Quick Overview

Want to earn passive income with your CELO tokens? Staking is your answer. Here’s how to get started and maximize your returns in 2024:

- Choose a reliable staking platform

- Set up your wallet

- Lock up your CELO tokens

- Select a validator

- Start earning rewards

Let’s dive into the details and get you staking.

What is CELO Staking?

CELO staking is the process of locking up your CELO tokens to support the network’s operations and security. By doing so, you’re essentially becoming a virtual validator, helping to verify transactions and maintain the blockchain’s integrity.

When you stake CELO, you’re not just letting your tokens sit idle. You’re putting them to work, contributing to the network’s strength and earning rewards in return. It’s a win-win situation for both you and the CELO ecosystem.

Why Should I Stake CELO?

Staking CELO isn’t just about earning passive income. It’s about being part of a financial revolution.

- Earn passive rewards

- Support the CELO network’s growth and security

- Participate in governance decisions

- Potentially benefit from token value appreciation

Don’t let your CELO tokens gather dust in your wallet. Put them to work and watch your investment grow. By staking, you’re not just earning rewards – you’re actively shaping the future of decentralized finance. Your participation strengthens the network, making it more resilient and attractive to potential users and developers. As the CELO ecosystem expands, your staked tokens could become even more valuable. It’s a way to be at the forefront of financial innovation while potentially growing your wealth.

How Much Can I Earn Staking CELO?

Your earnings from staking CELO can vary based on several factors:

- Amount of CELO staked

- Chosen validator’s performance

- Network activity and overall staking participation

- Current market conditions

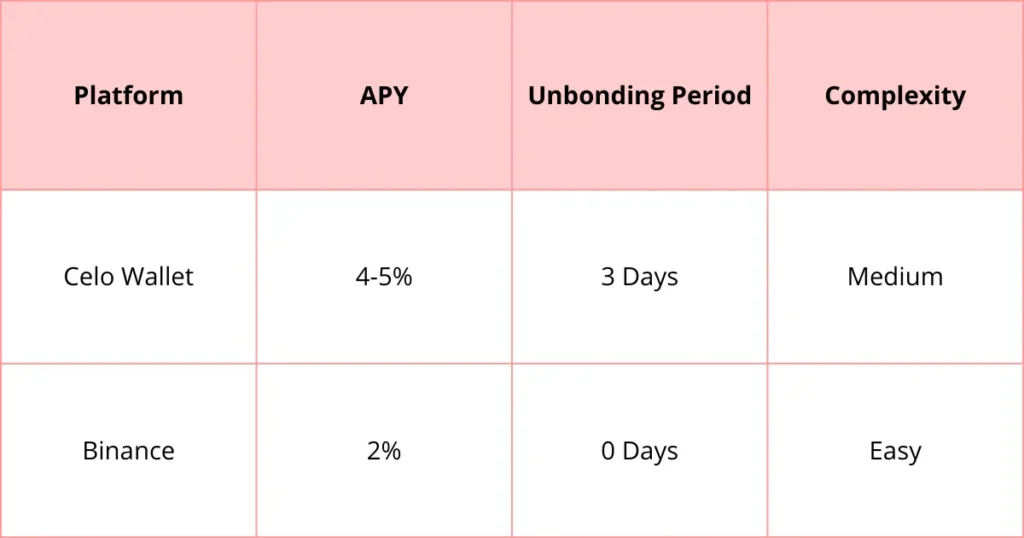

As of 2024, staking on the Celo Wallet can yield around 4-5% APY. That means if you stake 1000 CELO, you could potentially earn 40-50 CELO in a year. Not bad for letting your tokens work for you, right?

Ways to Stake CELO

Self-Staking via Celo Wallet

This method gives you full control over your staking process. You choose your validator, manage your stake, and directly interact with the CELO network. It’s perfect for those who want a hands-on approach and maximum flexibility. For example, you can easily adjust your stake, switch validators, or participate in governance votes directly through the wallet interface.

Exchange Staking

Some exchanges offer CELO staking services, making it easier for beginners. However, you’ll typically earn lower rewards and have less control over your stake. Binance, for instance, offers CELO staking with a simple one-click process. While convenient, you’re limited to their fixed rates and terms. Other exchanges like Coinbase or Kraken might offer similar services, each with their own pros and cons in terms of rates, lock-up periods, and ease of use.

