Key Takeaways

- Staking Cosmos ATOM allows you to earn passive income by holding and supporting the Cosmos blockchain, similar to earning interest on a savings account.

- By staking ATOM, you contribute to the network’s security and can participate in governance decisions, influencing the future of the Cosmos ecosystem.

- The base APY for staking ATOM is 9.7%, with some platforms offering higher returns.

- You can stake ATOM through centralized exchanges, delegating to validators, or running your own validator node.

- Staking involves market volatility, potential slashing, a 21-day unbonding period, and technical challenges, particularly if you run your validator node.

Quick Answer

- Choose a staking method. My preference is to delegate to a validator.

- Create a Cosmos-supported wallet.

- Select a reliable validator.

- Enter the amount to delegate.

- Add a memo (optional) for extra security.

- Select the fee amount for validation.

- Confirm the transaction.

What is Cosmos Staking?

Cosmos ATOM staking allows you to earn rewards by holding and supporting the Cosmos blockchain. When you stake your ATOM tokens, you lock them up to help validate and secure network transactions. In return, you receive more ATOM tokens as a reward. This process is similar to earning interest on a savings account.

By staking ATOM, you also contribute to the network’s security. It’s an easy and effective way for ATOM holders to benefit from the Cosmos ecosystem.

Why Stake ATOM?

Staking ATOM provides numerous advantages for token holders. By locking up your tokens you:

- Earn rewards in the form of additional ATOM tokens, providing a steady source of passive income.

- Help secure and decentralize the blockchain, making the network more robust and reliable.

- Can participate in governance decisions, giving you a voice in the future direction of the Cosmos ecosystem.

How Much Can I Earn Staking ATOM?

Staking ATOM can be quite rewarding, with Cosmos offering a base annual percentage yield (APY) of 9.7% directly from the protocol. This means you can earn 9.7% more ATOM tokens yearly just by staking. However, many exchanges and staking pools offer even higher APYs to attract stakers to their platforms, allowing you to maximize your rewards and grow your investment more quickly.

21-Day Unbonding Period

When you decide to unstake your ATOM tokens, there is a 21-day unbonding period. During this time, your tokens remain locked and won’t earn rewards. This period is crucial for maintaining the network’s security and stability. After 21 days, your tokens will be fully accessible and available for use.

Ways to Stake ATOM

There are four ways to stake ATOM:

- Using a centralized exchange: This is the easiest method. Stake your ATOM through exchanges like Binance or Coinbase, where they manage all technical details, allowing you to earn rewards with minimal effort.

- Delegate directly to a validator: Slightly more complex, this method requires a Cosmos-supported wallet. By delegating your ATOM to a validator, you can gain higher rewards and more control, but it demands some basic understanding of the staking process.

- Liquid staking Cosmos: This method is intermediate. Stake your ATOM through liquid staking pools like Persistence, where you receive a tradable token while your ATOM is locked. It offers the flexibility to participate in DeFi, but requires familiarity with liquid staking platforms.

- Run your own validator node: This is the most challenging method, suitable for those with technical expertise. Running a validator node involves significant resources, including a computer with 32GB RAM and 500GB-2TB storage. It offers the highest rewards and complete control but requires substantial effort and knowledge of blockchain technology.

What are the best platforms for staking Cosmos ATOM?

