Quick Overview

Staking BNB involves locking your tokens on a centralized exchange platform to earn passive income through interest rewards.

Here’s how to stake BNB in 4 quick steps:

- Choose a staking platform (e.g., Binance or KuCoin)

- Transfer your BNB to the platform

- Navigate to the staking section

- Select your staking terms and confirm

Let’s explore the world of BNB staking and how you can maximize your crypto gains.

What is BNB Staking?

BNB staking is a process where you lock up your BNB tokens for a set period to earn rewards. It’s similar to putting your money in a high-yield savings account, but with cryptocurrency. By staking your BNB, you’re essentially lending your tokens to the platform, which then uses them for various purposes within their ecosystem.

However, BNB staking has undergone significant changes recently. With the sunsetting of the BNB Beacon Chain, traditional staking through validators is no longer available. Instead, BNB staking now primarily occurs on centralized exchanges. While this shift might not be ideal for decentralization purists, it still offers a way to earn passive income on your BNB holdings.

Why Should I Stake BNB?

It would be best if you staked BNB because it’s a smart way to make your crypto work for you.

Here are the key reasons:

- Passive income: Earn more BNB without active trading

- Hodl with benefits: Get rewarded for long-term holding

- Relatively low-risk: Compared to active trading strategies

- Inflation hedge: Potentially offset the effects of inflation on your crypto holdings

- Compound growth: Reinvest earnings for exponential growth over time

By staking your BNB, you’re not just sitting on your assets – you’re actively growing them. It’s like planting a money tree in the crypto garden. Sure, it might not make you rich overnight, but over time, those rewards can really add up.

How Much Can I Earn Staking BNB?

Your potential earnings from staking BNB depend on several factors, including the platform you choose, the amount you stake, and current market conditions.

Factors influencing your earnings:

- Chosen platform and its APY rates

- Amount of BNB staked

- Duration of staking period

- Market volatility and BNB price fluctuations

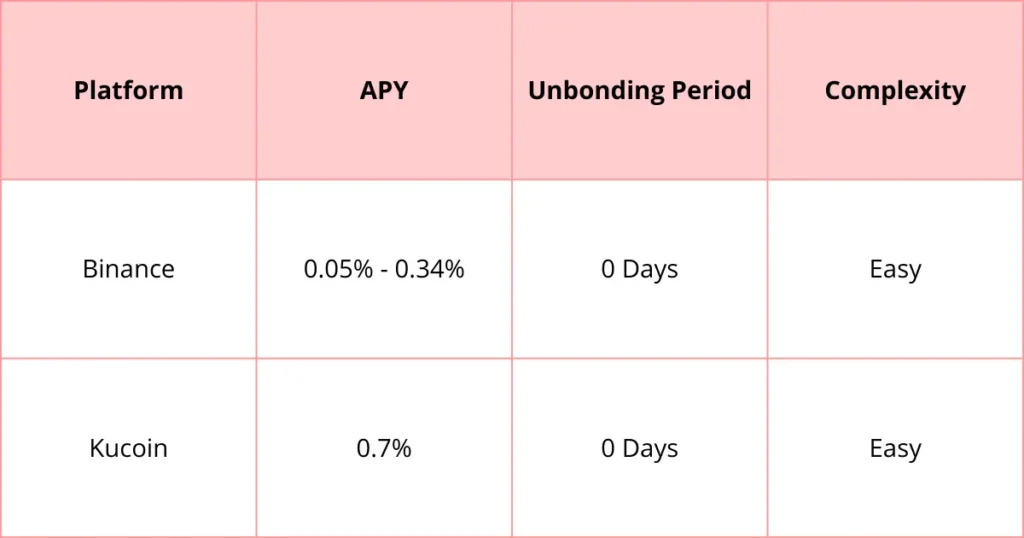

As of now, staking on Binance can yield between 0.05% to 0.34% APY, while KuCoin offers around 0.7% APY. These rates might seem modest, but remember – in the world of compound interest, even small percentages can lead to significant growth over time.

