Main Points

- Minimum Staking Requirement: At least 1 ALGO is needed to earn participation rewards.

- Lockup Periods: No lockup for participation rewards; a 3-month lockup for governance rewards.

- Staking Options: Available through wallets, exchanges, and liquid staking.

- Unstaking Period: Up to 3 days if using an exchange.

Rewards System: Adds to circulating supply, considered inflationary.

Recommended Wallets: Pera Wallet, Exodus, Ledger

Quick Answer

- Choose a staking Method. Editors choice – Governance

- Create a wallet. Editors choice – Pera Wallet

- Connect your wallet to the Algorand Governance Platform

- Commit ALGO to Governance

- Participate in Voting

What is ALGO Staking?

Staking ALGO means using your Algorand tokens to support the network’s security and operations. By staking ALGO, you validate transactions and maintain the network’s integrity. Algorand uses a unique Pure Proof-of-Stake (PPoS) mechanism, where simply holding ALGO in a compatible wallet lets you earn participation rewards. This method differs from other staking models as it doesn’t require choosing a staking pool or validator. Participation rewards are automatic but low, incentivizing users to engage in governance for higher earnings.

Why Should I Stake ALGO?

Staking ALGO offers multiple advantages:

- Passive Income: Earn rewards simply for holding onto your ALGO. It’s like putting your crypto to work at the gym, raking in gains while you relax.

- Network Security: Staking helps keep the Algorand blockchain secure and strong, making it a trustworthy and efficient system for everyone.

- Governance Participation: By staking, you get a say in the future of Algorand through participation in governance (we’ll break that down later).

Algorand Governance

Algorand Governance empowers holders of ALGO tokens to actively participate in shaping the future of the Algorand blockchain. The community members can submit proposals for consideration. These proposals can encompass a wide range of topics that impact the network’s operation and development, such as adjustments to transaction fees, upgrades to the protocol’s technical specifications, or even the allocation of future staking rewards.

The ability to vote on these proposals is directly tied to the amount of ALGO an individual has staked. The more ALGO you stake, the greater your voting power becomes. This ensures that stakeholders with a vested interest in the long-term health and success of the network have a significant voice in its evolution. By staking and voting, ALGO holders can ensure that Algorand continues to evolve based on the community’s values and priorities.

How Much Can I Earn Staking ALGO?

Earnings from staking ALGO can vary based on several factors, including the platform you use and the overall staking participation on the network. Generally, you can expect annual yields ranging from 5% to 15%. For instance, Binance offers up to 6.59% APR for fixed-term staking, while staking directly through Algorand Foundation you can earn ~10% – 15%. It’s important to regularly check the current rates on your chosen platform, as these rates can fluctuate based on market conditions and platform policies.

Ways to Stake ALGO

Staking Algorand (ALGO) can be done in several ways, each with its unique advantages and requirements. Here’s a breakdown of the main methods:

- Participation: Rewards are earned automatically by holding ALGO in a supported wallet like Pera Wallet. This method is simple and doesn’t require active management but typically offers lower yields.

- Governance: Staking involves committing your ALGO to participate in the network’s decision-making process. By staking for governance, you can vote on proposals and earn higher rewards. This method requires a 3-month commitment and active participation in voting sessions.

- Centralized Exchange: Staking on centralized exchanges such as Binance and Coinbase is user-friendly and convenient. These platforms handle the technical aspects, offering competitive rewards. For instance, Binance provides up to 6.59% APR for fixed-term staking. This method is ideal for beginners and those looking for a hassle-free experience.

- Liquid staking allows you to stake ALGO while retaining liquidity. Platforms like AlgoFi and Folks Finance offer tokens that represent your staked assets, which you can use in other DeFi applications. This method provides flexibility, enabling you to earn rewards without locking up your assets.

What are the best places for staking ALGO?