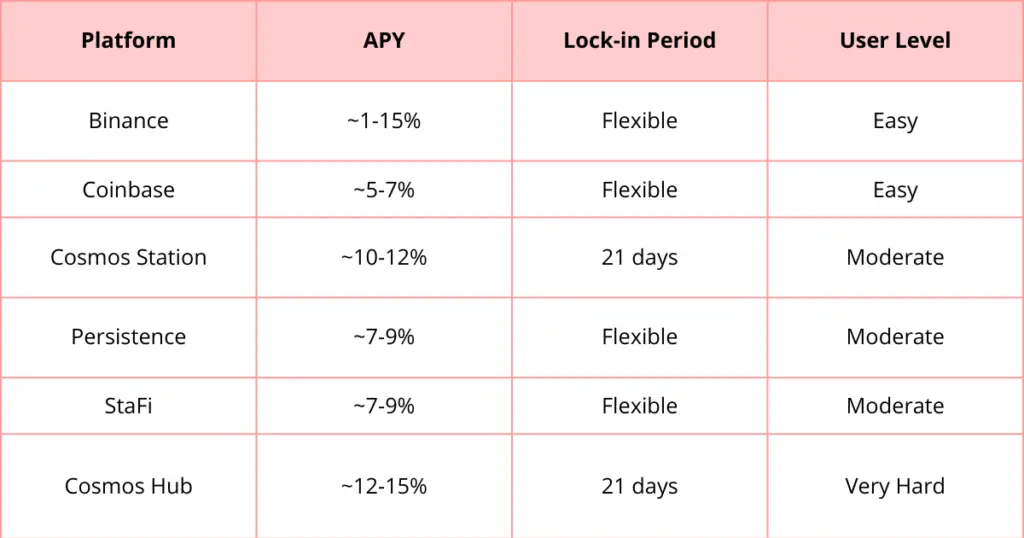

I’ve crafted a comparison table to help you navigate the best place for staking ATOM. If you are already planning to stake ATOM, I recommend choosing the platform based on your technical knowledge level.

How to Stake ATOM on Binance? Step-by-Step Guide

Step #1 – Navigate to Binance Staking

- Hover over the “Finance” tab on the Binance homepage and click on “Binance Earn”.

- Click on the “Staking” tab within the Binance Earn section.

- Use the search bar to find Cosmos (ATOM) staking options.

Step #2 – Stake Your ATOM

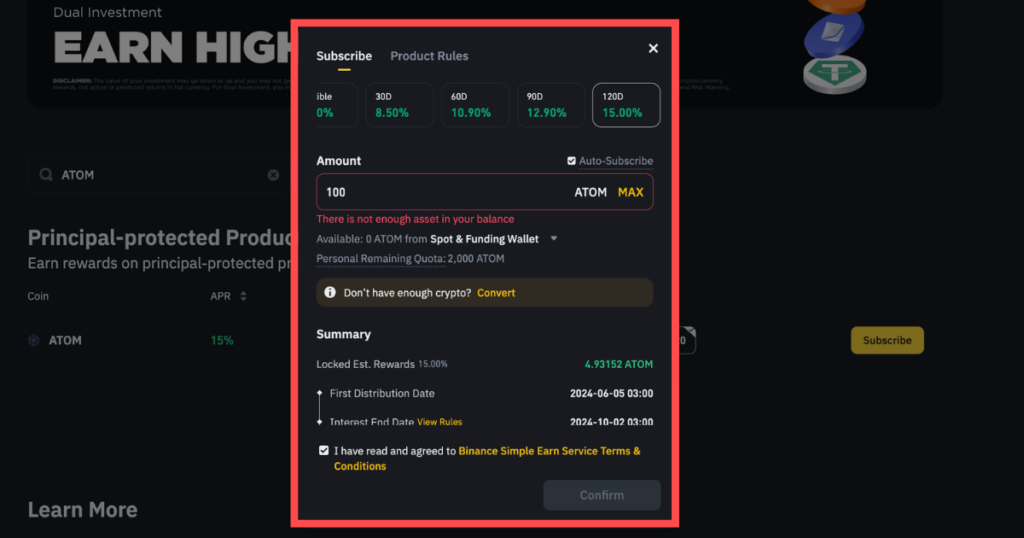

- Choose the staking option that suits your preference (e.g., flexible or locked staking).

- Click on the “Stake Now” button next to the ATOM staking option.

- Enter the amount of ATOM you want to stake. Ensure it’s within the available balance in your wallet.