Ways to Stake BNB

Centralized Exchanges

Given the current state of BNB staking, centralized exchanges are now the primary method for staking BNB. Platforms like Binance and KuCoin offer user-friendly interfaces, competitive rates, and handle all the technical aspects of staking. This makes it easier for both newcomers and experienced crypto enthusiasts to participate in BNB staking without worrying about the complexities of running a validator node.

What are the Best Places for Staking BNB?

When it comes to staking BNB, your options are somewhat limited, but you still have choices. Let’s compare two popular platforms:

Editor’s choice – Binance

Binance takes the crown as our top pick for BNB staking. Why? It’s not just about the APY. Binance offers a robust ecosystem, top-notch security measures, and a user-friendly interface that makes staking accessible to everyone. Plus, as the native platform for BNB, Binance often provides exclusive staking opportunities and promotions for BNB holders. The seamless integration with other Binance services also means you can easily manage your entire crypto portfolio in one place.

How to Stake BNB on Binance: Step-by-Step Guide

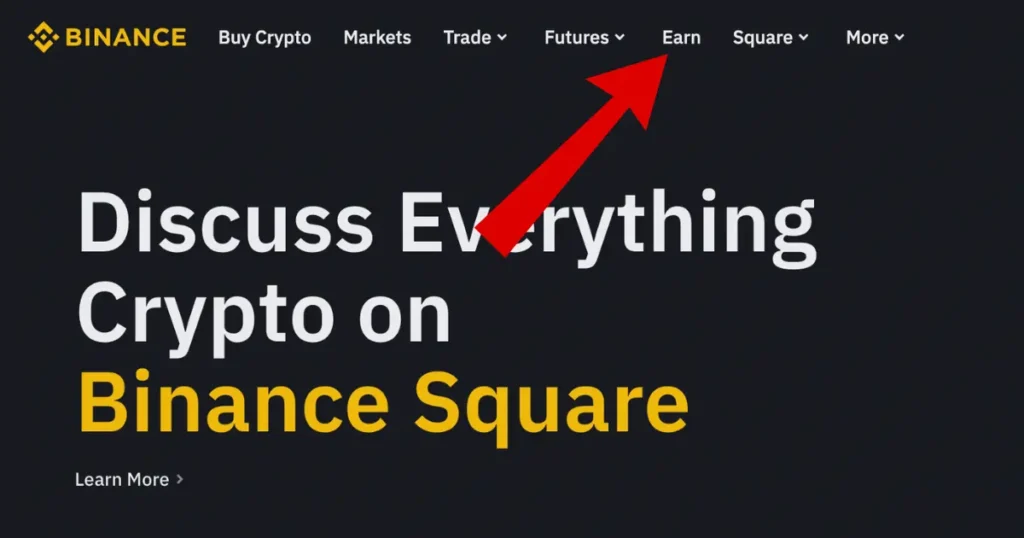

Step 1: Navigate to Binance Staking

- Hit up the Binance homepage and hover over “Finance”

- Click on “Binance Earn”

