When I started investing in cryptocurrency, I quickly realized that taking profits often meant selling my assets, which went against my desire to hold for the long term. Selling could lead to taxes, reduce my position, and sometimes leave me regretting it later when prices went up. Over time, I found a better way to extract value from my crypto investments without having to sell – staking and reinvesting the rewards.

Staking is a straightforward method that allows me to grow my crypto holdings over time. Instead of cashing out, I prefer to let my assets work for me, earning rewards that I can reinvest to accelerate growth. Here’s how I do it and why it’s my go-to strategy.

Why Take Profits Without Selling?

Taking profits from crypto without selling has several distinct advantages. This approach allows you to maintain your position in the market, avoid triggering taxable events, and continue benefiting from future price increases.

Long-Term Growth Potential

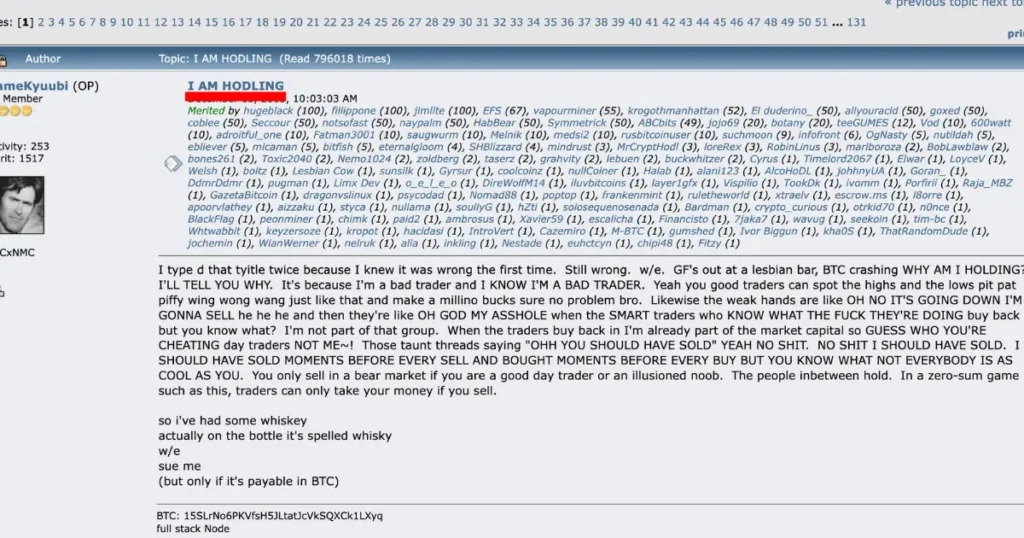

HODLing, originally a typo, has now become a meme in the crypto world. It represents holding onto your assets long-term, no matter the market swings. Cryptocurrencies like Bitcoin and Ethereum have shown that holding for several years can lead to significant gains.

By not selling, you allow your assets to grow and compound over time, which can result in exponentially higher returns.

Avoiding Tax Implications

Avoiding tax implications is a key advantage of not selling your crypto. In many places, selling triggers capital gains taxes, which can eat into your profits. By holding onto your assets, you defer these taxes, keeping more of your capital invested and allowing it to continue growing.

Additionally, there are strategies that help you optimize your tax situation. For instance, taking out loans against your crypto doesn’t create a taxable event, enabling you to access liquidity without triggering taxes. This approach can be highly beneficial, especially if you plan to hold your assets for the long term.

Maintaining Exposure to Market Upside

Everybody likes to see their portfolio in green numbers. By holding onto your investments, you stay positioned to capture future gains without sacrificing your original holdings. Plus, keeping ownership allows you to take advantage of other income-generating opportunities, like staking or yield farming, all while still benefiting from the market’s upward trends.

Key Strategies for Earning Profits Without Selling

Here are the primary methods I use to take profits without liquidating my crypto holdings. Each strategy has its benefits and risks, but when combined, they create a balanced approach to generating income while keeping assets intact.

Staking: Passive Income Generator

Staking has become a key part of my strategy for earning passive income from crypto without the need to sell. It’s a simple yet effective way to put your assets to work while still holding onto them.

What is Staking?

Staking involves locking up your cryptocurrency to help maintain and secure a blockchain network that operates on a Proof of Stake (PoS) consensus mechanism. In exchange for your participation, you earn rewards, typically paid out in the same crypto you’re staking. These rewards can provide a steady stream of income, making staking an attractive option for long-term investors.

My Staking Strategy

I focus on well-established cryptocurrencies like Ethereum, Polkadot, and Cardano. These projects have proven track records and offer decent returns with a lower risk profile compared to more speculative tokens. I only stake on the native platforms, avoiding third-party services. This strategy shields me from risks associated with centralized platforms that can collapse unexpectedly, as we saw with the FTX scandal. Additionally, I regularly reinvest my staking rewards to compound my earnings, boosting my returns over time.

Top Cryptocurrencies for Staking

- Ethereum (ETH): Dominates the DeFi and smart contract space, with staking APY between 4% to 8%.

- Solana (SOL): High-performance blockchain with fast transactions, offering an APY of 6% to 8%.

- Toncoin (TON): Emerging platform with growing support, delivering an APY of 6% to 7%.

- Cardano (ADA): Secure and research-driven, providing an APY of 5% to 7%.

