Quick Answer

- Choose a Staking Platform. Editors’ choice – Core Wallet

- Deposit AVAX into your wallet

- Navigate to the Staking Section

- Select a validator

- Stake AVAX tokens

- Approve the transaction

What is AVAX Staking?

AVAX staking is the process of participating in the Avalanche network by locking up your AVAX tokens. When you stake AVAX, you help secure the network and validate transactions. In return, you earn rewards in the form of additional AVAX tokens.

How It Works

Staking in the cryptocurrency world is similar to earning interest on a savings account. Just as banks use the money in your savings account to make loans and investments, the Avalanche network uses staked AVAX to maintain its operations and security.

By staking your AVAX, you play a crucial role in the network’s functionality and stability, and in return, you receive a reward for your contribution.

Why Should I Stake AVAX?

Staking AVAX is like planting a tree. Just as a tree grows and provides fruit over time, staking AVAX allows your tokens to grow and yield rewards. By staking your AVAX, you contribute to the health of the Avalanche network, much like how planting a tree benefits the environment. Additionally, you receive rewards for your contribution, similar to enjoying the fruits of a well-tended tree. Here are the key benefits of staking your AVAX:

- Passive Income: Earn rewards for supporting the network.

- Network Security: Enhance the security and decentralization of Avalanche.

- Community Participation: Be an active member of the Avalanche community.

How Much Can I Earn Staking AVAX?

The amount you can earn by staking AVAX depends on three main factors: the amount you stake, the duration of your staking period, and the performance of the network. For example, staking AVAX on Binance typically offers a yield of around 6.59%, while using the Avalanche Wallet can provide returns of approximately 7.6%.

These rates can fluctuate based on market conditions and network activity. Generally, staking more AVAX for a longer period results in higher rewards.

Ways to Stake AVAX

Staking AVAX can be done through various methods, including wallets, centralized exchanges, and DeFi platforms. Here’s a closer look at each option:

Wallets

Using wallets like the official Avalanche Wallet allows you to stake AVAX directly. This method puts you in complete control of your funds and the staking process. By self-staking with a wallet, you can maximize your rewards and play an active role in the network’s governance. This option is perfect for those who enjoy managing their own assets and have a good grasp of the technical side of things.

Centralized Exchanges

Centralized exchanges like Binance and Kraken provide user-friendly staking services. These platforms handle the technicalities of staking for you, making it easy for beginners to get started. By staking on a centralized exchange, you get professional management and support, though you might have to pay some fees and give up a bit of control over your assets. This method is convenient and accessible, offering a nice balance between simplicity and earning potential.

DeFi Platforms

DeFi platforms such as Aave and Yield Yak offer decentralized staking options for AVAX. These platforms let you stake your tokens in a decentralized way, often with innovative yield-earning strategies. By using DeFi platforms, you can explore various financial products and services built on the Avalanche network.

This approach can potentially boost your returns through strategies like yield farming and liquidity mining. It’s ideal for users who are comfortable with decentralized finance and eager to maximize their returns with advanced methods.

What are the Best Places for Staking AVAX?

Various platforms offer different levels of earning potential, lock-up requirements, and complexity. Whether you want a user-friendly experience or higher yields with more complexity, there’s a staking option for you. Below is a comparison of some of the best platforms for staking AVAX, highlighting their key features.

Comparison Table

Platform Details

- Core Wallet: Offers high earning potential with fixed lock-up periods. This option requires a moderate level of technical knowledge but gives you full control over your staking process.

- Binance: Provides a good yield and handles the technical aspects for you. The lock-up periods are flexible, making it an accessible and convenient choice for beginners.

- Coinbase: Offers a lower yield but with flexible lock-up periods and an easy-to-use interface. It’s ideal for those who prioritize simplicity and ease of use.

- Crypto.com: Combines a competitive yield with flexible lock-up periods and an easy staking process. This platform is suitable for users seeking a balance between earning potential and convenience.

- Aave: A DeFi platform that offers a moderate yield with fixed lock-up periods. It requires more advanced knowledge of decentralized finance but provides a reliable staking option.

Editor’s Choice

The best platform to stake AVAX is the Core Wallet. It offers the highest earning potential at 7.5% and allows you to have full control over your staking process, making it the top choice for those with a moderate level of technical knowledge looking to maximize their rewards.