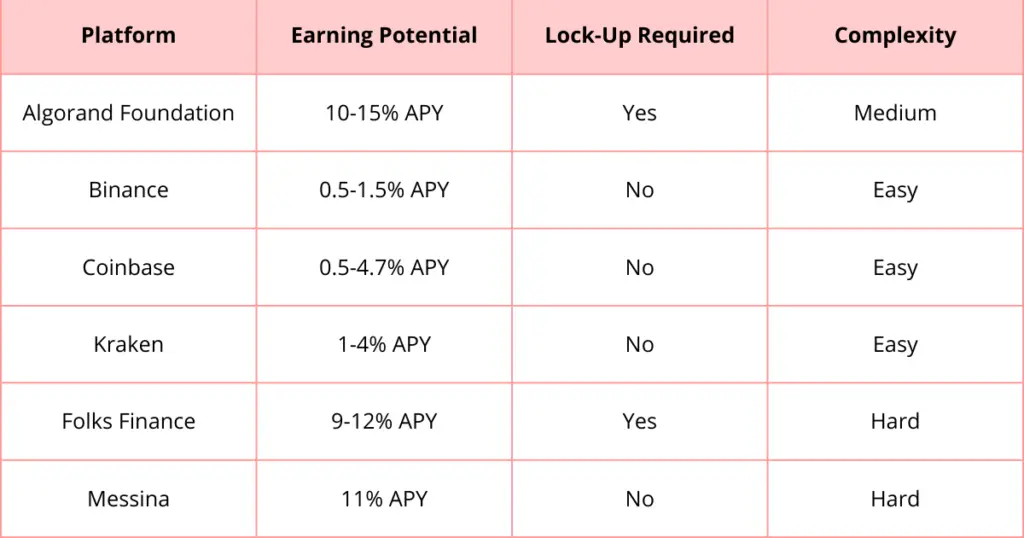

I’ve crafted a comparison table to help you choose the best platform for staking ALGO. To select the optimal platform, consider factors such as technical complexity, lock-up periods, and earning potentials.

How to Stake ALGO on Algorand Foundation? Step-by-Step Guide

Staking ALGO on the Algorand Foundation can be a rewarding way to earn passive income while supporting the network. There are two primary ways to stake your ALGO tokens:

- Participation Rewards: Earn rewards automatically by holding ALGO in your Perra wallet, or Exodus wallet. Rewards are quite low for this one.

- Governance Rewards: Participate in the governance process by voting on proposals and earn additional rewards. Rewards can vary, usually ~10-15% APY.

Earn rewards participating

Step #1 – Purchase ALGO Tokens

If you don’t already have ALGO tokens, you can purchase them on a cryptocurrency exchange such as Coinbase, Binance, or Kraken.

Step #2 – Transfer ALGO Tokens

After purchasing, transfer your ALGO tokens to a secure wallet that supports staking, such as the Perra Wallet, Exodus Wallett, or Ledger.

That’s it, when you have ALGO tokens in your wallet, you will start earning participation rewards automatically. You will need atleast 1 ALGO in your wallet to be eligible.

