Quick Answer

Staking XTZ (Tezos) is straightforward and can be done through various platforms for attractive rewards.

- Choose a Tezos-compatible wallet like Kukai or Ledger.

- Set up your wallet and securely store your recovery phrase.

- Transfer XTZ to your wallet from an exchange or another source.

- In your wallet, find the delegation or staking option.

- Select a baker (validator) from the list provided.

- Enter the amount of XTZ you want to stake and confirm.

Your XTZ remains in your wallet while staked. Rewards typically start after about 23 days and continue regularly. You can unstake anytime, but rewards may take a few days to stop.

What is XTZ Staking?

XTZ staking is a way to earn more Tezos coins by helping the network run smoothly. When you stake your XTZ, you’re letting the system use your coins to check and approve new transactions. In return, you get extra XTZ as a reward.

Here’s how it works: You put your Tezos coins in a special wallet or on a website that offers staking. Your coins then join a big pool with other people’s coins. This pool takes turns adding new blocks to the Tezos blockchain. Every time your pool adds a block, everyone in the pool gets a small share of new XTZ.

The best part? Your original coins stay safe, and you can take them back whenever you want. It’s like growing more Tezos while you sleep!

Why Should I Stake XTZ?

Staking XTZ can be a smart move for Tezos holders. It offers several benefits that make it attractive to both new and experienced crypto users.

- Earn passive income: Get more XTZ just by holding

- Support the Tezos network: Help make transactions faster and safer

- Keep your XTZ while earning rewards: No need to sell your coins

- Potentially increase your long-term gains: As you earn more XTZ, your stake grows

- Low risk compared to trading: You’re not trying to time the market

By staking, you play a part in securing the blockchain and making it run smoother. This helps Tezos grow stronger, which could increase its value over time. Plus, you get more XTZ without having to buy them, which can add up significantly in the long run.

How Much Can I Earn Staking XTZ?

Staking XTZ can make you extra Tezos coins. How much you earn depends on a few things.

The more XTZ you stake, the more you can earn. Some staking places give better rewards than others. If lots of people are using Tezos, you might earn more. The number of other people staking also affects your earnings.

Most of the time, you can earn about 4-5% more XTZ each year. If you stake 1000 XTZ, you could get 40-50 new XTZ by the end of the year. But these numbers can change. It’s a good idea to look at the current rates before you start staking.

Ways to Stake XTZ

Crypto exchanges

Many big crypto exchanges offer XTZ staking right on their platform. It’s super easy – you just buy XTZ and turn on staking with a click. You don’t need to know much about tech to do it. But remember, when your XTZ is on an exchange, you don’t fully control it. Some popular exchanges for Tezos staking are Binance, Kraken, and Coinbase.

Decentralized Wallets

These are special apps or programs you can use to stake XTZ on your own. They give you more control over your coins. You pick who to stake with and can move your XTZ anytime. It takes a bit more work to set up, but many people like the freedom. Some good Tezos wallets are Kukai ,Ledger, Galleon, and Atomic Wallet.

DeFi platforms

DeFi means decentralized finance. These are new ways to use crypto without banks. Some DeFi platforms let you stake XTZ and do other cool stuff with it at the same time. You might earn extra rewards or tokens. It can be risky and tricky to understand, but some people like the extra benefits. Plenty and Youves are examples of Tezos DeFi platforms.

What are the Best Places for Staking XTZ?

I’ve created a comparison table to help you understand the different XTZ staking options available.

Editor’s Choice – Kukai Wallet

Kukai Wallet stands out as the top choice for XTZ staking. It offers the highest Annual Percentage Yield (APY) at 6%, which is significantly better than most exchanges. While rewards start after 23 days, this waiting period is standard for non-exchange staking and allows for potentially higher returns.

The medium complexity level suggests that it provides a good balance between user control and ease of use.

Kukai Wallet is a non-custodial solution, meaning you retain full control of your assets, which is ideal for users who prioritize security and ownership of their crypto.