How to Stake AVAX on Core Wallet: Step-by-Step Guide

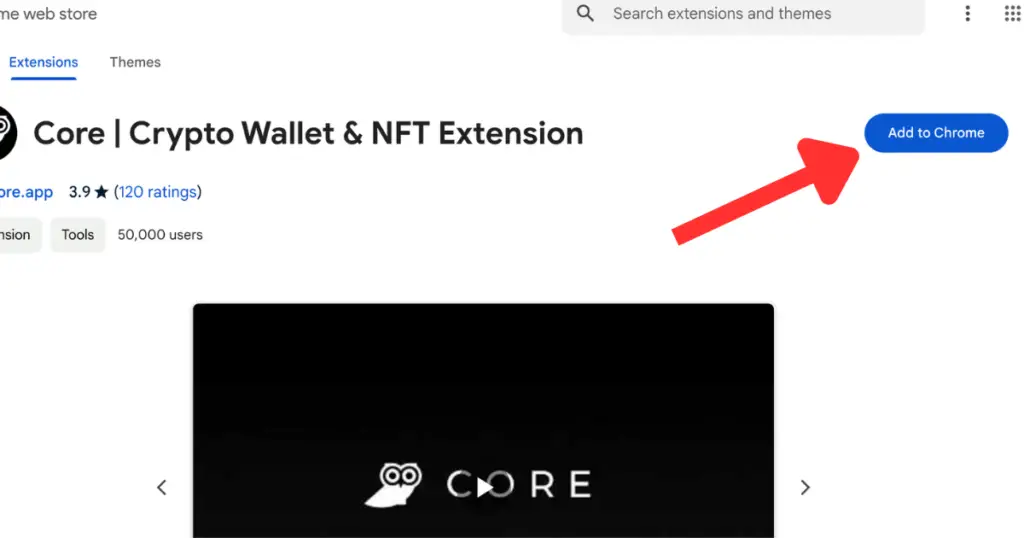

Step 1: Download and Install the Core Wallet

- Visit the Core Wallet Website: Go to the official Core Wallet website.

- Download the Wallet: Choose the appropriate version for your operating system (Windows, macOS, or Linux) and download the installation file.

- Install the Wallet: Follow the installation instructions specific to your operating system to install the Core Wallet on your device.

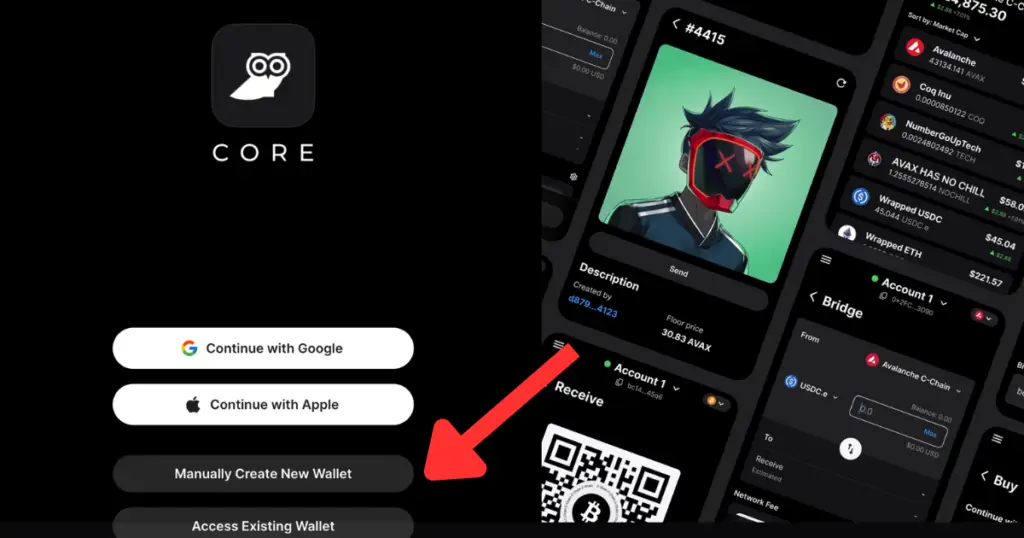

Step 2: Create a New Wallet

- Open the Core Wallet: Launch the Core Wallet application on your device.

- Create a New Wallet: Click on “Create New Wallet” and follow the prompts to set up your wallet. Make sure to securely store your recovery phrase as it is essential for accessing your wallet in case you forget your password.

Step 3: Fund Your Wallet with AVAX

- Obtain AVAX: Purchase AVAX tokens from a cryptocurrency exchange if you don’t already have them.

- Transfer AVAX to Core Wallet: Copy your Core Wallet AVAX address and use it to transfer AVAX tokens from your exchange account to your Core Wallet.