- Find the “Staking” tab

- Use the search bar to find BNB staking options

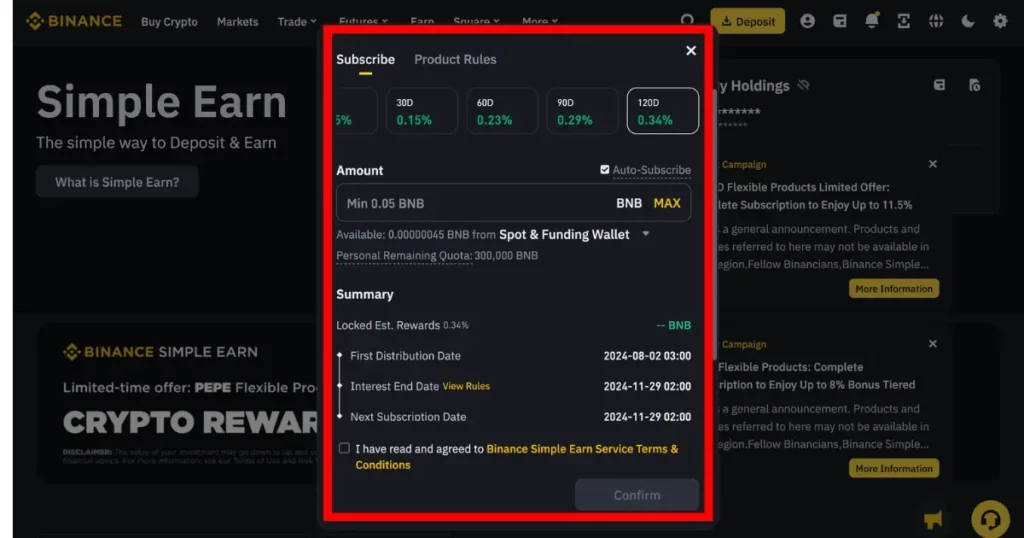

Step 2: Stake Your BNB

- Choose your staking flavor (flexible or locked)

- Hit “Stake Now” next to your chosen option

- Enter how much BNB you’re throwing in

- Double-check the details (duration, APY, terms)

- Click “Confirm” and you’re in business

Step 3: Monitor Your Staking

- Keep tabs on your staking game in the “Wallet” tab under “Earn”

- Watch those rewards roll in based on your chosen staking period

Step 4: Unstake BNB (When Desired)

- Head back to “Earn” under the “Wallet” tab

- Find your staked BNB and click “Redeem”

- Review and confirm – but watch out for any lock-up periods

Risks of Staking BNB

Let’s get real for a moment. While staking is generally considered a low-risk strategy, it’s not entirely without risks. Here are some key points to keep in mind:

- Market volatility: The value of your staked BNB can still fluctuate based on market conditions

- Platform risk: You’re trusting the exchange with your funds, so choose reputable platforms

- Opportunity cost: Your BNB is locked up and can’t be quickly traded if market conditions change

- Regulatory changes: Crypto regulations are evolving, which could impact staking in the future

- Technical risks: While rare, smart contract bugs or hacks could potentially affect your staked assets

Despite these risks, if you believe in the long-term potential of BNB and the Binance ecosystem, the rewards of staking often outweigh the risks for many investors.

Conclusion

Staking BNB isn’t just about earning a few extra tokens – it’s about taking an active role in your crypto investment strategy. Yes, the landscape has changed with the sunsetting of BNB Beacon Chain, but opportunities still exist for those willing to adapt.

So, what’s your next move? If you’ve got BNB sitting idle in your wallet, it might be time to put it to work. Start small if you’re unsure, but the important thing is to start. Your future self might thank you for taking action today.

Remember, in the fast-paced world of crypto, standing still is essentially moving backward. Keep learning, stay informed, and most importantly, take calculated actions. Your crypto journey is in your hands – make it count.

FAQ

Can I unstake my BNB at any time?

It depends on the platform and staking terms you choose. Some offer flexible staking with no lock-up period, while others might have fixed terms.

Is staking BNB safe?

While generally considered low-risk, staking does come with some risks, including market volatility and platform risks. Always do your due diligence.

Do I need technical knowledge to stake BNB?

Not really. Staking on centralized exchanges like Binance is designed to be user-friendly and doesn’t require technical expertise.

How often are staking rewards paid out?

This varies by platform. Some distribute rewards daily, while others might do it weekly or monthly. Check the terms of your chosen staking option.

Can I compound my staking rewards?

Yes, many platforms allow you to automatically reinvest your staking rewards, enabling compound growth over time.

What’s the minimum amount of BNB I need to start staking?

Minimum staking amounts vary by platform. On Binance, for example, it can be as low as 0.1 BNB for some staking options.