- Review the details such as staking duration, estimated APY (Annual Percentage Yield), and any other terms.

- Click on “Confirm” to finalize the staking process.

Step #3 – Monitor Your Staking

- You can monitor your staking status and rewards by going to the “Wallet” tab and selecting “Earn”.

- You will start receiving staking rewards based on the staking period you selected. These rewards can be viewed under the “Earn” section.

Step #4 – Unstake ATOM (When Desired)

- Navigate to the “Earn” section under the “Wallet” tab.

- Find your staked ATOM and click on the “Redeem” button.

- Review the details and confirm the unstaking process. Note that some staking options may have a lock-up period, so ensure you check the terms before unstaking.

How to Stake ATOM on Cosmostation? Step-by-Step Guide

Once you have ATOM in your wallet, you can start the staking process.

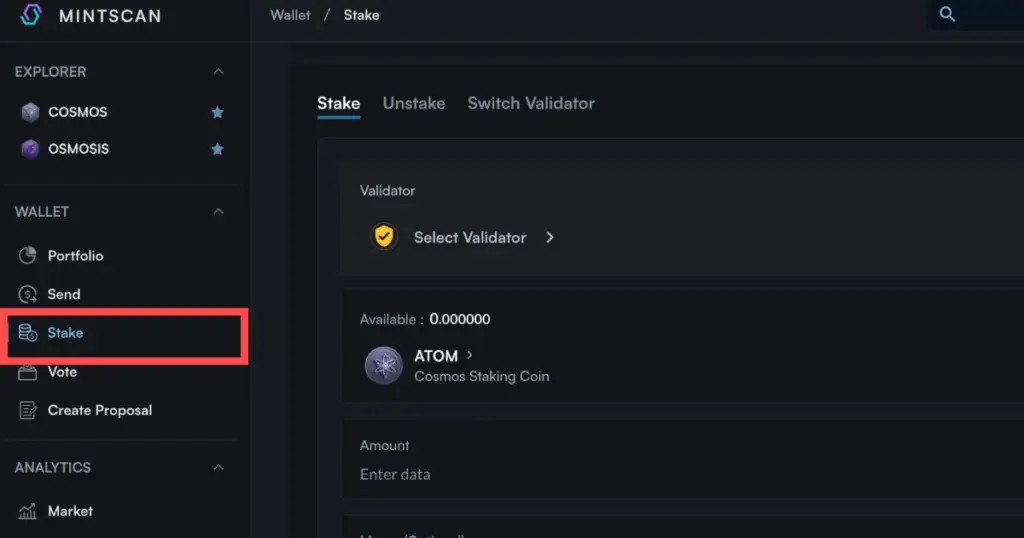

Step #1 – Visit Mintscan

- Visit this website – https://www.mintscan.io/

- On the main screen, click the “Stake” button.

Step #2 – Select a Validator:

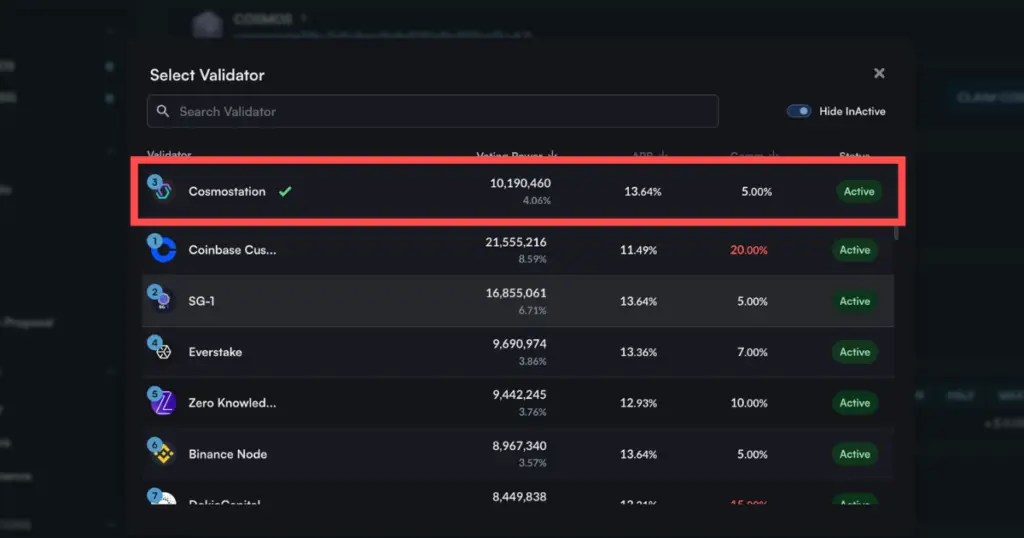

- Click on “Select Validator”

- Find a reliable validator and select it. I would go with “Cosmostation”

Step #3 – View Validator Details:

- A page with detailed information about the validator will open.

- Here you can see the fee amount and the annual return on staking.

- To stake ATOM tokens, click “Delegate”.

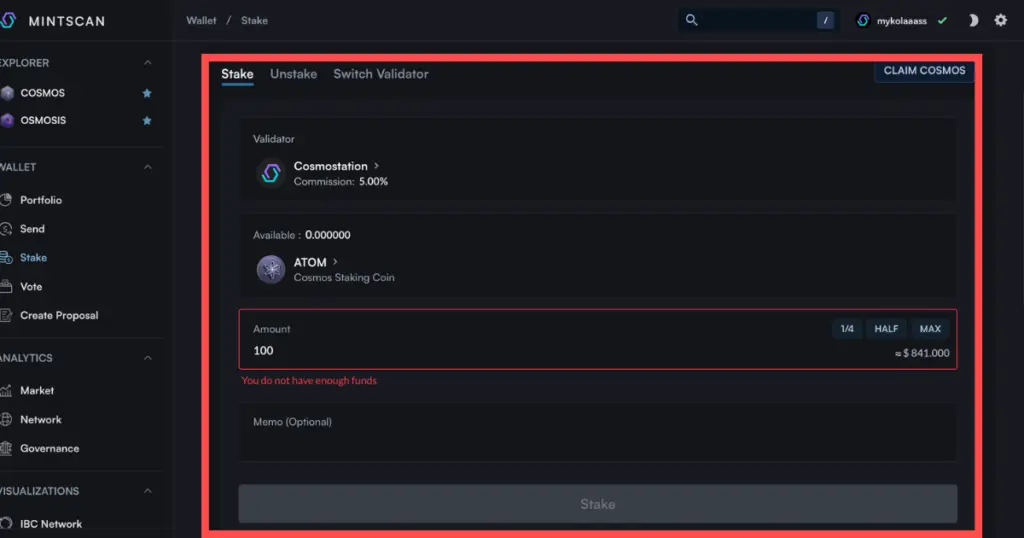

Step #4 – Enter the Amount to Delegate:

- Enter the amount of coins you want to delegate.

- You can enter the value manually or select one of the available options.

- Then click “Next”.

Step #5 (Optional) – Add a Memo:

- You can add a memo (optional). This parameter identifies the user.

- Note: If you use a memo, you will need to specify it to withdraw coins.

- If not using a memo, skip this step and move on.

Step #6 – Select the Fee Amount:

- Select the fee amount per transaction.

- The larger the fee, the faster the validators will confirm the transfer.

Step #7 – Confirm the Transaction:

- Check the transaction details again.

- Confirm the transaction.

Step #8 – Wait for Confirmation:

- Wait for the transaction to be confirmed; it may take a few minutes.

- If everything goes well, you will see a confirmation message.