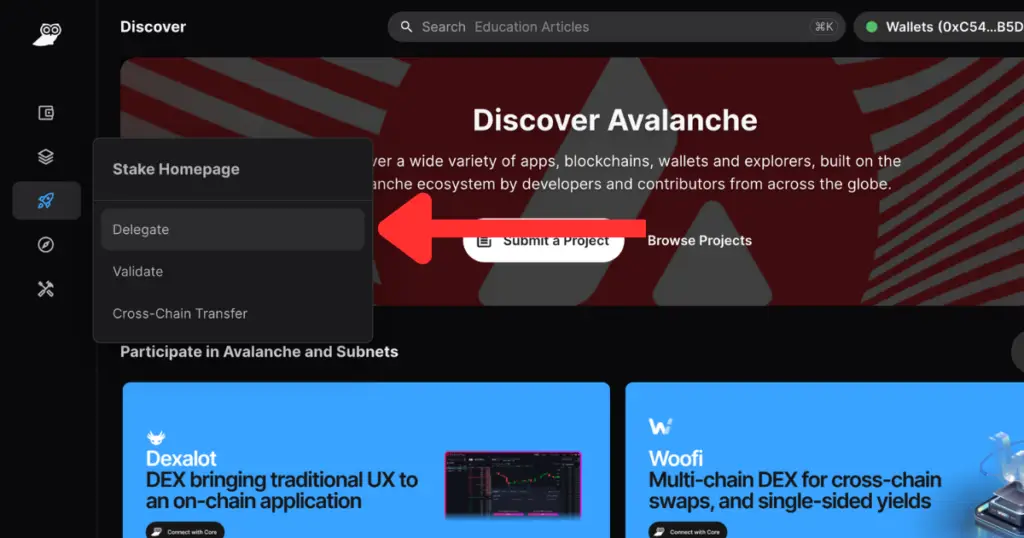

Step 4: Access the Staking Section

- Open the Core Wallet: Ensure you have the required amount of AVAX in your wallet.

- Navigate to Staking: In the Core Wallet interface, find and click on the “Staking” or “Earn” section to access staking options.

Step 5: Choose a Validator

- View Available Validators: Browse the list of available validators within the staking section.

- Select a Validator: Choose a validator based on factors such as their reputation, uptime, and commission rates. Selecting a reliable validator is crucial for maximizing your staking rewards.

Step 6: Delegate Your AVAX

- Enter the Staking Amount: Decide how much AVAX you want to stake and enter the amount.

- Confirm and Stake: Review the details and confirm the staking transaction. Your AVAX tokens will be locked in the staking process, and you will start earning rewards.

Step 7: Monitor Your Staking

- Check Staking Status: Use the Core Wallet to monitor your staking status and rewards.

- Withdraw Rewards: Periodically withdraw your staking rewards or reinvest them to increase your earnings.

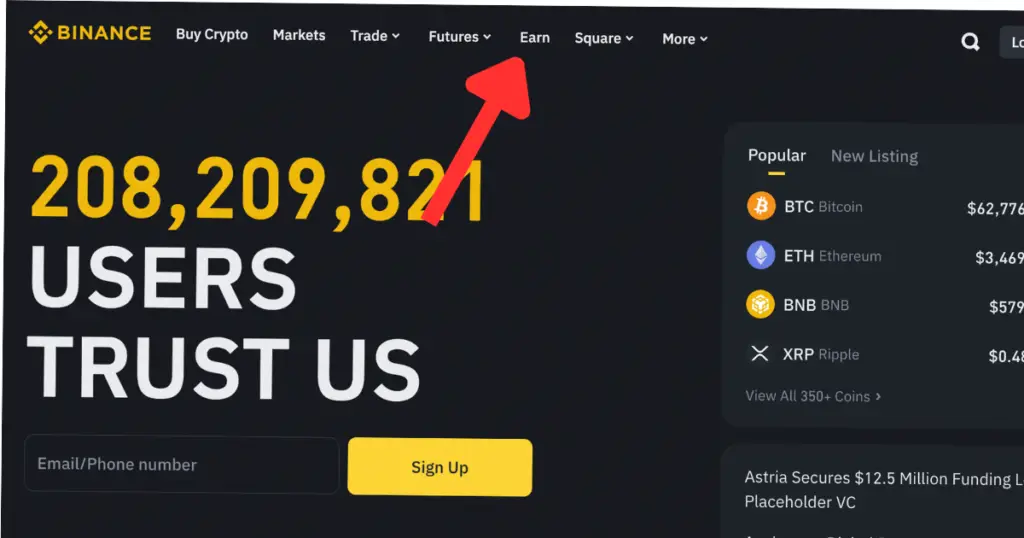

How to Stake AVAX on Binance? Step-by-Step Guide

Step 1: Navigate to Binance Staking

- Hover over the “Finance” tab on the Binance homepage and click on “Binance Earn.”