How to Stake XTZ on Kukai Wallet? Step-by-Step Guide

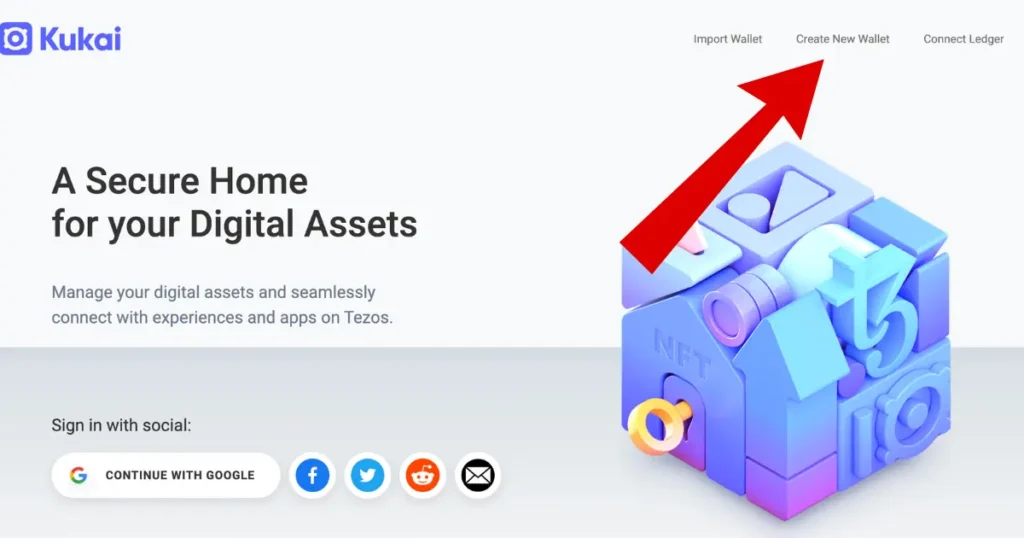

Step 1 – Create a Wallet

- Go to the Kukai Wallet website

- Click “Create New Wallet”

- Choose between a new seed phrase or a social media login

- If using a seed phrase, write it down and keep it safe

- Set a strong password for your wallet

- Verify your wallet creation

Step 2 – Transfer Funds

- Copy your Kukai Wallet XTZ address

- Go to the exchange or wallet where you currently hold XTZ

- Initiate a withdrawal to your Kukai Wallet address

- Double-check the address before confirming

- Wait for the transaction to complete (usually a few minutes)

