Quick Answer

Staking AKT is a way to earn rewards while supporting the Akash network. Here’s a quick overview:

- Choose a staking platform (like Keplr Wallet)

- Deposit AKT tokens into your chosen wallet

- Select a validator and stake your tokens

- Monitor your rewards and manage your stake

With potential returns around 20% APY and options for different skill levels, staking AKT can be an attractive strategy for growing your crypto holdings, but always consider the risks and lock-up periods before getting started.

What is AKT Staking?

AKT staking is a way to earn rewards with your Akash tokens. When you stake AKT, you lock up your coins to help keep the network safe. This process lets you grow your AKT holdings over time. Staking is like planting a seed. You put your tokens in a special wallet and wait for them to grow.

The network uses these staked tokens to make decisions and run smoothly. In return, you get more AKT as a thank-you for helping out.

You can start staking with just 1 AKT. The longer you stake, the more rewards you can earn. But remember, while your tokens are staked, you can’t use them for other things.

Why Should I Stake AKT?

Staking AKT has several compelling advantages that can benefit both you and the Akash network, making it an attractive option for token holders. Here are the three main perks:

- You earn more tokens without doing extra work

- You help make the Akash network stronger and more secure

- You get a say in how the network grows and changes

These benefits make staking a smart choice for many AKT holders.

How Much Can I Earn Staking AKT?

Your earnings from staking AKT can vary. The amount you can make depends on a few key factors:

- How many people are staking across the whole network

- What fees and commission your chosen validator charges

- How much AKT you decide to stake

Generally, you can expect around 20% APY when staking through Keplr wallet. Remember that staking rewards can change over time, so it’s smart to check current rates before you start. The Akash network is always changing, and new updates can affect how much you earn. Some weeks you might earn more, other weeks less. It’s a good idea to keep an eye on your rewards and stay informed about any big changes in the network.

Ways to Stake AKT

Wallets

Beginner to intermediate users often choose this method. It’s great for individuals who want a balance between ease of use and control over their tokens. Perfect for those new to crypto or casual investors.

Exchanges

This is the go-to for beginners and casual users. It’s ideal for people who already use exchanges to buy and sell crypto. Busy folks who don’t want to deal with the technicalities of wallets and validators prefer this option.

Direct with Validators

Advanced users and institutions typically opt for this route. It’s suited for large-scale investors, tech-savvy individuals, and organizations deeply involved in the Akash ecosystem. This method offers the most control but requires more expertise and time investment.

What are the Best Places for Staking AKT?

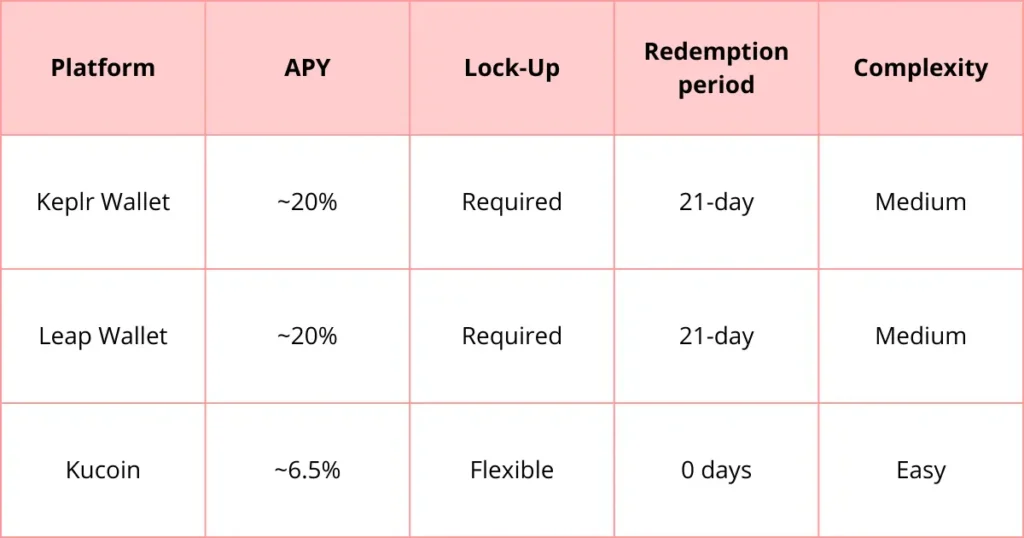

Choosing the best place to stake AKT depends on your needs, but here are some top options to consider:

Editor’s Choice

We recommend Keplr Wallet for most AKT stakers. It offers a good balance of high returns, user-friendly interface, and direct involvement with the Akash network. While it has a 21-day redemption period, the ~20% APY makes it worthwhile for those who can commit their tokens for longer periods.