- Click on the “Staking” tab within the Binance Earn section.

- Use the search bar to find AVAX staking options.

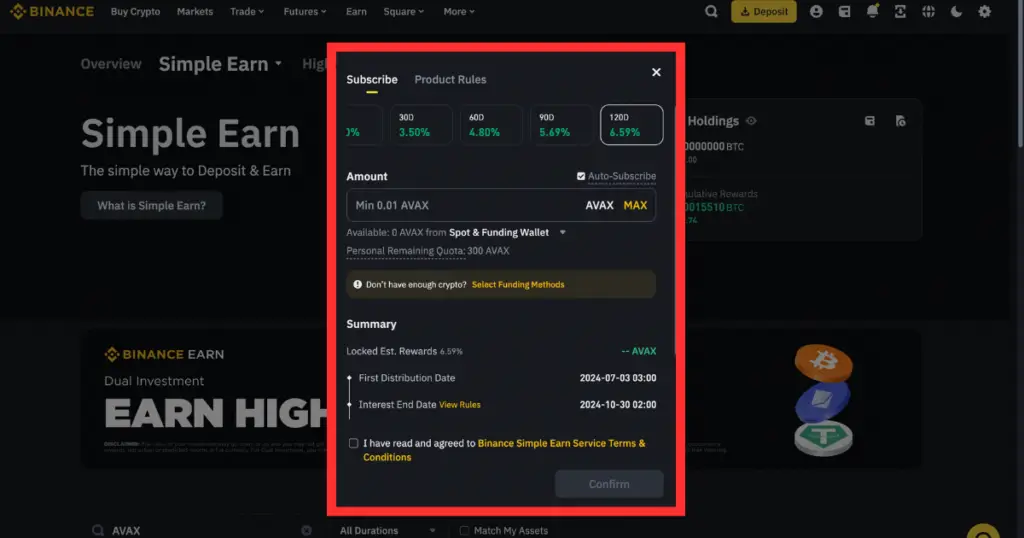

Step 2: Stake Your AVAX

- Choose the staking option that suits your preference (e.g., flexible or locked staking).

- Click on the “Stake Now” button next to the AVAX staking option.

- Enter the amount of AVAX you want to stake. Ensure it’s within the available balance in your wallet.

- Review the details such as staking duration, estimated APY (Annual Percentage Yield), and any other terms.

- Click on “Confirm” to finalize the staking process.

Step 3: Monitor Your Staking

- Monitor your staking status and rewards by going to the “Wallet” tab and selecting “Earn.”

- You will start receiving staking rewards based on the staking period you selected. These rewards can be viewed under the “Earn” section.

Step 4: Unstake AVAX (When Desired)

- Navigate to the “Earn” section under the “Wallet” tab.

- Find your staked AVAX and click on the “Redeem” button.

- Review the details and confirm the unstaking process. Note that some staking options may have a lock-up period, so ensure you check the terms before unstaking.

Risk of staking AVAX

Staking AVAX involves several risks that you should be aware of before committing your tokens. Here are the key risks:

Market Volatility: The value of AVAX can fluctuate significantly. If the market value drops, so does the value of your staked tokens and rewards.

Lock-Up Period: Your tokens are locked for a specific period, during which you cannot sell or transfer them. Consider your liquidity needs before staking.

Validator Risks: Delegating to a validator means trusting them to perform well. Poor performance, downtime, or malicious activity from a validator can impact your rewards. Choose reliable validators.

Inflation and Dilution: New AVAX tokens are issued as staking rewards, increasing the overall supply and potentially diluting the value of your tokens over time.

Slashing Risks: Some networks penalize misbehaving validators by slashing their staked tokens. While Avalanche doesn’t currently use slashing, this could be a future risk.

Understanding these risks helps you make an informed decision about staking AVAX. By considering these factors and conducting thorough research, you can better navigate the staking landscape.

Conclusion

Staking AVAX offers a unique opportunity to earn passive income, enhance network security, and participate actively in the Avalanche community. By understanding the various platforms and methods available, such as using wallets, centralized exchanges, or DeFi platforms, you can choose the best option that suits your needs and technical expertise.

While the potential rewards are attractive, it’s crucial to be aware of the associated risks, including market volatility, lock-up periods, and validator performance. Thorough research and careful consideration will help you maximize your staking rewards while mitigating potential downsides.

FAQ

1. What is the minimum amount of AVAX to stake?

The minimum amount of AVAX to stake is 25 AVAX.

2. Where to stake AVAX?

You can stake AVAX on platforms like Binance, Kraken, and the official Core Wallet.

3. Can Avalanche be staked?

Yes, AVAX can be staked to earn rewards and support the Avalanche network.