Liquid Staking Protocols

This is an emerging option in the CELO ecosystem. Platforms like Steakwallet offer a way to stake your CELO while receiving a liquid token in return, which you can use in other DeFi applications. This allows you to maintain some liquidity while still earning staking rewards. However, it’s important to note that these protocols are relatively new and may carry additional smart contract risks.

What are the Best Places for Staking CELO?

When it comes to staking CELO, you’ve got options. Let’s break them down:

Editor’s choice: Celo Wallet

While Binance offers simplicity, the Celo Wallet gives you better returns and more control. It’s worth the extra effort. With the Celo Wallet, you’re not just staking – you’re becoming an active participant in the network. You can vote on important protocol decisions, have a say in validator selection, and even run your own validator node if you’re technically inclined.

The higher APY is just the cherry on top of a much richer and more empowering staking experience. Plus, by using the native wallet, you’re supporting the decentralization of the network, which is crucial for its long-term success and stability.

How to Stake CELO on Celo Wallet: Step-by-Step Guide

Step 1 – Set up your CELO Web Wallet

- Head to Celowallet.app

- Go through the signup process

- WRITE DOWN your seed phrase – this is crucial!

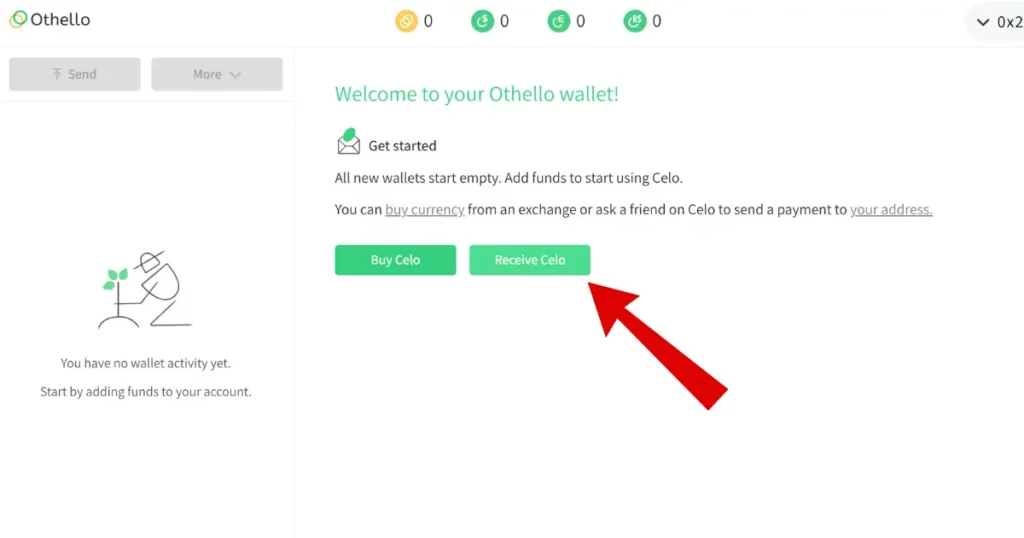

Step 2 – Find your CELO Wallet address

- Click on ‘Receive CELO’ to view your wallet address

- You’ll need this to transfer CELO to your wallet

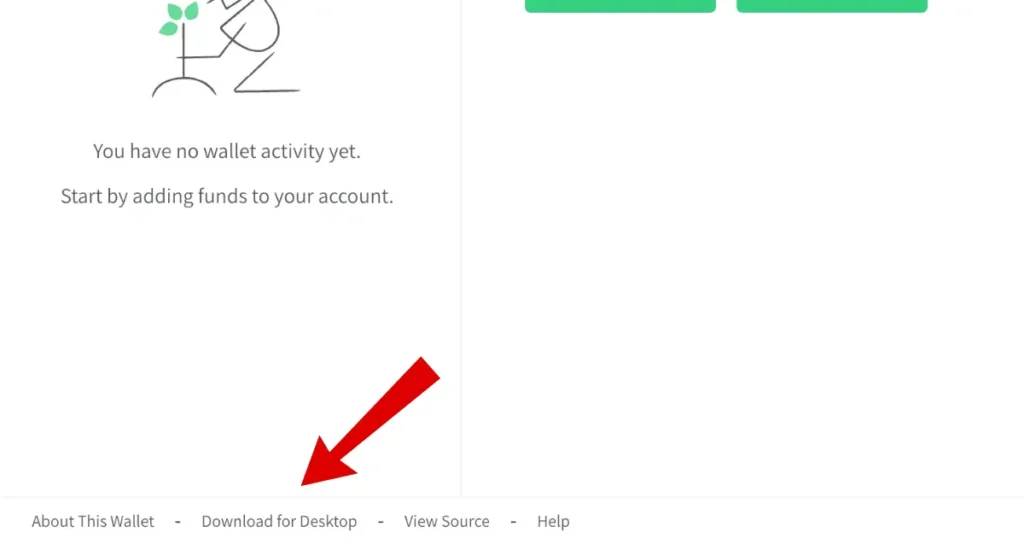

Step 3 – Set up your Desktop CELO Wallet

- Download the desktop app

- Restore your wallet using the seed phrase from Step 1

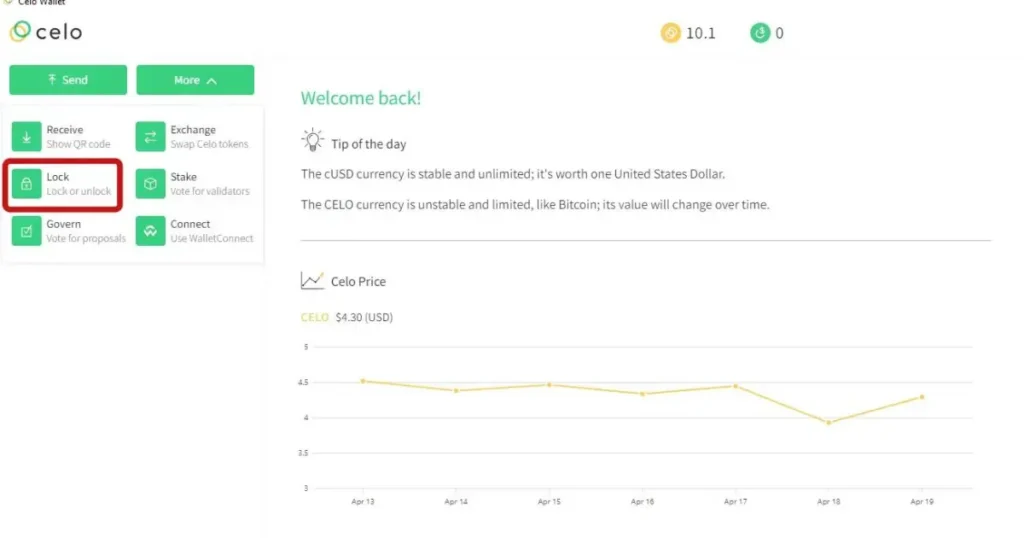

Step 4 – Lock your CELO

- Click the down arrow on the green ‘More’ button

- Select ‘Lock’

- Input the amount of CELO you want to lock

- Click ‘Continue’ and then ‘Lock’

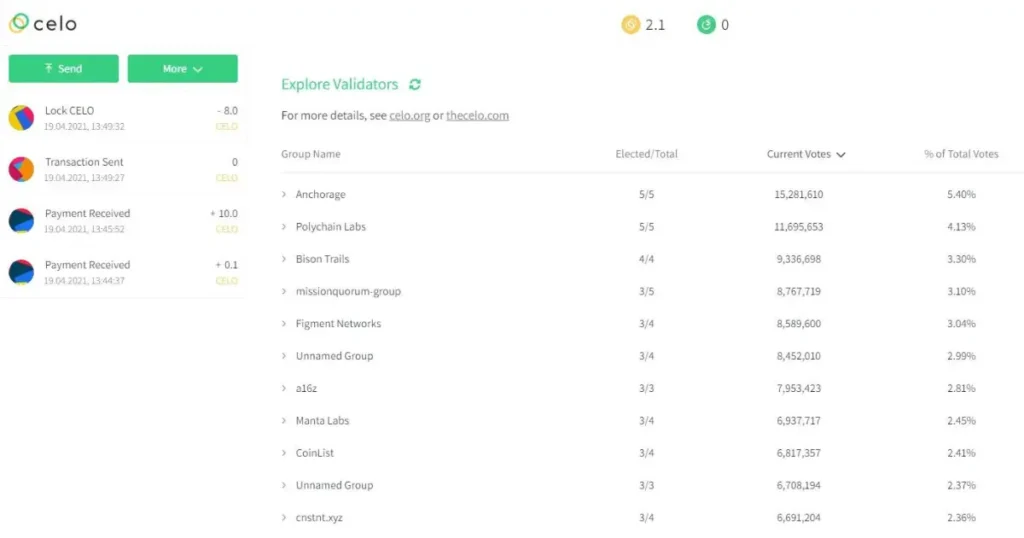

Step 5 – Explore CELO Validators

- Click ‘More’ then ‘Stake’