How to Stake AKT on Keprl: Step-by-Step Guide

Step 1: Create a Keplr Wallet

- Visit the Keplr website and install the browser extension.

- Once installed, open the extension and click “Create new account.” Follow the prompts to set up your wallet and securely save your seed phrase.

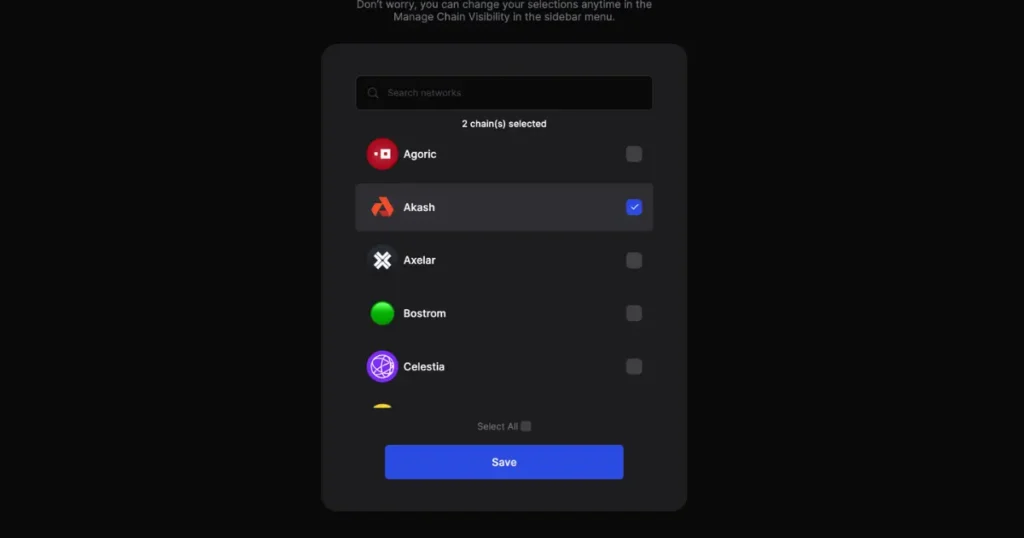

Step 2: Deposit Keplr into Your Wallet

- Open your Keplr wallet and select “Deposit” from the menu.

- Choose the “Akash” network and copy your wallet address.

- Transfer AKT tokens from an exchange or another wallet to this address.

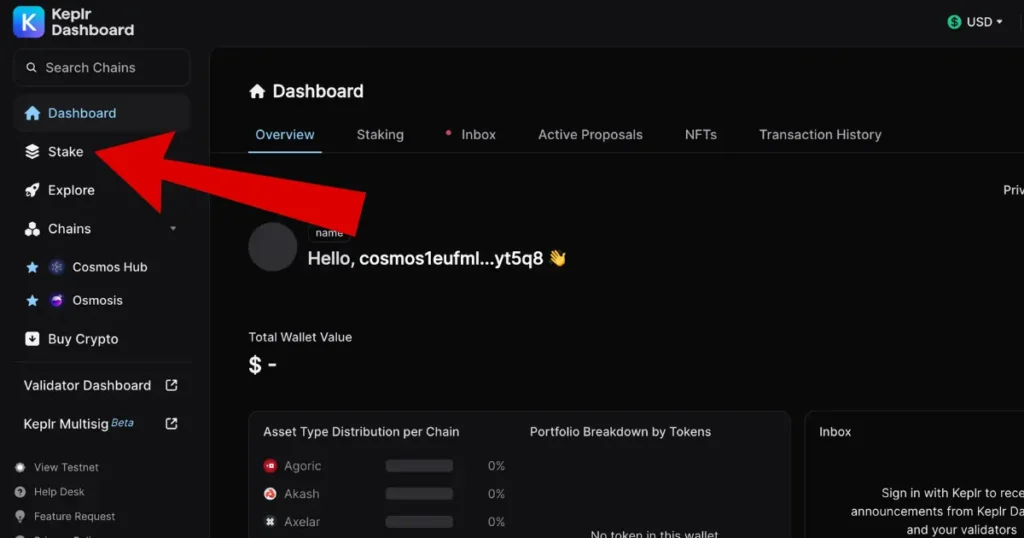

Step 3: Open Your Keplr Wallet

- Open the Keplr extension in your browser and unlock your wallet by entering your password.