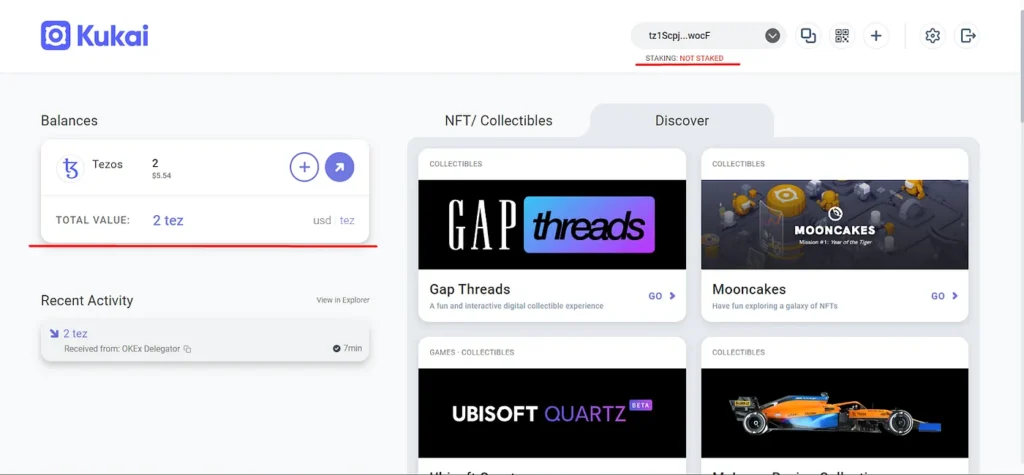

Step 3 – Find Delegation Option

- Log into your Kukai Wallet

- Look for a “Staking: NOT STAKED” button on the main dashboard

- Click on this option to open the delegation menu

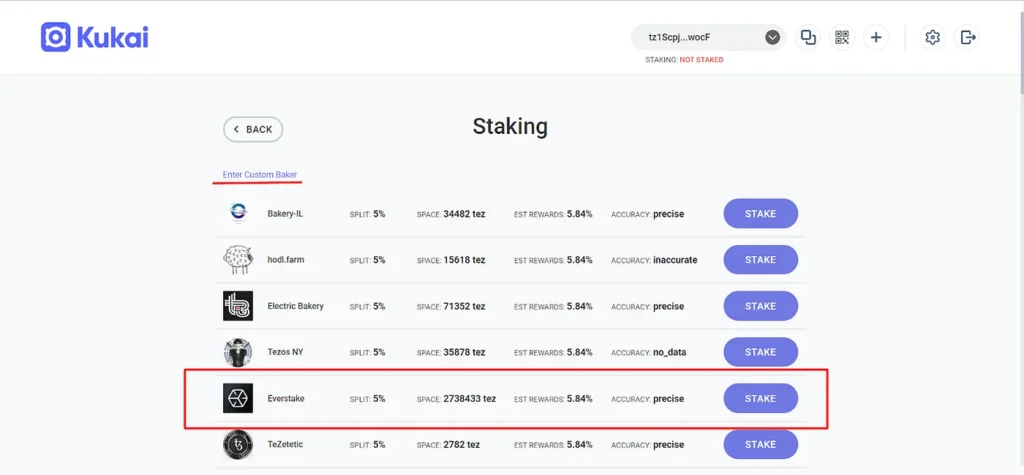

Step 4 – Choose a Baker

- Review the list of available bakers in Kukai

- Check each baker’s fee, capacity, and reliability score

- Consider the baker’s payout frequency and minimum delegation amount

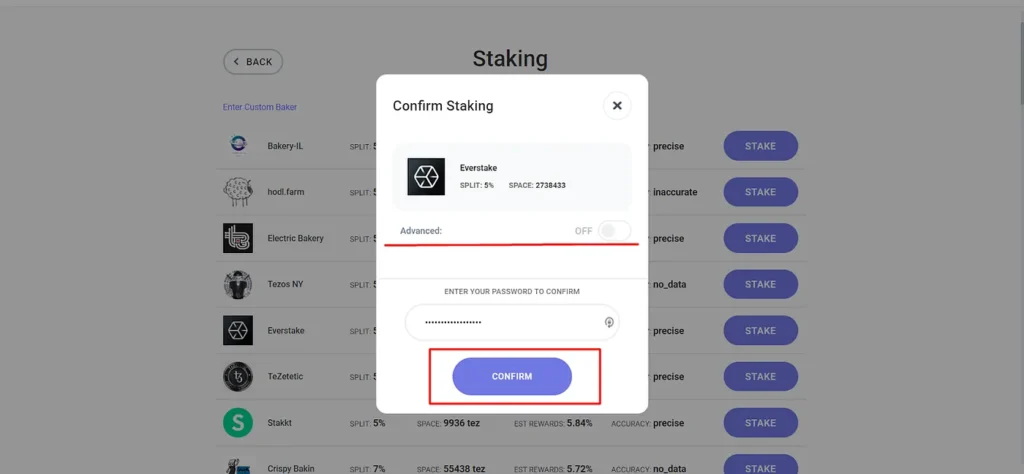

Step 5 – Delegate Your XTZ

- Select your chosen baker from the list

- Enter the amount of XTZ you want to delegate (or choose “Max” for all)

- Review the delegation details and fees

- Confirm the delegation transaction

Step 6 – Monitor Your Staking

- Wait for about 23 days for your first rewards to arrive

- Check your wallet periodically to see incoming rewards

- Consider reinvesting rewards to compound your earnings

How to Stake XTZ on Binance? Step-by-Step Guide

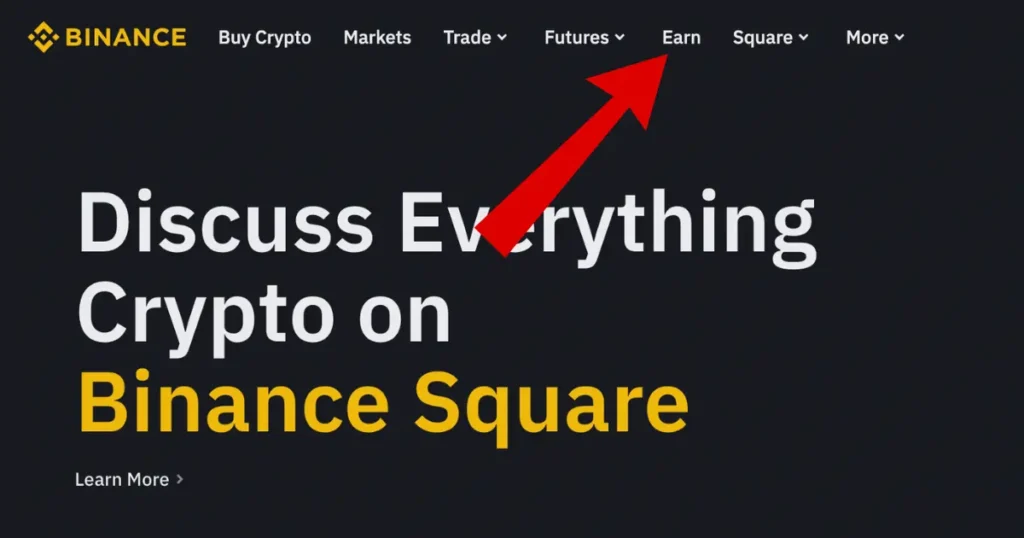

Step 1: Navigate to Binance Staking

- Hover over the “Finance” tab on the Binance homepage and click on “Binance Earn.”

- Click on the “Staking” tab within the Binance Earn section.