- Review validator performance by clicking the down arrow

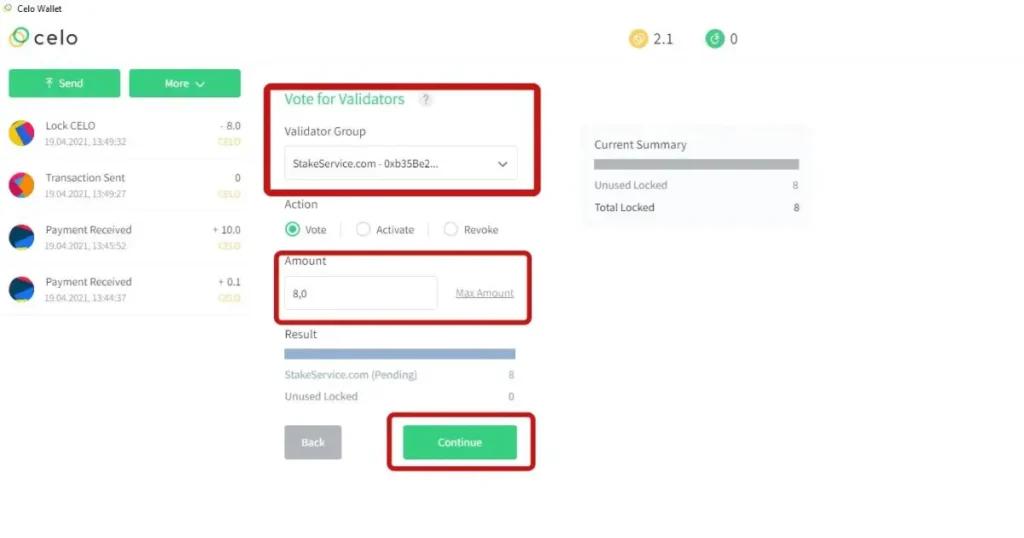

Step 6 – Delegate to a validator

- Click ‘See/Change your Vote’

- Select your preferred Validator Group

- Input how much CELO you wish to stake

- Click ‘Continue’ and then ‘Vote’

Step 7 – Activate your Validator Votes

- Wait 24 hours after Step 6

- Click on the ‘Vote for Validator’ transaction in your history

- Select your validator group

- Click ‘Continue’ and then ‘Activate’

Risks of Staking CELO

Staking isn’t without its risks. Be aware of:

- Market volatility affecting CELO’s value

- Validator performance impacting your rewards

- Unbonding periods limiting access to your funds

- Smart contract vulnerabilities (though rare)

Stay informed and only stake what you can afford to lock up. It’s crucial to understand that while staking can be rewarding, it’s not without its challenges. Regularly monitor your staked assets, keep an eye on your chosen validator’s performance, and stay updated with the latest developments in the CELO ecosystem. Consider diversifying your crypto investments to mitigate risk, and always have a clear exit strategy. Remember, in the world of crypto, being cautious and well-informed is your best defense against potential pitfalls.

Conclusion

Staking CELO is your ticket to earning passive income while supporting a revolutionary blockchain network. With the Celo Wallet offering solid returns and full control, it’s an opportunity you don’t want to miss in 2024.

Don’t let your CELO tokens sit idle. Start staking today and watch your investment grow. The future of finance is here – are you in?

FAQ

Is staking CELO safe?

While generally secure, all investments carry some risk. Stick to reputable platforms and validators to minimize potential issues.

Can I unstake my CELO at any time?

Most platforms have an unbonding period. On the Celo Wallet, it’s 3 days.

Do I need technical knowledge to stake CELO?

Basic crypto knowledge helps, but platforms like Binance make it accessible for beginners.

Are staking rewards taxable?

In many jurisdictions, yes. Consult a tax professional for advice specific to your situation.

Can I stake any amount of CELO?

Most platforms have a minimum stake amount. On the Celo Wallet, you’ll need enough to cover transaction fees (roughly 0.001 CELO).