Earn rewards through governance

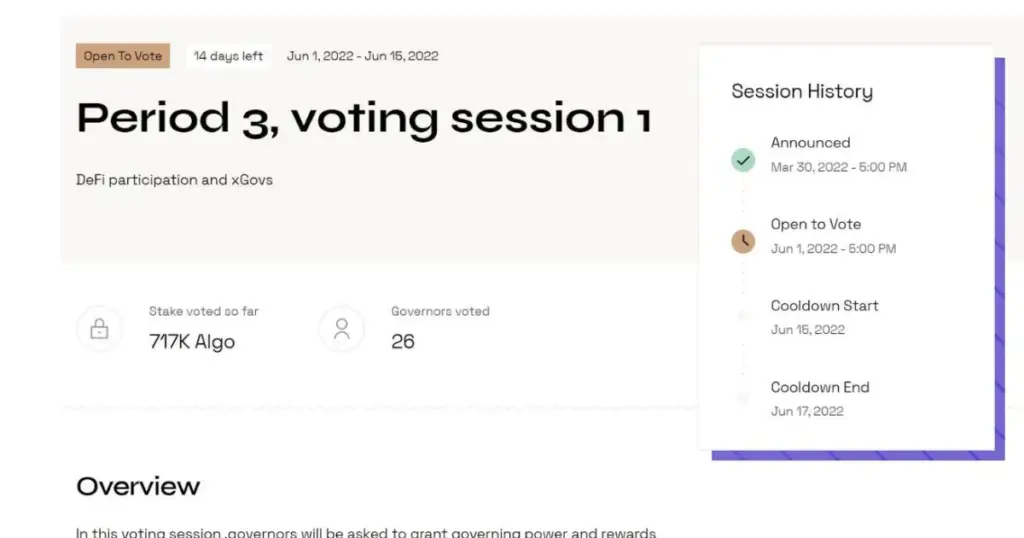

Before proceeding to staking ALGO through Governance, you should know that Governance Periods start at each calendar quarter – Jan, April, July and October.

Step #1 – Visit the Algorand Governance Platform

Go to the Algorand Governance Platform. This is where you can manage your participation in governance and see updates on the current governance period.

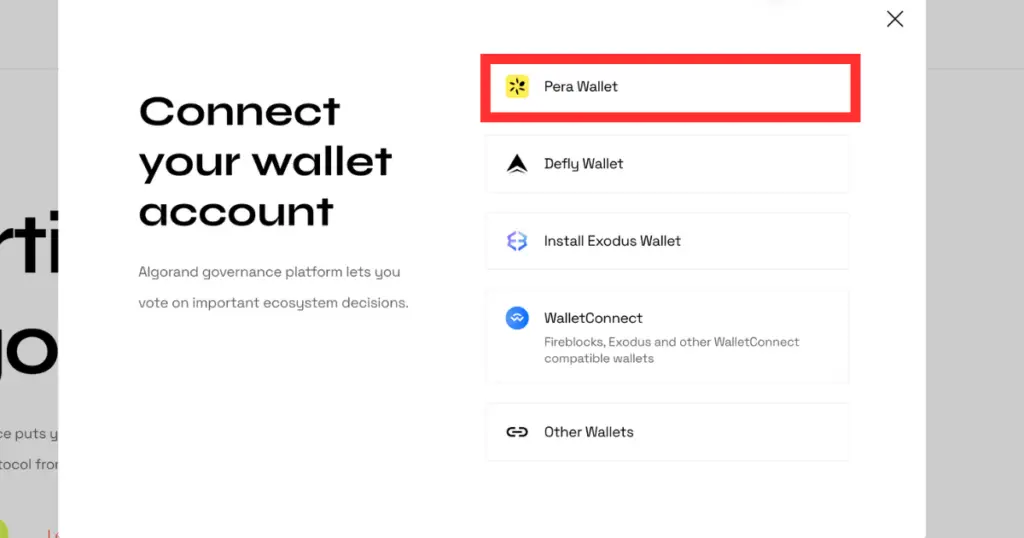

Step #2 – Connect Your Wallet

- Access the Dashboard: Click on the “Connect Wallet” button located on the platform’s main dashboard.

- Select Wallet: Choose the wallet you use, such as Pera Wallet, MyAlgo, or any other supported wallet.

- Authorize Connection: Follow the on-screen instructions to authorize the connection. This typically involves scanning a QR code or approving the connection in your wallet app.

