Quick Overview:

Here’s a guide to staking AAVE in 2024:

- Select a staking platform

- Connect your wallet

- Approve the staking contract

- Stake your AAVE

- Monitor your rewards

Note that there’s a 10-day unbonding period when you want to unstake.

What is AAVE Staking?

AAVE staking is a process where users lock up their AAVE tokens in the Safety Module to earn rewards and bolster the protocol’s security. By participating in AAVE staking, you’re not just earning passive income – you’re actively contributing to the stability and decentralization of the Aave ecosystem.

Staking also grants you governance rights, allowing you to vote on proposals that shape Aave’s future. This dual benefit of earning rewards while having a say in the protocol’s direction makes AAVE staking an attractive option for long-term believers in the platform.

Why Should I Stake AAVE?

Staking AAVE offers several benefits:

- Earn passive income through staking rewards

- Support the security of the Aave protocol

- Gain voting rights in Aave governance

- Potential to benefit from future protocol fees

Staking allows AAVE token holders to potentially increase their holdings while actively participating in the protocol.

How Much Can I Earn Staking AAVE?

Your potential earnings from AAVE staking depend on several factors:

- Total amount of AAVE staked across the network

- Your personal stake amount

- Current reward rate

- Protocol fees (if implemented in the future)

As of 2024, staking on the AAVE Staking Platform offers an Annual Percentage Yield (APY) of 4.71%. To put this into perspective:

- Staking 100 AAVE could earn approximately 4.71 AAVE per year

- Staking 1000 AAVE could earn about 47.1 AAVE annually

Remember, these rates can fluctuate based on market conditions and protocol changes. Always check the current APY before making staking decisions.

Ways to Stake AAVE

AAVE Staking Platform

The AAVE Staking Platform allows users to stake their AAVE tokens directly through the protocol. This method offers higher returns and provides governance rights, but requires more familiarity with DeFi interfaces.

Users who choose this platform benefit from direct interaction with the protocol and maintain control over their tokens. However, it does involve a medium level of complexity compared to other options.

Centralized Exchanges

Some centralized exchanges offer AAVE staking services. This method is generally easier to use but typically provides lower returns.

While centralized exchanges offer convenience and often allow for instant unstaking, users should be aware that they relinquish control of their tokens and usually don’t receive governance rights.

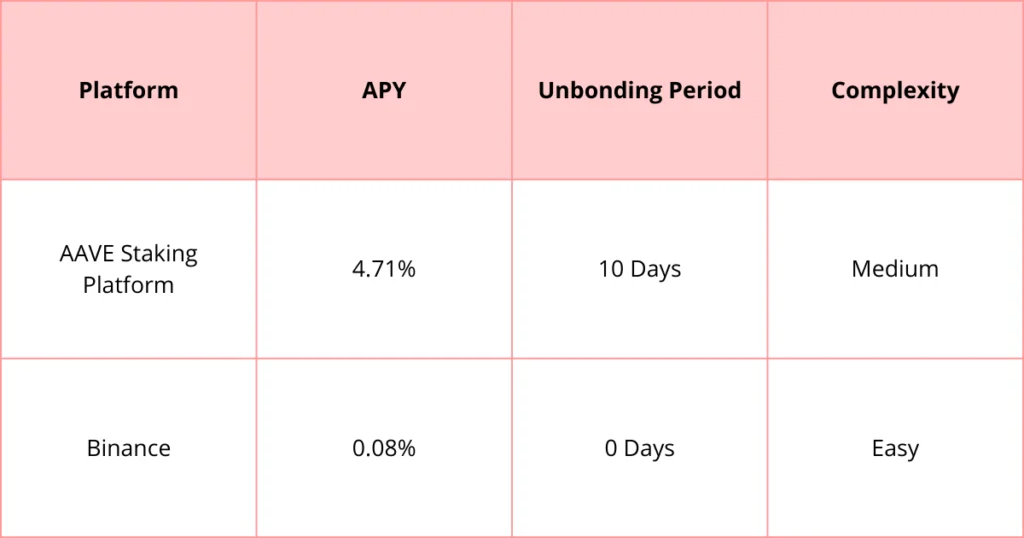

What are the Best Places for Staking AAVE?

Here’s a comparison of staking options:

Note: APY rates are subject to change. Always verify current rates before staking.

Editor’s choice – The AAVE Staking Platform

Stands out due to its higher APY and the ability to participate in governance decisions. It’s a suitable choice for users who are comfortable with DeFi platforms and prefer direct interaction with the protocol.

This platform allows users to maximize their potential returns and have a say in the future development of the Aave protocol. However, users should be mindful of the 10-day unbonding period when considering this option.