How to Stake ATOM on Persistence? Step-by-Step Guide

Step #1 – Navigate to the pSTAKE ATOM App

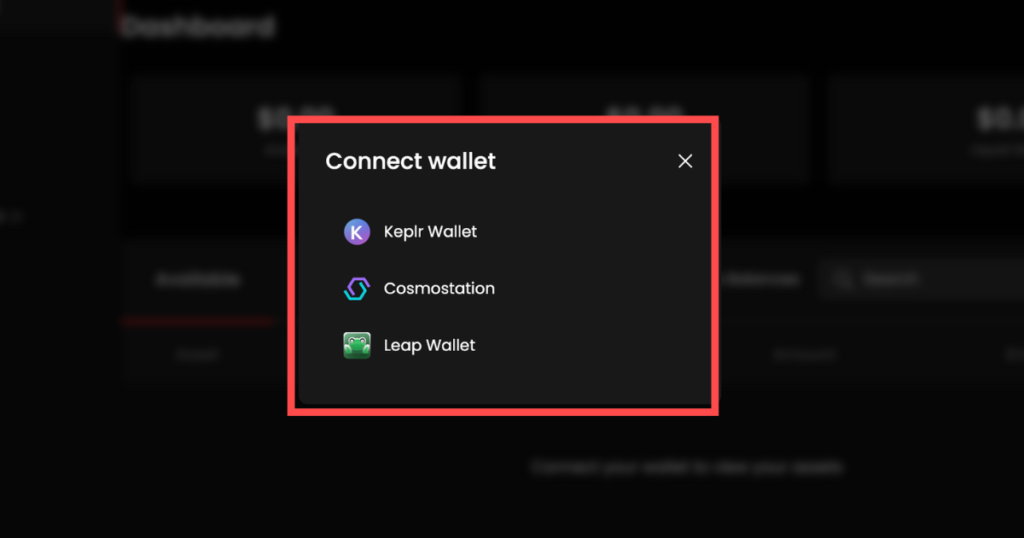

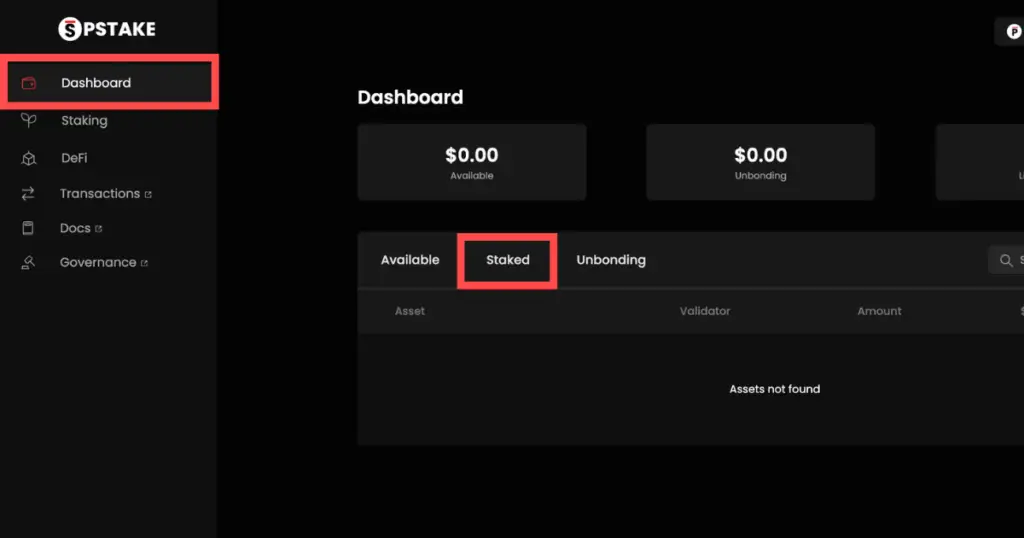

First, go to https://cosmos.pstake.finance/. Connect your Keplr, Cosmostation, or Leap wallet to the platform by following the on-screen instructions. If you are prompted to switch networks, make sure to do so. Before proceeding further, carefully read and accept the Terms & Conditions to ensure your wallet is ready for staking.