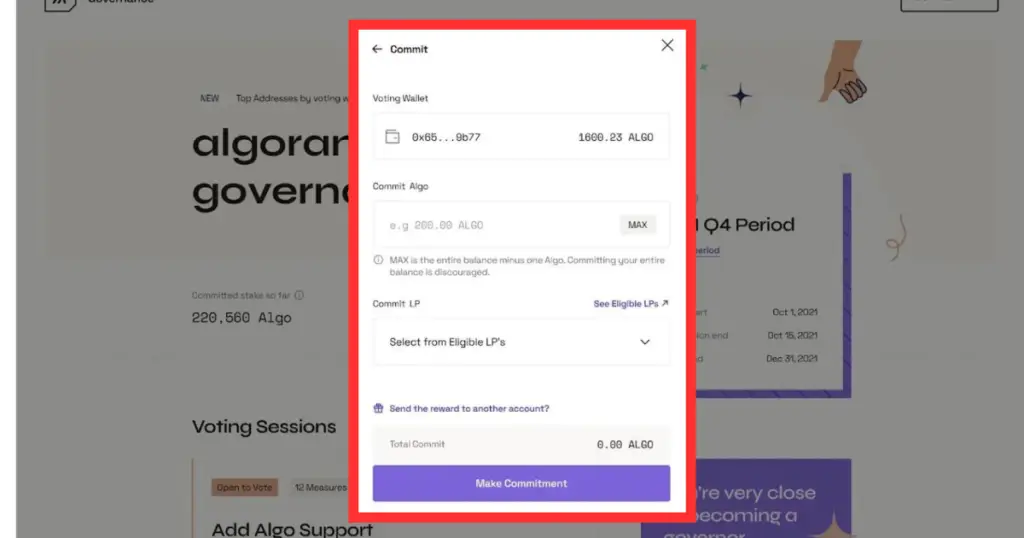

Step #3 – Commit ALGO to Governance

- Navigate to Commit: Once your wallet is connected, click on the “Commit Algos” button.

- Specify Amount: Enter the amount of ALGO you want to commit to governance. Ensure you leave a small amount in your wallet to cover transaction fees.

- Confirm Commitment: Review your commitment details and confirm. This will lock your ALGO for the governance period, and you will not be able to use it until the period ends.

Step #4 – Confirm your availability for Voting

- Voting Periods: Keep track of the governance periods and when voting sessions occur. These periods are announced on the platform.

- Log In: During a voting session, log back into the Algorand Governance Platform.

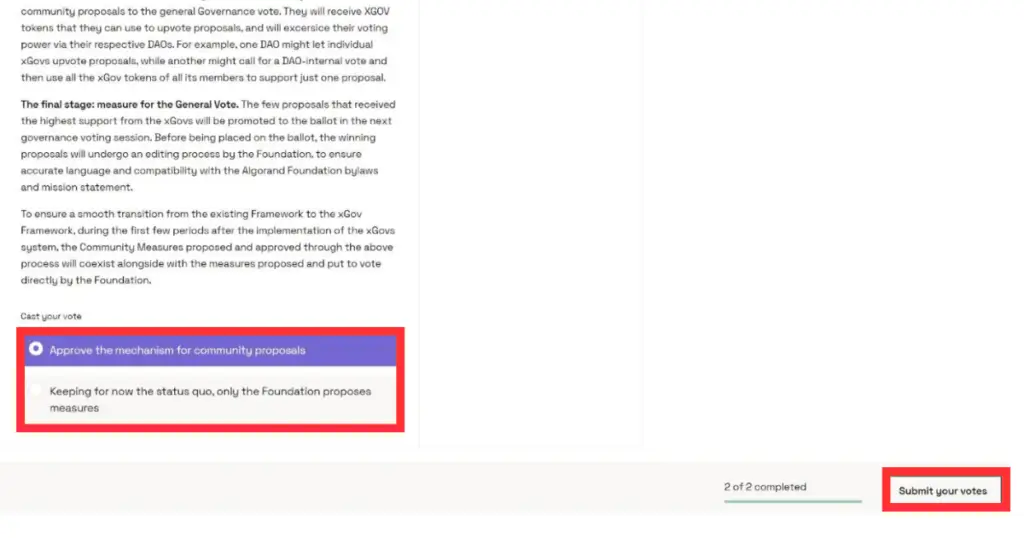

Step #5 – Participate in Voting

- Vote on Measures: Review the proposals up for vote. These can include decisions on network upgrades, reward distributions, or other important governance issues.

