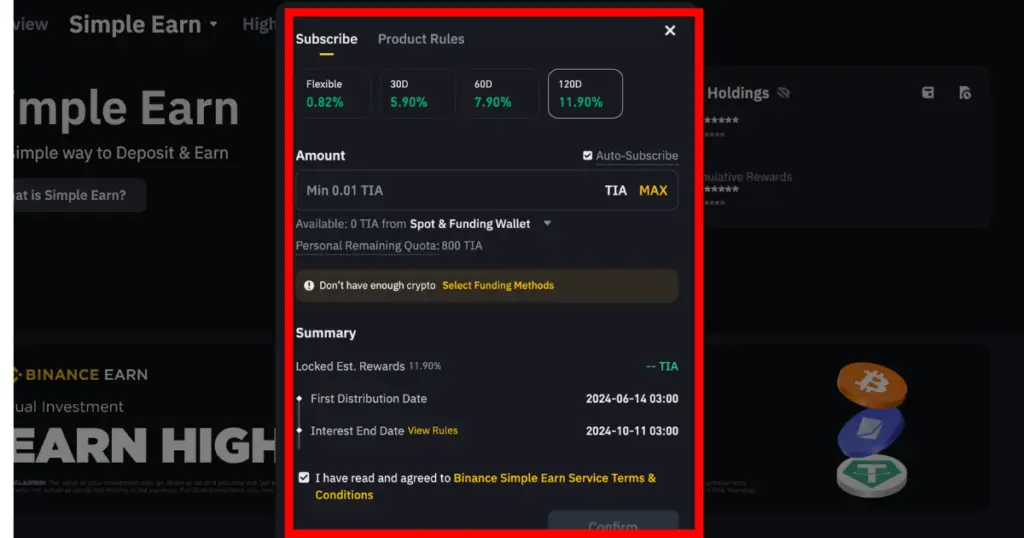

Step 2: Stake Your TIA

- Choose the staking option that suits your preference (e.g., flexible or locked staking).

- Click on the “Stake Now” button next to the TIA staking option.

- Enter the amount of TIA you want to stake. Ensure it’s within the available balance in your wallet.

- Review the details such as staking duration, estimated APY (Annual Percentage Yield), and any other terms.

- Click on “Confirm” to finalize the staking process.

Step 3: Monitor Your Staking

- Monitor your staking status and rewards by going to the “Wallet” tab and selecting “Earn.”

- You will start receiving staking rewards based on the staking period you selected. These rewards can be viewed under the “Earn” section.

Step 4: Unstake TIA (When Desired)

- Navigate to the “Earn” section under the “Wallet” tab.

- Find your staked TIA and click on the “Redeem” button.

- Review the details and confirm the unstaking process. Note that some staking options may have a lock-up period, so ensure you check the terms before unstaking.

Risks of Staking TIA

Staking TIA tokens can be a lucrative way to earn passive income, but it comes with several risks that investors need to consider. One significant risk is market volatility, as the value of TIA tokens can fluctuate dramatically, affecting the overall value of your staked assets and the returns you receive.

Additionally, some staking platforms may require a lock-up period during which you cannot access or withdraw your staked tokens, posing a risk if you need immediate access to your funds.

Another critical risk involves the security of the staking platform. Centralized platforms are susceptible to hacks and security breaches, leading to a loss of funds. Decentralized platforms, while often offering higher returns, can have vulnerabilities in their smart contracts.

Lastly, regulatory risks are always present, as new regulations could impact the legality or profitability of staking activities, making it essential for investors to stay informed about the regulatory environment in their jurisdiction.

Conclusion

Staking TIA tokens offers a great way to earn passive income while supporting the Celestia network. With various platforms like Keplr, Binance, and Milkyway, investors can find the best fit based on their preferences for security, ease of use, and potential returns. However, be mindful of risks such as market volatility, platform security, and regulatory changes. By staying informed and choosing the right platform, you can maximize your staking rewards while managing these risks effectively.

FAQ

How often do I receive staking rewards?

Staking rewards are typically distributed periodically, depending on the platform, ranging from daily to monthly distributions.

Can I unstake my TIA tokens at any time?

Yes, platforms like Binance, Coinbase, and Kraken allow for unstaking at any time, but some platforms like Milkyway require a lockup period.

What happens if the value of TIA decreases while my tokens are staked?

The value of your staked TIA will decrease with the market, impacting the overall value of your holdings and returns.

Can I choose which validator to stake with on all platforms?

Yes, when using staking wallets like Keplr, you can choose your preferred validator, while centralized platforms might assign one automatically.

What happens if a validator I chose misbehaves or gets slashed?

If a validator misbehaves, they can be penalized, and a portion of your staked tokens might be at risk. Always choose reputable validators to mitigate this risk.