- Navigate to Keplr Dashboard

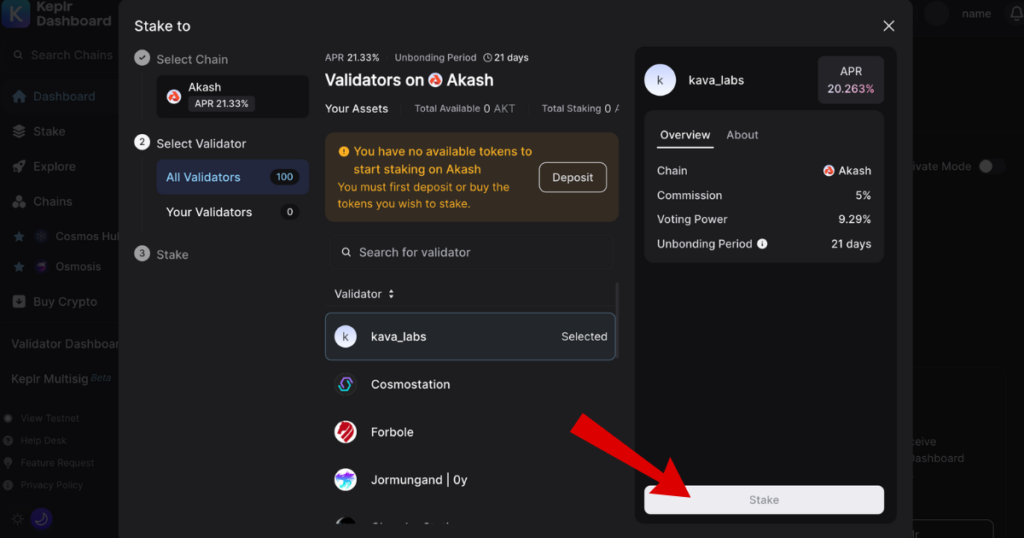

Step 4: Select Network and Validator

- In the left sidebar menu, click on “Stake.”

- Select the “AKT” network and choose your validator.

Step 5: Stake AKT Tokens

- Click the “Stake” button next to your chosen validator

- Enter the amount of AKT you wish to delegate.

- Confirm by clicking “Stake” again.

Step 6: Confirm and Manage Your AKT Tokens

- Approve the staking transaction in your Keplr wallet.

- Use the Keplr dashboard to manage your staking activities: monitor your staked AKT, claim rewards, redelegate to different validators, or unstake your tokens as needed.

Risk of Staking AKT

Staking AKT isn’t risk-free. Here are some key things to watch out for:

- Market Volatility: AKT’s price can go up or down quickly. Even if you earn staking rewards, the overall value of your investment might drop if AKT’s price falls.

- Slashing: If your chosen validator misbehaves, you could lose some of your staked tokens. This is rare but possible.

- Lockup Period: When you decide to unstake, your AKT is locked for 21 days. During this time, you can’t use or sell these tokens, which might be a problem if you need quick access to your funds.

Always think carefully before staking, and never stake more than you can afford to have locked up.

Conclusion

Staking AKT can be a smart way to grow your crypto holdings. It lets you earn rewards while supporting the Akash network. With options like Keplr Wallet offering around 20% APY, it’s an attractive choice for many.

But remember, staking comes with risks. The crypto market can be bumpy, and your tokens are locked up for a while. It’s crucial to pick a method that fits your skills and goals.

Before you jump in, do your homework. Compare different staking options, think about how long you can lock up your tokens, and stay informed about the Akash network. With the right approach, staking AKT could be a valuable part of your crypto strategy.

FAQ

How much can I make staking AKT?

Your earnings depend on several factors, including how much you stake and network conditions. Currently, you can earn around 20% APY using platforms like Keplr Wallet. But remember, rates can change over time.

How do I receive AKT staking rewards?

Rewards are usually added to your staked balance automatically. You can claim them anytime, but leaving them staked lets you earn compound interest. Some platforms might have different ways of distributing rewards.

When can I start earning AKT rewards?

You start earning rewards right after your stake is activated. This usually happens within one or two blocks on the Akash network, which is very quick – often just a few seconds.

How long does it take to unstake AKT?

There’s a 21-day unbonding period for AKT. During this time, your tokens are locked and don’t earn rewards. After 21 days, you can access your unstaked AKT. Plan ahead if you might need your tokens quickly.