- Submit Vote: Select your preferred options and submit your vote. This usually involves sending a zero-ALGO transaction, which is a way to verify your vote without spending ALGO.

You can learn more on Algorand Governor’s Guide.

How to Stake ALGO on Binance? Step-by-Step Guide

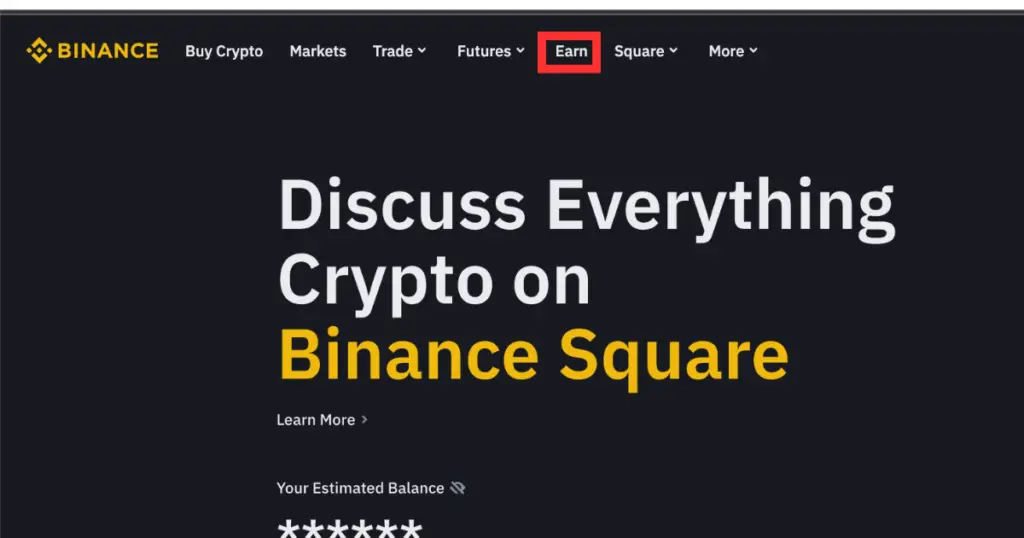

Step #1 – Navigate to Binance Staking

- Hover over the “Finance” tab on the Binance homepage and click on “Binance Earn”.

- Click on the “Staking” tab within the Binance Earn section.

- Use the search bar to find ALGO staking options.

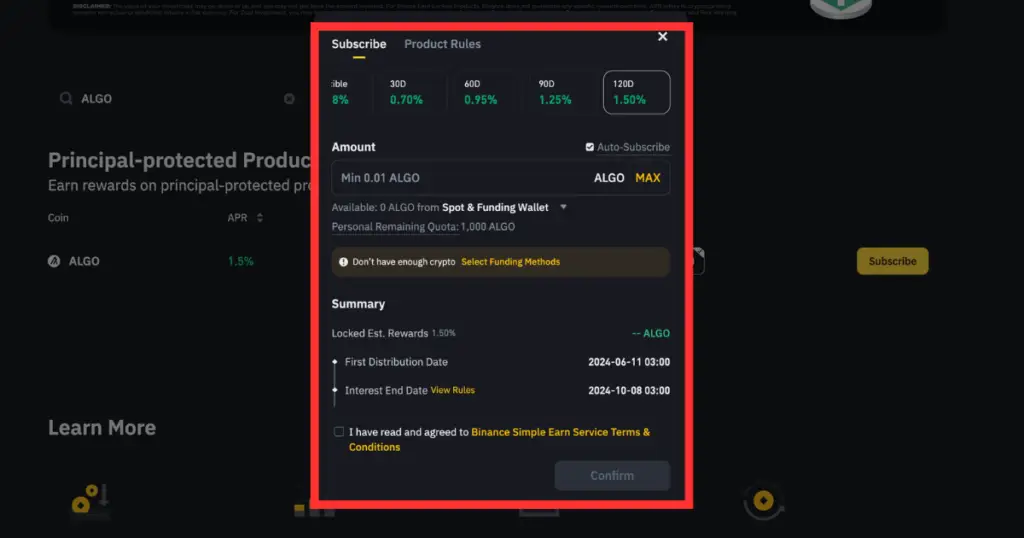

Step #2 – Stake Your ALGO

- Choose the staking option that suits your preference (e.g., flexible or locked staking).