Pros

- Generates consistent passive income without selling your crypto.

- Ability to reinvest and compound rewards for greater returns over time.

- Lower risk when staking established, well-secured networks.

Cons:

- Assets are locked, limiting your access to liquidity.

- Risk of slashing penalties if network issues occur or if your validator misbehaves.

- Potential delays in unstaking, making it harder to react quickly to market changes.

Yield Farming: Leveraging DeFi for High Returns

Yield farming offers an opportunity to earn significant returns by providing liquidity to decentralized finance (DeFi) platforms. However, this strategy comes with its own set of risks that should be carefully considered before diving in.

How Yield Farming Works

Yield farming involves lending your crypto assets to DeFi platforms, which use them to facilitate trading, lending, and other financial activities. In return, you receive rewards, usually in the form of transaction fees and the platform’s native tokens. The more liquidity you provide, the higher your potential rewards.

Best Platforms for Yield Farming

- Uniswap: A widely-used decentralized exchange that offers rewards for providing liquidity to various token pairs.

- Aave: Known for its flexibility, Aave allows users to earn rewards by lending and borrowing crypto assets.

- Curve Finance: Specializes in stablecoin liquidity pools, offering lower risk and more predictable returns compared to other platforms.

Risks to Consider

While yield farming offers the potential for high returns, it carries notable risks. One of the main concerns is smart contract vulnerabilities, as DeFi platforms depend on these contracts, which can have bugs or be exploited. Even if a platform has been audited, flaws may still exist, leading to potential losses.

Another risk is impermanent loss, which happens when the value of your deposited assets changes compared to when you first provided liquidity. This can result in lower profits than if you had simply held the assets, especially in volatile markets.

Finally, platform risks are significant since DeFi is a relatively new sector. There’s always the possibility that a platform could fail, face regulatory challenges, or experience issues that could negatively affect your investments.

Crypto-Backed Loans: Accessing Liquidity Without Selling

Crypto-backed loans offer a way to access liquidity without having to sell your digital assets. This strategy allows you to maintain your position in the market while still tapping into the value of your holdings.

Crypto-backed loans work by allowing you to deposit your cryptocurrency as collateral in exchange for a loan, typically in fiat currency or stablecoins. As long as the loan is repaid, your collateral remains secure and unaffected by market fluctuations.

Popular Platforms

Several platforms provide crypto-backed loans with varying terms and features:

- BlockFi: Known for competitive interest rates and support for major cryptocurrencies like Bitcoin and Ethereum.

- Nexo: Offers instant loans with flexible repayment options, making it a convenient choice for quick access to funds.

- Aave: A decentralized platform that supports borrowing and lending across a wide range of cryptocurrencies, offering more control and transparency.

Benefits

One of the key advantages is the ability to unlock liquidity without selling your crypto, meaning you can use the borrowed funds for various purposes—such as investments, expenses, or even reinvesting in more crypto—without giving up your original assets. Additionally, since you’re not selling your holdings, this approach can be more tax-efficient, avoiding the capital gains taxes that would otherwise be triggered by a sale.

Risks to Consider

Crypto-backed loans do come with risks, particularly the risk of margin calls. If the value of your collateral drops significantly, you may need to add more collateral or repay a portion of the loan to avoid liquidation. Additionally, while interest rates are typically low, they can still accumulate, especially with larger loans, which can affect your overall returns.

Crypto Savings Accounts: Passive Interest for Conservative HODLers

Crypto savings accounts offer a conservative approach to earning interest on your digital assets, especially those you intend to hold long-term. These accounts operate similarly to traditional savings accounts but typically provide much higher interest rates by lending out your crypto or stablecoins to other users.

Crypto savings accounts are particularly beneficial for stablecoins, where the value remains relatively constant. Platforms with a solid track record and strong security measures are crucial when considering this strategy.

Top Platforms

- Celsius: Offers interest rates up to 8% on stablecoins, with competitive rates for Bitcoin and Ethereum.

- Nexo: Provides up to 12% interest on stablecoins, with the added benefit of daily payouts.

- BlockFi: Known for its simple interface and consistent interest payouts, making it a reliable choice.

Expected Returns

- Stablecoins: Typically yield between 8% to 12% annually, making them a stable and attractive option.

- Bitcoin/Ethereum: Offer lower returns, usually around 4% to 6%, but still outperform traditional savings accounts significantly.

Crypto savings accounts provide a way to grow your assets passively, with returns that are much higher than what traditional financial institutions offer.

Crafting Your Own Strategy

Taking profits from crypto without selling requires a combination of strategies tailored to your risk tolerance and investment goals. By leveraging staking, yield farming, crypto-backed loans, and savings accounts, you can generate consistent income while maintaining exposure to long-term market gains. Remember to stay flexible, continually assess your strategies, and adjust as needed to maximize your returns.

FAQ

What is the best way to take profits from crypto?

The best way to take profits from crypto without selling is by using strategies like staking, crypto-backed loans, or yield farming. These methods allow you to generate income while keeping your assets intact, letting you benefit from future price appreciation.

Can you lose money in crypto if you don’t sell?

Yes, you can lose money if the market value of your crypto drops significantly and you hold onto it. However, if you’re not selling, you’re not locking in those losses, and there’s always the potential for the value to recover over time.