- Use the search bar to find XTZ staking options.

Step 2: Stake Your XTZ

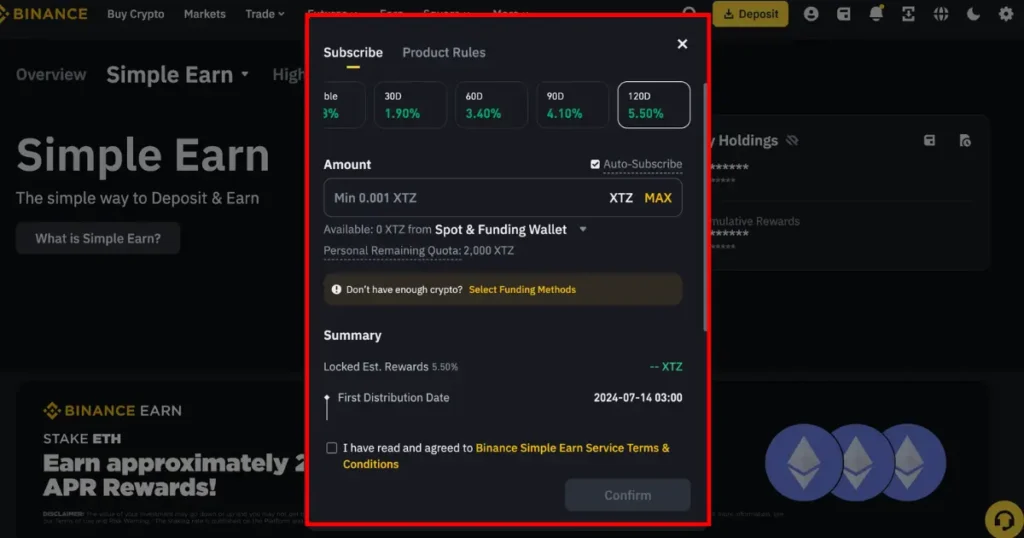

- Choose the staking option that suits your preference (e.g., flexible or locked staking).

- Click on the “Stake Now” button next to the XTZ staking option.

- Enter the amount of XTZ you want to stake. Ensure it’s within the available balance in your wallet.

- Review the details such as staking duration, estimated APY (Annual Percentage Yield), and any other terms.

- Click on “Confirm” to finalize the staking process.

Step 3: Monitor Your Staking

- Monitor your staking status and rewards by going to the “Wallet” tab and selecting “Earn.”

- You will start receiving staking rewards based on the staking period you selected. These rewards can be viewed under the “Earn” section.

Step 4: Unstake XTZ (When Desired)

- Navigate to the “Earn” section under the “Wallet” tab.

- Find your staked XTZ and click on the “Redeem” button.

- Review the details and confirm the unstaking process. Note that some staking options may have a lock-up period, so ensure you check the terms before unstaking.

Risk of Staking XTZ

Staking XTZ is generally safe, but it’s not without risks. The main danger is choosing an unreliable baker who might not pay your rewards or could go offline, causing you to miss out on earnings. There’s also a small chance of losing rewards if the baker makes mistakes or gets penalized by the network.

While your staked XTZ stays in your wallet, there’s always some risk with crypto due to market volatility, hacks, or losing access to your wallet. It’s crucial to use secure wallets, pick trustworthy bakers, and never stake more than you can afford to lose.

Conclusion

Staking XTZ offers a great way to earn passive income while supporting the Tezos network. It’s easy to start, with options ranging from user-friendly exchanges to more advanced DeFi platforms.

By staking, you can grow your Tezos holdings over time without needing to buy more. While there are some risks, they’re generally low if you’re careful. As the Tezos ecosystem grows, staking might become even more rewarding.

Whether you’re new to crypto or an experienced user, XTZ staking is worth considering as part of your investment strategy.

FAQ

What is the minimum stake for Tezos?

There’s no set minimum to stake Tezos. However, some bakers may have their own minimum requirements. Generally, you can start staking with as little as 1 XTZ.

How long does Tezos staking take?

It takes about 23 days from when you start staking to receive your first reward. After that initial period, rewards come every 3 days.

How often does Tezos pay interest?

Tezos pays staking rewards every 3 days. This regular payout allows for frequent compounding if you choose to reinvest your rewards.

Is staking Tezos worth it?

Yes, staking Tezos can be worth it. It offers a way to earn passive income on your XTZ holdings, with annual yields typically around 5-6%. It also helps secure the Tezos network.

What is the best wallet to stake Tezos?

The best wallet depends on your needs. Popular options include:

- Ledger (hardware wallet for maximum security)

- Kukai (web wallet for ease of use)

- Temple (browser extension for convenience)

- Atomex (for both storage and exchange features)