- Click on the “Stake Now” button next to the ALGO staking option.

- Enter the amount of ALGO you want to stake. Ensure it’s within the available balance in your wallet.

- Review the details such as staking duration, estimated APY (Annual Percentage Yield), and any other terms.

- Click on “Confirm” to finalize the staking process.

Step #3 – Monitor Your Staking

- You can monitor your staking status and rewards by going to the “Wallet” tab and selecting “Earn”.

- You will start receiving staking rewards based on the staking period you selected. These rewards can be viewed under the “Earn” section.

Step #4 – Unstake ALGO (When Desired)

- Navigate to the “Earn” section under the “Wallet” tab.

- Find your staked ALGO and click on the “Redeem” button.

- Review the details and confirm the unstaking process. Note that some staking options may have a lock-up period, so ensure you check the terms before unstaking.

Risks of Staking ALGO

Staking ALGO involves several risks. The value of your staked crypto assets can decrease due to market volatility, meaning you could end up with less value than you initially staked. Decisions made through the governance process can have significant impacts on the network and the value of the token, potentially leading to changes that may not be favorable to all stakeholders.

Additionally, the platforms and wallets used for staking can be vulnerable to hacks, which could result in the loss of your staked assets. Understanding these risks is crucial before deciding to stake your ALGO tokens.

Conclusion

In conclusion, staking Algorand (ALGO) is a great way to earn passive income while helping to secure and govern the network. You have several options for staking, including participation rewards, governance rewards, centralized exchanges, and liquid staking. You can choose the method that best fits your needs and skill level. Beginners might prefer the simplicity of exchange staking, while experienced users might enjoy participating in governance.

No matter which option you choose, staking ALGO can be both rewarding and beneficial. However, it’s important to stay aware of market conditions and potential risks. Make sure your staking strategy matches your financial goals and comfort with risk. By choosing the right platforms and understanding how staking works, you can maximize your rewards and contribute to the Algorand community.

FAQ

1. What is the minimum amount of ALGO required for staking?

To start staking ALGO, you need at least 1 ALGO in your wallet. This minimum amount is enough to earn participation rewards automatically, but for governance rewards, a larger commitment may be beneficial to increase your voting power and potential earnings.

2. Are there any fees associated with staking ALGO?

Yes, there are small transaction fees when transferring ALGO to a staking wallet or committing ALGO to governance. These fees are minimal and are necessary for processing transactions on the Algorand network. Ensure you leave a small amount of ALGO in your wallet to cover these fees.

3. Can I unstake my ALGO anytime?

If you are staking on a centralized exchange, unstaking can take up to 3 days. For governance staking, your ALGO will be locked for the duration of the governance period, typically 3 months. Participation rewards staking does not have a lock-up period, allowing more flexibility.

4. How are staking rewards taxed?

Staking rewards are generally considered taxable income in many jurisdictions. The specific tax treatment can vary, so it’s important to consult with a tax professional to understand how your staking rewards will be taxed based on your location and personal financial situation.

5. What are the risks of staking ALGO?

Staking ALGO carries risks, including market volatility which can decrease the value of your staked assets. Governance decisions can also impact the network and token value. Additionally, platforms and wallets used for staking can be vulnerable to hacks. Understanding these risks is essential before committing to staking your ALGO tokens.

6. Where is the best place to stake ALGO?

The best place to stake ALGO is the Algorand Foundation, offering 10-15% APY through governance staking