How to Stake AAVE on AAVE Staking Platform: Step-by-Step Guide

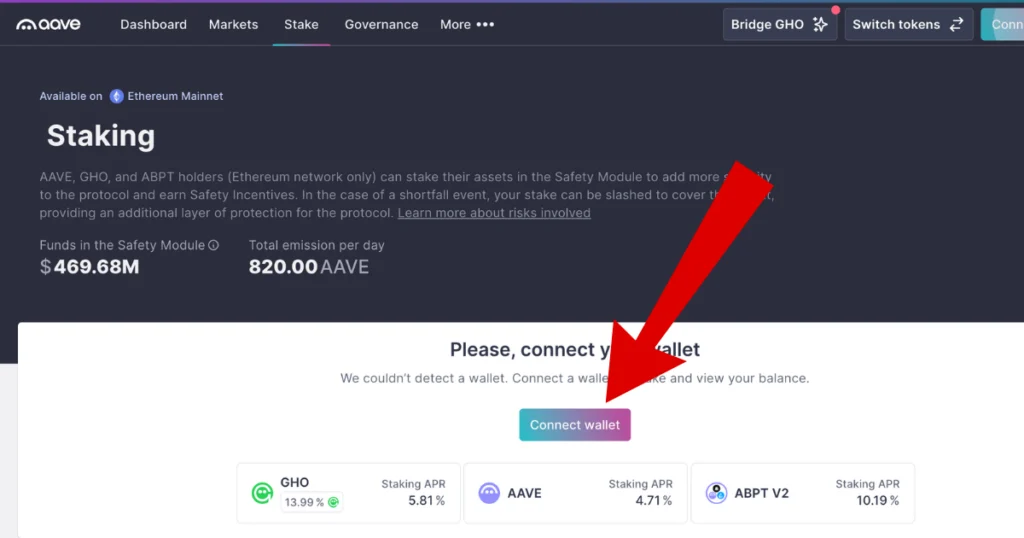

Step 1: Connect Your Wallet

- Visit the AAVE Staking Dashboard

- Click “Connect Wallet”

- Select your wallet provider

- Approve the connection

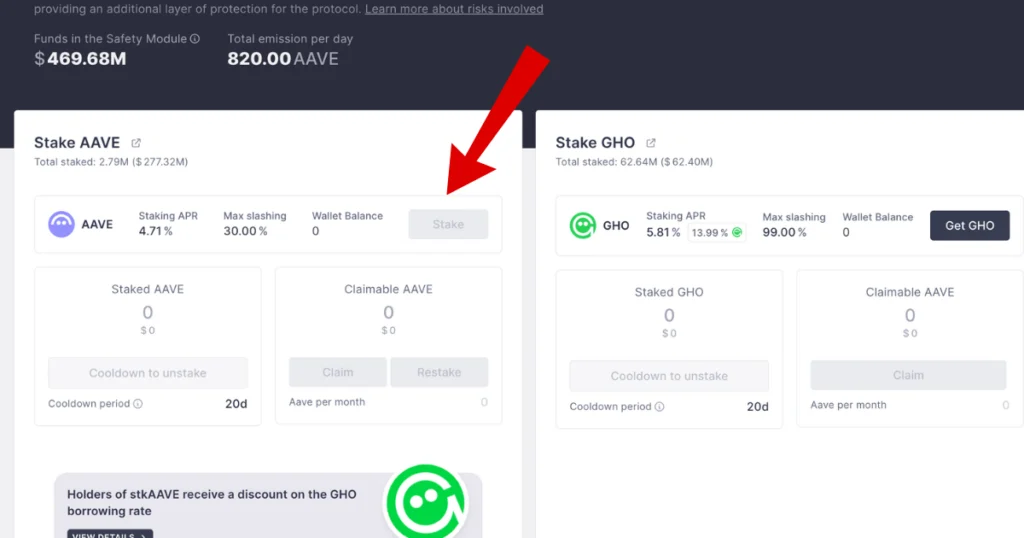

Step 2: Approve the Staking Contract

- Under ‘Stake AAVE’, click ‘Stake’

- Enter the amount to stake

- Click ‘Approve to continue’

- Confirm the transaction in your wallet

Step 3: Stake Your AAVE

- Once approved, click ‘Staked’

- Confirm the staking transaction in your wallet

- Your AAVE is now staked

Risks of Staking AAVE

Consider these risks when staking AAVE:

- Slashing risk: Up to 30% of staked AAVE could be used to cover a protocol deficit.

- Token issuance events: New AAVE tokens might be issued to cover large deficits, potentially affecting token value.

- Unbonding period: The 10-day cooldown limits immediate access to your tokens.

- Protocol security: There’s always a possibility of undiscovered bugs or exploits in DeFi projects.

Conclusion

Staking AAVE can be a powerful way to earn passive income and actively participate in the Aave ecosystem. By choosing the right platform – with the AAVE Staking Platform being the top choice for most users – and understanding the associated risks and benefits, you can make informed decisions about putting your AAVE tokens to work.

Remember to stay updated on the latest APY rates, keep an eye on protocol developments, and always prioritize the security of your assets.

FAQ

Can I unstake my AAVE tokens at any time?

No, there’s a 10-day cooldown period before you can unstake.

Do I need to claim my staking rewards manually?

No, rewards accrue in real-time and are distributed when you withdraw or transfer from the Safety Module.

Can I participate in governance while staking?

Yes, staked AAVE (stkAAVE) provides voting rights in Aave governance proposals.

Is there a minimum amount required to stake AAVE?

There’s no official minimum, but consider gas fees when staking smaller amounts.

Can I lose my staked AAVE?

While uncommon, up to 30% of staked AAVE could be used in case of a significant protocol shortfall.