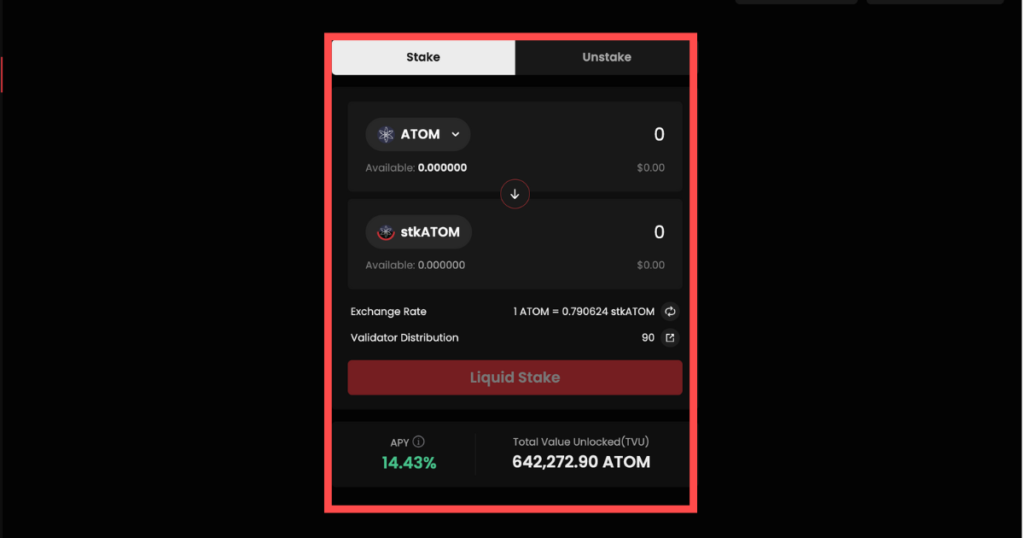

Step #2 – Stake Your ATOM

You will be taken to the ATOM staking page where the “Stake” tab will be selected by default. On this page, you can see the available ATOM balance in your Cosmos wallet. Decide how much ATOM you want to liquid-stake, enter the amount, and click “Liquid Stake” at the bottom of the page. Confirm the transaction when prompted by your wallet.

Step #3 – Complete IBC Transactions

To complete the staking process, you need to perform two IBC transactions. The first transaction will transfer your ATOM from the Cosmos Hub to the Persistence Core-1 chain. The second transaction will liquid-stake the transferred ATOM. Your wallet will prompt you to approve each transaction separately. Follow the prompts to authorize both transactions.

Step #4 – Mint stkATOM

Once the transactions are confirmed, the pSTAKE protocol will mint stkATOM and deposit it into your wallet. You can check your new stkATOM balance on the left-hand side of the page. Congratulations! You have successfully liquid-staked your ATOM on pSTAKE. Your staking rewards will now be automatically compounded, providing you with additional yields.

Staking Cosmos (ATOM) on Cosmos Hub (Run Your Own Validator)

Staking Cosmos (ATOM) on Cosmos Hub by running your own validator is a rewarding process but requires careful consideration of several requirements and costs. Here’s a comprehensive guide on what you need to get started:

Requirements

- Hardware Requirements:

- CPU: Minimum 4 cores (8 threads) processor. Recommended is 8 cores (16 threads) or higher.

- Memory: At least 16 GB RAM. Recommended is 32 GB or higher.

- Storage: SSD with at least 1 TB of storage. NVMe SSD is preferred for faster data access.

- Network: A stable and high-speed internet connection with at least 100 Mbps bandwidth. It should have low latency and high availability.

- Operating System: Preferably Linux (Ubuntu 20.04 LTS or later) for better performance and support.

- Software Requirements:

- Cosmos SDK: Installation and configuration of the Cosmos SDK and relevant binaries.

- Go Programming Language: Required to build and run the Cosmos SDK. Ensure the correct version is installed as specified in the Cosmos documentation.

Hardware and Infrastructure Costs

- Initial Setup: Costs for purchasing or leasing hardware. If using cloud services, costs vary based on provider and configuration.

- Ongoing Maintenance: Monthly expenses for internet connectivity, electricity, and potential hardware upgrades.

- Cloud Services: If opting for cloud infrastructure (e.g., AWS, Google Cloud, Azure), costs can range from $100 to $500+ per month depending on the instance type and usage.

Staking Requirements:

- Minimum ATOM: A certain amount of ATOM is required to stake and become a validator. The amount can vary based on network conditions and competition but expect to need at least several thousand ATOM to have a competitive stake.

- Commission Rates: Validators can set a commission rate on the rewards earned by delegators. This commission serves as your income for running the validator.

Other Important Information

- Delegation: Delegators can delegate their ATOM to your validator. The more ATOM delegated, the higher your chance of being selected to validate blocks.

- Uptime and Performance: Maintaining high uptime and performance is crucial. Poor performance or downtime can lead to slashing (penalties) and loss of staked ATOM.

- Community Engagement: Active participation in the Cosmos community can help attract delegators and improve your validator’s reputation.

- Governance: Validators participate in the governance of the Cosmos Hub, voting on proposals that affect the network.

For more detailed and up-to-date information, please visit the official Cosmos website. Here, you can find comprehensive guides, documentation, and community resources to assist you in setting up and managing your Cosmos validator node.

Risks of Staking Cosmos ATOM

Staking Cosmos ATOM comes with several risks that potential stakers should be aware of:

- The value of ATOM can fluctuate significantly due to market volatility. While staking rewards are paid in ATOM, the fiat value of these rewards can decrease if the market price of ATOM drops.

- If the validator you delegate your ATOM to performs poorly, engages in malicious activity, or experiences downtime, a portion of your staked ATOM may be slashed as a penalty. This can result in a loss of your staked tokens.

- There is a 21-day unbonding period for unstaking ATOM. During this period, your tokens are locked and cannot be used or traded. Additionally, they do not earn staking rewards during this time, which could result in opportunity costs if the market conditions change.

- Choosing a validator is crucial. Validators have varying levels of reliability, performance, and fees. Delegating to an unreliable validator can reduce your rewards and expose you to higher slashing risks.

- For those running their own validator node, technical expertise is required to maintain uptime, manage security, and ensure proper functioning of the node. Failure to do so can lead to slashing and other penalties.

Conclusion

Staking Cosmos ATOM is an excellent way to earn passive income while contributing to the security and decentralization of the Cosmos network. With several staking options available, from using centralized exchanges for convenience to running your own validator node for maximum rewards, there is a method suitable for every level of expertise and involvement.

While staking offers attractive rewards, it also comes with inherent risks such as market volatility, slashing, and technical challenges. It is crucial to thoroughly understand these risks and choose your staking method and platform carefully. By doing so, you can maximize your earnings and support the growth and stability of the Cosmos ecosystem. Always stay informed and make decisions that align with your investment goals and risk tolerance.

FAQ

Should I stake Cosmos?

Staking Cosmos (ATOM) is a beneficial way to earn passive income while supporting the network’s security and decentralization, but it comes with risks such as market volatility and slashing; if you’re comfortable with these risks and have a long-term investment perspective, staking could be a profitable and rewarding option.

What is the minimum amount of ATOM required to start staking?

The minimum amount of ATOM required to start staking varies by platform, but typically you can start with as little as 1 ATOM when delegating to a validator, while centralized exchanges usually have no minimum requirements.

How do I choose a reliable validator for staking my ATOM?

To choose a reliable validator for staking your ATOM, consider their historical performance and uptime, commission rates, reputation within the community, and level of engagement, ensuring they have a strong track record of reliability and community support.